Edited by Brian Birnbaum.

Note: Most graphs are extracted from Tesla´s Q4 2022 shareholder deck.

Tesla continues to compound its AI, manufacturing and energy businesses. The combination is likely to yield a much higher market cap in the future.

Tesla remains a fundamentally misunderstood company, with the market focusing on its superficial aspects. Tesla as an organization has a supreme ability to evolve. Evolution has created the wonderful universe that we live in via incessant experimentation and iteration. Partly due to its flat hierarchy and mostly due to its culture, Tesla is constantly able to evolve its respective business lines and excel despite pervasive gloomy narratives.

“On a full year basis, revenue increased over 50%, operating income doubled, free cash flows increased over 50%, and our margins remained industry-leading.” - Zack Kirkhorn, CFO @ Q4 2022

In my original Tesla thesis, I outlined how the company is set to unlock material abundance for humankind by compounding and connecting:

AI.

Manufacturing.

Energy.

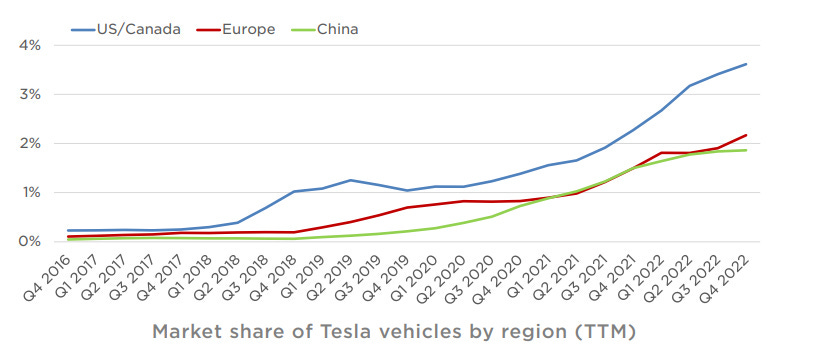

The gradual commoditization of the above is bound to redefine our economy. Being a shareholder since 2016 (SolarCity acquisition), I see two general paths. On one path Tesla remains a car company. Even within such a scenario, with EVs accounting for a relatively small % of market share, there’s plenty of room to grow. The other path allows Tesla to evolve into a platform for products and services in robotics, manufacturing, and intelligence on a global scale. Naturally, the latter path offers much more runway, therefore justifying a much higher valuation than today´s $654B.

Realistically, the company may successfully yield any number and combination of these verticals and, regardless, greatly increase market cap. As I explore below, the company is executing well on all three fronts and, thus, odds are looking quite favorable.

At the end of Q4, 400,000 customers in North America had access to FSD Beta. This is up from a few thousand just over 2 years ago. The autopilot is still not on par with human performance, but it’s only inevitable as computing power compounds over the next decade and the beta spreads to more owners of Tesla vehicles. Simultaneously, Tesla continues to compound its hardware advances through vast improvements in AI training and inference. Check out my AMD deep dive for an in-depth exploration of Tesla´s approach to hardware.

“ […] we think Dojo will be competitive with the NVIDIA H1 at the end of this year and then hopefully surpass it next year.” - Elon Musk, CEO @ Q4 2022.

