Lemonade: Fundamentals Continue to Improve.

Q2 2025 ER Digest

This is an update of my original Lemonade deep dive and Q1 2025 Lemonade earnings digest.

Lemonade is on the Singularity Scaler path.

Lemonade continues making good progress towards becoming a Singularity Scaler. The following datapoints suggest that Lemonade’s underwriting ability, driven by AI, continues to improve fast:

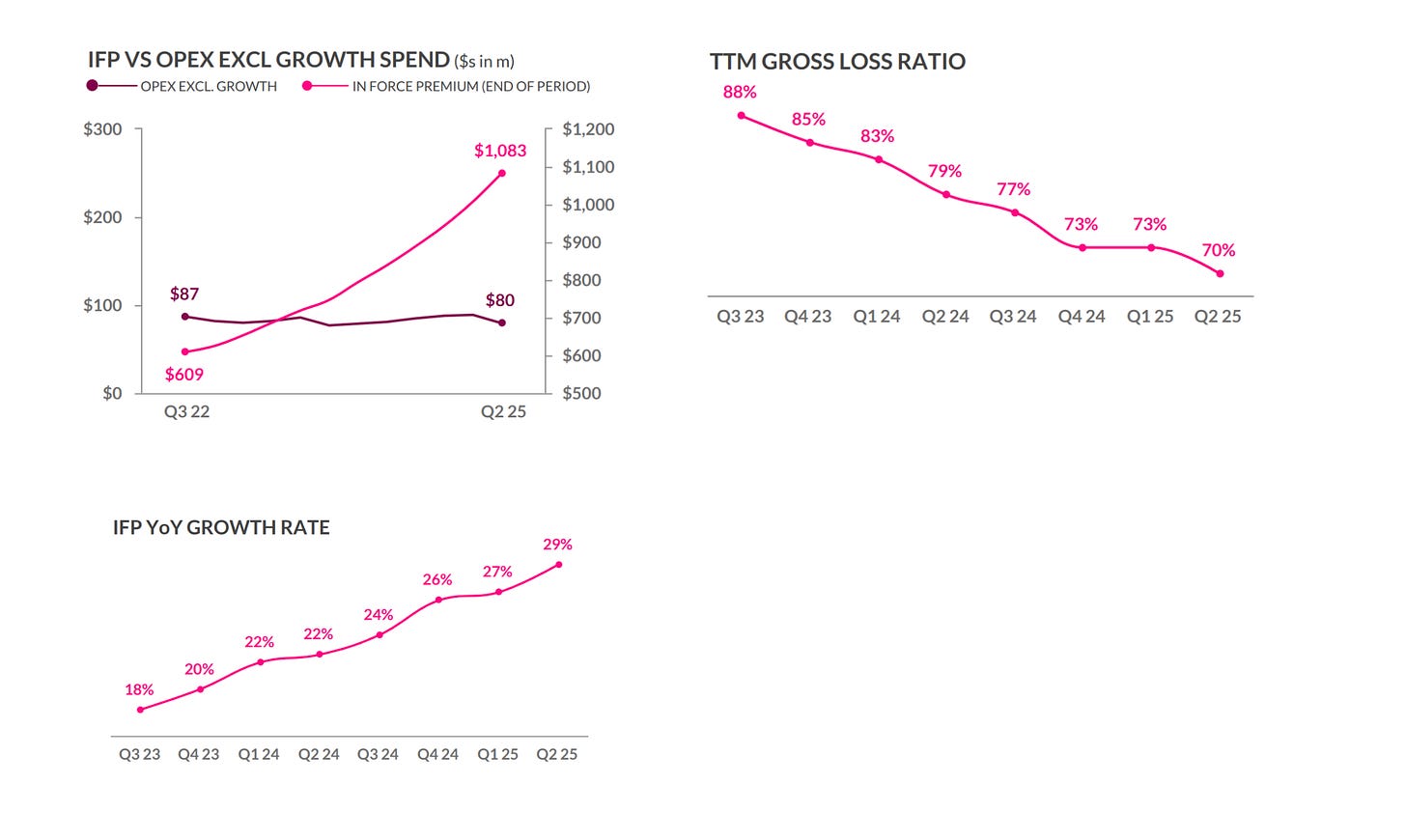

The rapidly rising IFP (in-force premiums), which is up 29% YoY.

OpEx staying relatively flat YoY.

The continued decline of the gross loss ratio, which is down to 67% this quarter.

More notably, IFP growth is accelerating which suggests that Lemonade’s offering is resonating more with customers.

There are now meaningful odds that Lemonade’s underwriting ability improves enough to unlock a quality of service at scale that incumbents may severely struggle to match. Indeed, the thesis is not only about Lemonade’s underwriting ability but the operating leverage of its platform, which is also powered by AI. It enables the rapid onboarding of customers and the subsequent settlement of claims. Said operating leverage is well evidenced by the fast IFP growth in Europe, as Lemonade Director Shai Wininger explained during the Q2 2025 earnings call:

In the past few quarters, we've really seen our European business come into its own and is now a meaningful driver of growth for the organisation. We concluded Q2 with $43 million Europe IFP, which represents over 200% growth, our eighth consecutive quarter of triple-digit growth and our fourth consecutive quarter of growth rate acceleration.

[…]

This performance is powered by structural cost advantages driven by our AI platform.

