This is an update of my original Spotify thesis.

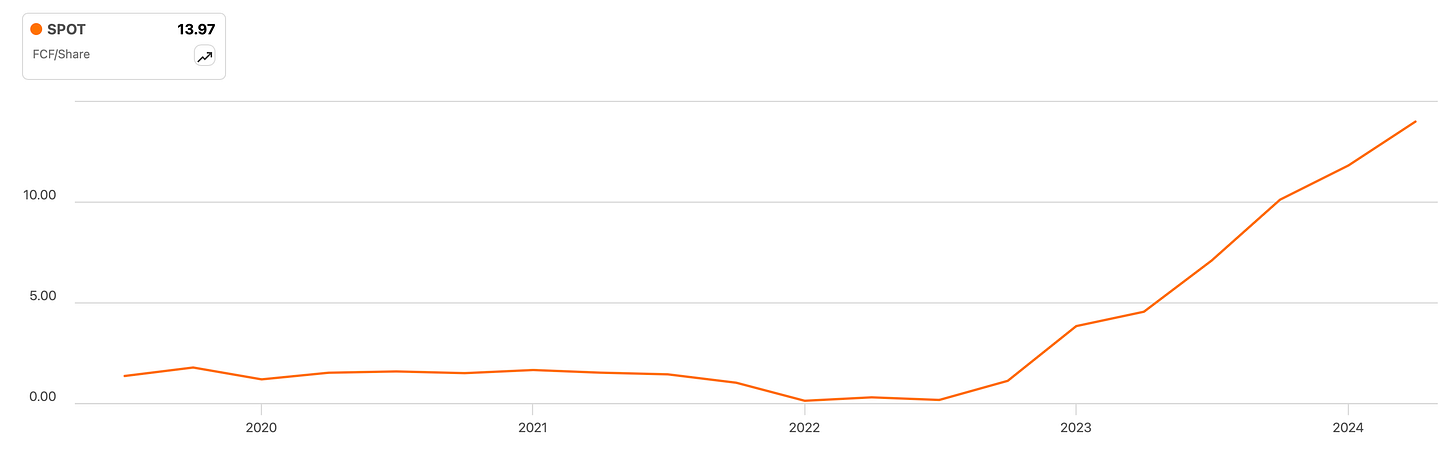

As you can see in the graph below, Spotify’s free cash flow per share continues to trend up as of Q1 2025. And as I’ve said many times, the stock price will track this metric over the long term.

Spotify’s rising free cash flow per share, as depicted in the graph below, is driven by its ability to grow its user base and increase engagement levels over time. Q1 is a seasonally soft quarter for Spotify, with margins coming in at 31.65% in Q1 2025 versus 32.65% in Q4 2024. However, gross margins are up 4.04% YoY in absolute terms and both user growth and engagement levels remain healthy. Therefore, Spotify’s journey towards becoming a better business continues intact.

After yesterday’s earnings report, the market sent Spotify stock down ~9% at market open. This move seemed to be triggered by Daniel Ek’s remarks about “noise” potentially coming in the short term. Later on in the call, Daniel clarified that he was referring to macroeconomic noise and not to Spotify’s fundamental progress. The volatility suggests the market continues to misunderstand Spotify’s business, which is essentially about growing the user base and making more money per user.

In Q1 2025 MAUs (monthly active users) declined from 425M to 423M, but this has been largely driven by an outperformance of paid subscriber additions. Paid subscribers increased from 263M to 268M, which was the second largest Q1 increment in Spotify’s history. Therefore, the long term user base growth trajectory continues in Q1 2025. As the platform keeps getting bigger, it’ll tend to get more valuable over time regardless of the macroeconomic environment.

The main driver of this growth is Spotify’s focus on maximising value per dollar spent on behalf of customers. As Daniel Ek explained during the Q1 2025 earnings call, every time they invest in enhancing the value to price ratio Spotify tends to grow. Indeed, the Spotify thesis not about gross margins going up and to the right linearly - it’s about Spotify’s ability to choose where to invest in order to maximise long term value creation. See Daniel’s remarks about this:

What we've found as a truism is that whenever you add more value to our subscribers and whenever this value to price ratio goes up, what we're seeing is, is that is that there's incrementality in growth and this is all of the time a better way to spend a dollar than to spend an incremental dollar in marketing.

As we saw in my Nike deep dive, managers are constantly confronted with two alternatives: maximise short term financial performance or invest in long term value creation, at the expense of the former. During and after the Q1 2025 earnings call, the market’s concern with declining gross margins QoQ was palpable. However, long term shareholders will be rewarded if management is able to balance short term financial performance with long term value creation. So far, so good.

