Oscar Health trades at a P/S ratio of 0.4 because investors are forecasting that Republicans will shoot themselves in the foot.

This seems unlikely to me and I see ~20X valuation upside for Oscar as a result, based on valuation multiples expanding to reasonable levels once/if fears dissipate.

Two things are true:

Oscar Health likely has a notable ability to deliver more value to customers per dollar spent, as evidenced by the rapid user growth seen over the last year. It’s taken Oscar Health 11 years to gain its first million members and just 15 months to add its second million subscribers.

The company trades at 0.4 times sales because investors are concerned congress won’t renew the enhanced ACA (Affordable Care Act) premium tax credits at the end of 2025. But Republicans currently control both chambers of Congress and 64% of Oscar’s ACA membership comes from red states.

Thus, if one is willing to play the political odds, Oscar Health is looking like a highly asymmetric bet. Oscar’s fair value is probably in the 8 to 10 times sales range, which means that the valuation could expand between 20 and 25 times once/if the regulatory fears dissipate. The upside is still appealing if one assumes fair value is 4 times sales, which would be rather conservative for a company growing revenue at 50%+ YoY. Not renewing subsidies would make health insurance much more expensive for folks, which would disproportionately upset Republican voters. And thus, the Republican party is unlikely to go against its own interests.

The rapidly growing subscriber base is a strong signal, because according to Oscar co-founder and CTO Mario Schlosser they only had the lowest cost plan in 2022 in 5% of its markets. In this podcast at minute 14:05 Mario explains how Oscar Health shares economy of scale with customers, by passing efficiency gains back to patients in the form of lower prices. Thus, the recent growth acceleration is likely driven by lower prices, but also signals users responding to a rapidly widening value to price ratio.

In the abstract, Oscar is executing the Costco Algorithm but in healthcare insurance. The latter is generally a dire experience and Oscar seems to be making it frictionless enough for its subscriber base to now be growing exponentially. A lot of this has to do with making the operations of healthcare providers more efficient. Reading back in time, Oscar’s quarterly conference call transcripts are littered with examples of how they’re doing this, to ultimately provide a better experience for end customers. See Oscar CEO Mark Bertolini’s remarks during the Q1 2025 earnings call:

Our technology is also further optimising our operations and improving the member experience. The team recently launched a free live chat feature for Oscar, Virtual Urgent Care, which collects patient symptoms and severity, before provider engagement.

Use of the new capability decreased member response times by 90%, and drove a 28% boost in provider efficiency.

Similarly, our new AI tool for care guides, is more quickly addressing member needs. We continue to build a scalable and efficient technology infrastructure that, positions us to grow and differentiate the Oscar experience.

And here’s another example from the Q4 2024 earnings call, in which you may appreciate how Oscar is accelerating the pace of iteration (by deploying apps faster):

We continue to reduce provider administrative tasks. More than 50% of onboarding and post care instructions today are AI powered in Oscar Urgent Care.

Our actions are reducing provider paperwork, improving speed to care.

We are also deploying applications at greater speeds, significantly reducing implementation time. All of this is possible because of our industry-leading platform, which continues to fuel major strides in operational efficiency, member engagement and affordability.

The overall experience has clearly struck a chord with customers, which is elegantly summarised by the graph below. You will notice that Oscar’s cash from operations (orange line, left axis)) has grown exponentially over the last year, while CapEx (blue line, right axis) hasn’t increased all that much. However, note that much of this cash from operations consists of risk adjustment payables. These are amounts owed to a federal pool under the ACA but not yet paid:

For example, if Oscar owes $600 million but the payment isn’t due until later in the year, it records the liability now without an immediate cash outflow.

This delay boosts operating cash flow temporarily, even though it doesn’t reflect actual cash earnings. It's a timing effect which can be helpful in the short term, but is not a permanent cash gain.

Regardless, the trend of Oscar’s cash from operations is more reminiscent of Hims’s than of LifeMD’s. The main takeaway from my LifeMD deep dive is that although the company has plenty of upside and far less legal risk than Hims, they don’t offer anything that has truly struck a chord with customers, per the evolution of their financials. As you can see below, cash from operations (orange line, left axis) is growing, but far from exponentially. The delta suggests that Oscar is fixing an acute problem while LifeMD hasn’t quite hit the spot (yet, at least).