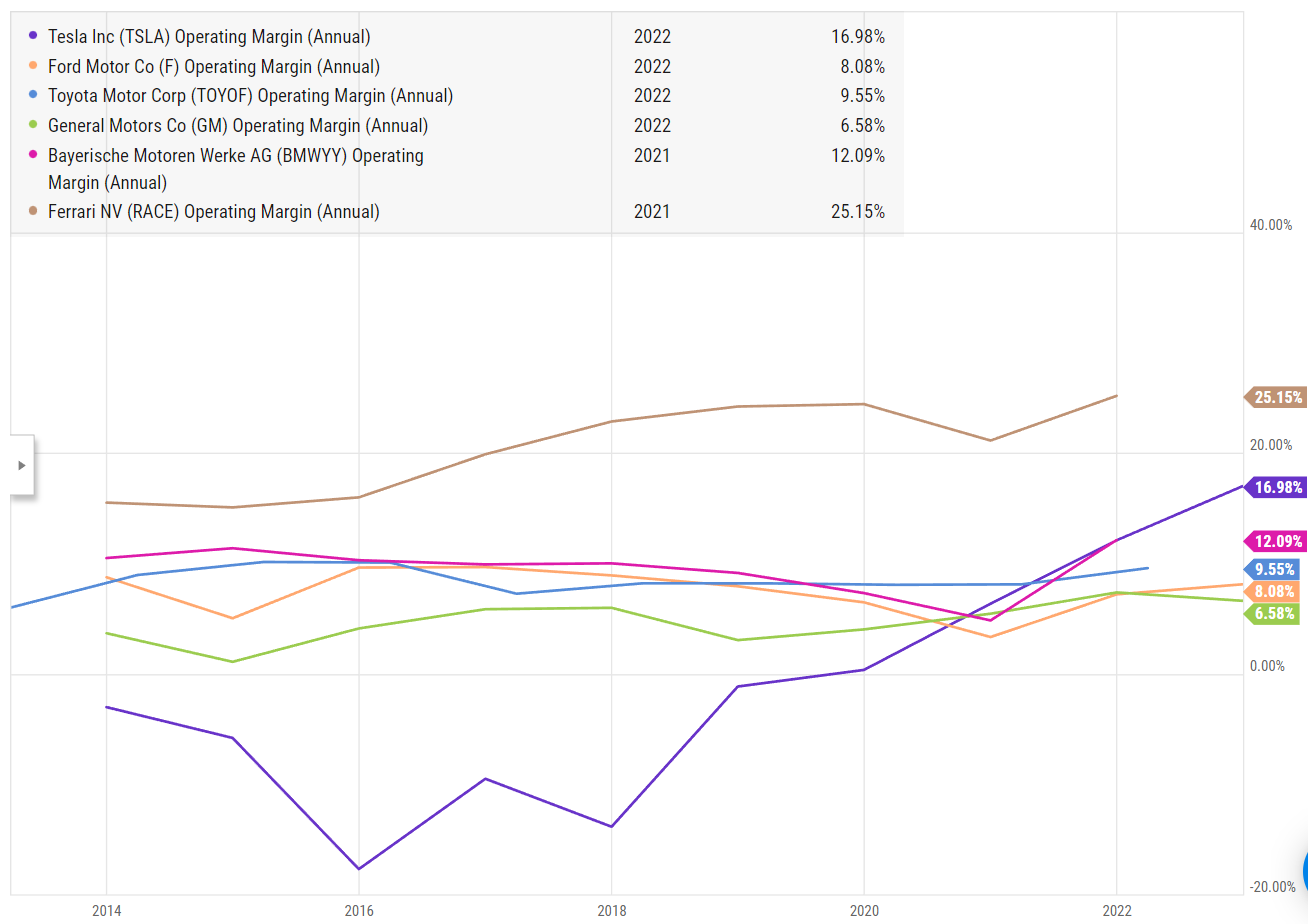

Further, in my Tesla deep dive I learned about the company´s quest for lean manufacturing. Thus far they’ve been successful by decreasing the cost of change, enabling rapid iteration as modern software will allow. Evidence of such lies in Tesla´s operating margin (purple line) versus that of other auto OEMs, which the market (sometimes) believes are directly comparable. In Q4, Tesla´s operating margin came in at 17%, despite the inflation and supply chain disruptions.

Tesla is also ramping up 4680 cell production, hitting 1000/week at the end of FY2022. The 4680 cells not only improve the cars but also serve as the foundation of their energy business. Indeed, renewable energy only goes as far as how much yield can be stored. In theory, sufficient economies of scale could deliver energy at a marginal cost to the world. Tesla is, at the very least, keeping this vision alive.

Q4 2022 excerpt:

Analyst: “[…] it looks like the investment cost per kilowatt-hour is less than half of what I've seen anywhere else.”

Elon: “And it goes back to the point I was making. I said it several years ago, I think Tesla's really the competitive strength that will be, by far, the hardest for other companies to replicate is Tesla being just d*** good at manufacturing and having the most advanced manufacturing technology in the world. And if you've got that sort of advanced manufacturing toolbox, you can apply it to many things and we're applying it now to battery cells.”

Tesla´s three big bets make their cars better and allow them to maintain the same levels of profitability while lowering prices. In turn, they compound goodwill through economies of scale, satisfying their customer base and paving the way successful distribution of their next-gen products and services. I’d wager the ASP deltas over the last year are noise. I believe Tesla cars are as desirable as they were when the market was pumping Tesla’s share price–perhaps even more so.

With $1.5B in long term debt and $22.18B in cash, the company is inured to recession. At this point I feel somewhat generous labeling the coming recession considering the ceaseless nature of its imminence. The company's ability to generate cash limits my level of worry. I also believe that Tesla is positioned to keep growing come rain come shine. Whilst I cannot put a finger on where the company will be exactly a few years from now, it remains one of the more attractive probabilistic set ups in the market.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Hi Antonio

Upfront - not a TLSA short, and wish Musk all success in his mission. Your statements re cash and LT debt, however, are highly misleading. The cash + ST Investments are more than offset by short term liabilities. You could argue that ST Assets > ST liabilities, which is fair if you assume the business keeps churning through its WC cycle, but from a pure BS analysis perspective, one should haircut the inventory component quite heavily.

Anyway - not implying you're trying to mislead, but I think in particular in the case of an ethically impaired leader as is the case here (most recent example: sign contract, then thinks he can just say 'nah, changed my mind'), it behoves any honest analyst to be conservative and ultra-specific with statements, lest you just become part of the touts for whom everything Elon does is great and every criticism is sacrilege.

C.

Hi Antonio, thanks for sharing!

Do you think consensus analysts are wrong projecting next 5yrs growth CAGR at 25%?