At times, the best decision for management will be to invest in increasing the value to price ratio. Other times, there won’t be clear opportunities to do so and so the best decision will be to not invest so much. Therefore, while the market has gotten accustomed to Spotify increasing margins linearly, this concept is far removed from the reality of long term value creation. Indeed, while rising gross margins are good in Spotify’s case, the platform will tend to produce better financials over the long term as the user base grows and engagement levels go up.

Daniel Ek’s remarks during the Q1 2025 earnings call were highly insightful:

So, the natural way to think about this and to kind of dumb it down into one metric that could be helpful is the SAC (subscriber acquisition cost) to LTV (lifetime value). How much does it cost us to grow? And how much lifetime value does that the customer give?

And so you would naturally -- any investor would naturally think that -- if you have a great delta between the SAC to LTV, meaning your SAC is much lower than your LTV, you should just invest -- and you shouldn't too much focus on what the gross profit for that quarter, I will say.

[…]

But what's really changed for us over the past few years is that -- we operate now way more than before, unless it's hell, yes, it's no. And so the bar that we keep for thinking about new initiatives is much higher than before.

And if we can time trade, making something that's right for the long term by sacrificing a little bit on the short term, we will do that. We will try to the best of our ability to communicate to you guys when we do it and why we think this investment makes sense.

As I explain in my Tech Stock Goldmine course, relying on financial metrics only is poor strategy for long term investors. They tend to be the tip of the iceberg, as depicted below. Good financials are the result of underlying processes, which put the company in question in a position to durably increase profits over the long term. This is why long term investors must identify deeper level KPIs that more closely track a company’s ability to create value over time. These metrics present less volatility and offer more clarity.

Within reason, regardless of what Spotify’s gross margins do in the short term, the company’s market cap will go up as it acquires more users and is able to better monetise them - the latter being directly correlated to engagement levels. Indeed, if one had relied on Spotify’s financials only to assess the real value of the company back in 2022, the result would’ve been missing out on a 500%+ return. See Spotify Chief Business Officer Alex Norstrom’s remarks about this, during the Q1 2025 earnings call:

The best way to predict MAU is to look at the trend or engagement. So this trend is strong and the leading indicator of engagement in turn is product improvement as in features and content experiences, which is ultimately the way we've managed our business in the past two decades.

And the engagement we're seeing right now suggests that [we’ve become] even more central to people's lives, to Daniel's point in the remarks. And really, that happens only when you consistently develop solutions that meet more of our users' needs.

Spotify’s free cash flow per share is now growing exponentially due to the investments the company made during the 2020-2023 time period. These investments hurt short term financial performance enough for the market to send Spotify’s stock price below the IPO price. I’m up over 500% on my Spotify position and in order to deliver even more returns to shareholders, the company has to make new investments. However, per management’s above remarks, it seems that they will remain focused in tandem on profitability.

Additionally, the market has a tendency to focus on the income statement. But as I’ve said many times, non-cash expenses and the rapidly evolving nature of businesses like Spotify makes focusing on the income statement futile. As previously mentioned, focusing on Spotify’s income statement in 2022 has turned out to be a tremendous mistake - as I predicted. Once again, Spotify’s financial prowess is best portrayed in Q1 2025 by the rapidly rising cash from operations, which came in at a record €534M.

The graph below is worth a thousand words. In aggregate, Spotify management expects FY2025’s gross margins to be higher than FY2024 gross margins. However, per all the above, what truly matters is cash from operations and free cash flow per share.

Perhaps the most interesting aspect of the Q1 2025 earnings call was Daniel’s intensified focus on operational efficiency. He has termed 2025 as the “year of accelerated innovation” and allegedly, Spotify has decreased the time spent rolling out updates across their various apps by 10X. Spotify has also decreased the time required to scale up new features by 6X. In essence, Spotify is merely a machine that delivers more value per dollar spent over time. This new focus on operational efficiency is likely to have them accelerating the pace at which they deliver value, which should bode well for shareholders.

See Daniel’s remarks during the Q1 2025 earnings call about this:

So I wish I could say to you guys that this is a linear journey. It's not. But what I will say, ultimately for us is we are focusing on speeding up our execution because if we are executing faster, we will solve problems faster. If we're solving problems faster, we will add more value.

And if we're adding more value faster, then we'll have more opportunities to either take that in the context of having a lower price but higher effective growth in certain markets or take it in terms of a price increase that then gives us growth that way.

As Daniel explains, the value they deliver can be converted into growth and/or price increases. If in a given quarter Spotify chooses the former, value will tend to show less in the financial statements. While if Spotify chooses the latter, value will be more visible. In either case, long term shareholders get rewarded so long as Spotify continues to focus on creating long term value. And so far, Spotify’s focus on long term value creation is only increasing.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Oops. Thick thumb. Can you explain how they calculate or come up with this “value to price ratio” they talk about? What are its components? Thanks much

value to price ratio