Oscar Health does not directly deliver medical care. Instead, it partners with established health systems and providers to offer care to its members. The platform solves a very specific problem, which is making health insurance frictionless for folks enrolled in ACA. This involves underwriting its own insurance products, dealing with all the regulatory and financial complexity for them, while making providers more efficient and delivering a much better insurance experience via an appealing user experience. By focusing on this exclusively, Oscar has another 43 million individuals to scale out to in the US that are enrolled in ACA.

In essence, the Oscar thesis is identical to the Spotify and Uber thesis, for example. Exclusive focus on a single task for a long time ends up creating a moat, because eventually it gets too hard for competitors to deliver as much value to end customers per dollar that they spend. Unlike in the case of Spotify, I don’t have decades of data in which I can clearly see Oscar increasing the value to price ratio against all odds. However, the rapid growth coupled with the strong operating leverage gains are also a strong signal of extraordinary organisational capabilities.

As you can see in the graph below (taken from Oscar’s latest investor presentation in slide 35, from FY2024), the SG&A expense ratio is declining rapidly. This shows me Oscar is capable of getting much more efficient while growing quickly, which is typically a sign of a highly capable organisation. The SG&A expense ratio came in at 15.8% in Q1 2025 versus 19.1% in Q4 2024, which also shows Oscar is executing ahead of schedule - typically also a sign of investable companies. By enhancing the value to price ratio and getting more efficient over time, Oscar is likely to meaningfully increase both the top and bottom line - and the track record is there.

Much of this efficiency seems to be driven by AI advancements, per CEO Mark Bertolini in the Q4 2024 earnings call, which is bullish for AI companies like Palantir and AMD:

And on the AI front, we did not project AI enhancements in our three-year projections that we shared with you in June. But last year, we put in 11 new use cases. And this coming year, we're going to have – we have 10 more in the pipeline for just the first quarter.

So we continue to find ways to use these tools to help us drive the SG&A down.

And that's why, quite frankly, our numbers are ahead of where we thought we were going to be when we put together a three-year projections.

Oscar’s MLR (medical loss ratio or what % of premiums are spent on medical care) is following a similar trend, with MLR coming in at 75.4% in Q1 2025. The sharp decrease in MLR combined with the rapid user growth suggests that Oscar’s platform is particularly efficient. Any relative underperformance in terms of its ability to price risk would’ve been magnified with the subscriber base doubling in the past 15 months. We’ve seen MLR drop to new lows instead, which again points to notable organisational properties and an ability to price risk better as more users come in. As outlined in my last Lemonade update, this an ability that Lemonade is yet to manifestly prove.

The ACA mandates that insurers spend at least 80% of premiums on medical care and quality improvement. In this light, Oscar management guided for MLR to be in the range of 80.7% and 81.7% going forward. While the MLR in Q1 2025 is a strong signal (given its exceptionally low value, in the face of rapid user growth), the metric can’t be taken at face value in the short term. This is because lowering the MLR by itself is not the goal, but rather minimising MLR while maximising value delivered to end customers per dollar spent (and thus maximising scale) is the goal. At times management will spot great opportunities to maximise subscriber growth my increasing MLR.

Broadly, however, Oscar is on a long term path to get more efficient across the board, thus drop prices for customers, bring in more subscribers, obtain more data on care patterns and utilisation, train better AI models and keep the flywheel spinning faster and faster. Much like Wise, this opens the door for Oscar to become a platform on which healthcare providers run entirely, because it gets hard to operate at a level of efficiency that appeals to end customers otherwise. In Q3 2024 Oscar CEO Mark Bertolini made a mention of +Oscar (their platform as a service offering) having grown to serve over 500,000 lives, but no mention has been made in subsequent earnings calls:

This morning we announced a new agreement with Stanford Health plan, a provider sponsored plan supporting one of the largest U.S. health systems. The multi-year agreement leverages our campaign builder technology to drive member engagement and interconnectivity through their operations.

[…]

After just one year of offering campaign builder to third-parties, we have grown to serve 500,000 lives.

In the same call, Mark illustrated how +Oscar helps providers get more efficient:

The addition of Stanford Health builds on campaign builders' success with +Oscar clients.

A recent example includes a large physician group in MSO, where we initiated an annual wellness visit campaign, which successfully engaged approximately 86% of patients.

That outreach drove a 10% increase in PCP (primary care provider) utilisation within 30 days of campaign execution. In addition, we continue to build new campaign builder features that integrate OpenAI for +Oscar clients and Oscar Health Insurance.

Oscar’s exposure to ACA regulation over the long term may also be mitigated by its penetration of the ICHRA (Individual Coverage Health Reimbursement Arrangements) market. ICHRA is a way for employers to reimburse employees tax-free for individual health insurance premiums. In 2025, an estimated 450,000 individuals were covered through ICHRAs, with the potential market estimated to be twice that size. The tailwind for ICHRA to grow is in place, because the former is especially useful for gig economy companies like Uber, Lyft, DoorDash, and others that don’t offer traditional group health plans

Oscar reported having 3.7K ICHRA members in Q3 2023, but has not updated the metric since. Oscar CEO Mark Bertolini said in the Q1 2025 earnings call that they’re seeing “high engagement” from ICHRA members:

Our solid retention and new membership growth reflect the value of Oscar's innovative plan designs, and superior member experience. Our condition focused plans are strong performers in the book.

We are also seeing high levels of digital engagement across our IFP and ICRA membership, allowing us to more effectively manage member care.

Oscar is deepening our market presence with new partnerships that give members more value added services.

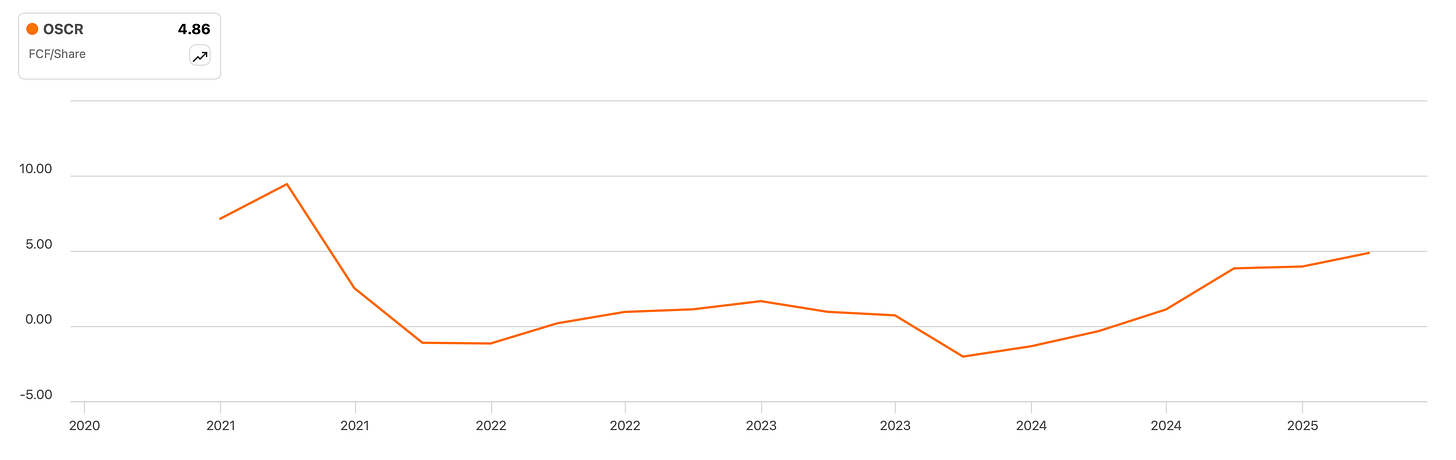

As evidenced by the evolution of Oscar’s free cash flow per share (reaccelerating in early 2023), my impression is that they’ve just recently found true product-market fit. Given the notable efficiency gains over the past year in the face of rapid user growth, my impression is that Oscar will tend to compound this product-market fit and continue growing successfully. However, although I also tend to believe that Republicans will not shoot themselves in the foot by making insurance much more expensive for their voters, I am not a politics expert. Therefore, I choose to not invest in this company because I don’t know for sure what they will do with the ACA subsidies.

I will be nonetheless following Oscar closely, because I am impressed with their ability to execute.

Meanwhile, total cash (orange line, left axis) is far higher than total debt (blue line, right axis) and with the positive cash from operations, Oscar’s financials support the asymmetric thesis.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

If US law mandates that the MLR is 80%, doesn't that put a upper limit on the amount of profit that it can generates per customer? Also $OSCR is a US only company. Nothing wrong with that, but it's not a $HIMS or $NFLX or $SPOT right?

It's not going to "disrupt" insurance in the UK where the NHS is there.

The insurance industry does fetch a p/s of more than 1 or 2 at steady state and oscars growth is also tapered to 20% for next few years. I am not sure what would have to change for it get a P/S of 8-10. The max I can think of is 2-3 p/s which would be stretching the valuation.