Wininger then explained this was partially driven by Lemonade’s LoCo tech:

One great example of this is a technology we call LoCo, our LLM-first no-code insurance application builder. With LoCo, we can rapidly build new products, launch new regions, iterate on pricing and underwriting, and experiment with various dynamic experiences all in hours instead of weeks and without touching any code.

[…]

Where our competitors have large local teams on the ground in the regions they operate and with each region having its own specific legacy infrastructure, our proprietary technology enables us to expand our geographical footprint with unmatched velocity and limited incremental overhead.

Perhaps the strongest signal that Lemonade’s AI is indeed maturing successfully is Lemonade management deciding to reduce quota share reinsurance down from 55% to 20% this quarter. It signals confidence in Lemonade’s ability to produce capital rather than consume in.

Insurance businesses are required to hold a 3:1 ratio of capital per every dollar they insure. By sharing quota, they effectively offload a portion of those capital requirements to a re-insurer. By reducing the quota shared, they take on more of the aforementioned capital requirements and by design, Lemonade chooses to operate at a 6:1 ratio, which adds further strain that otherwise required by regulators. Therefore, the quota reduction signals management truly believes their ability to price risk and thus underwrite policies is increasing rapidly.

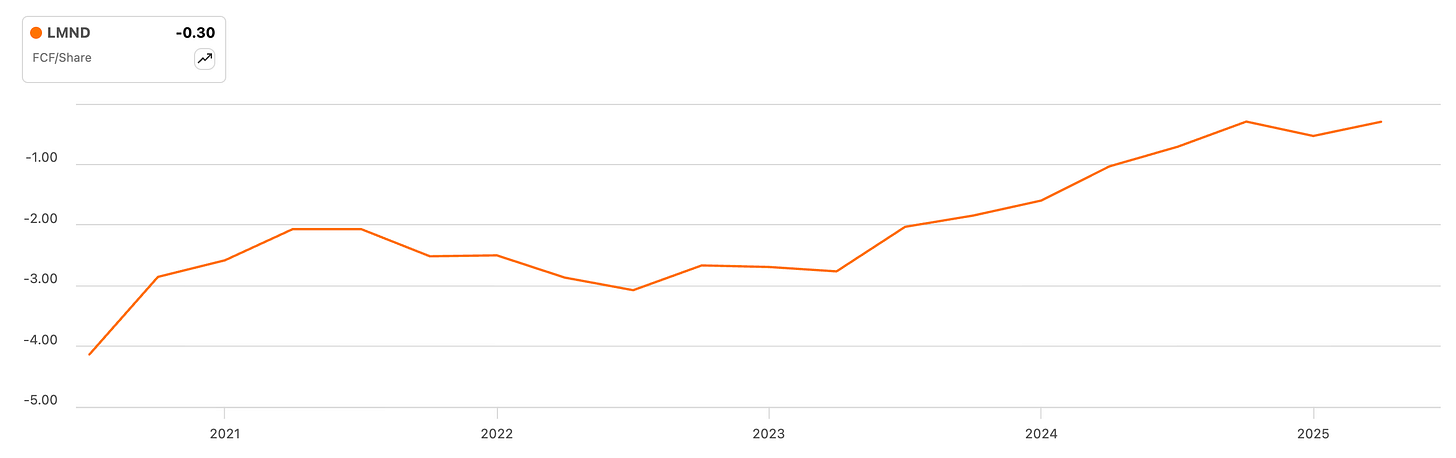

As you can see in the graph below, Lemonade’s free cash flow per share is negative. However, it continues to converge towards the positive domain as gross loss ratio continues to decline. During the Q2 2025 earnings call CEO Daniel Schreiber said that Lemonade has now achieved “healthy loss ratios” and that driving them down further would at times imply prices not being competitive enough. Thus, in case of success additional free cash flow per share gains from here will likely be driven by:

Increase scaled and leverage of operations, as we have seen in Europe and across the board over the past few quarters.

The effect of renewal policies (which have better unit economics that initial policies) amplified by continued cross-sell (half of Lemonade’s growth thus far has come from cross-selling policies, according to Lemonade CFO Timothy Bixby.

The combination of the two above factors, coupled with an AI that continues to get better, could be yield to an explosive improvement of Lemonade’s financial results. AS I highlight in my Q2 2025 Lemonade update, my initial impression of management and of their AI strategy was unfavourable: they allegedly chose to create a secret AI model that outperforms every other model, instead of pursuing an absolute proprietary data advantage and then leveraging existing frontier models, which is what according to Meta CEO Mark Zuckerberg works best. Regardless, Lemonade’s fundamentals are thus far proving me wrong.

A marginal underwriting advantage could have Lemonade achieving an absolute advantage over incumbents on the data side of things rather quickly. Per the signals that I breakdown above, it seems that Lemonade is currently on a path to achieving that. Meanwhile, it was excellent to see management alluding to two things I look for in businesses constantly:

An Innovation Stack, as Block co-founder Jim McKelvey defined it, whereby years of obsessive focus and iterations end up creating a moat.

A willingness to share economies of scale with customers, in the spirit of the Costco Algorithm, thus delivering more value to customers per dollar spent on their behalf over time.

Lemonade Nicholas Stead’s remarks during the Q2 2025 earnings call were highly insightful and apart from pointing at the aforementioned Innovation Stack, also pointed to the concept of an insurance Ontology:

And you're right, Emmanuel, to focus on AI-first companies as we believe the gap between us and incumbent insurers who are built on legacy systems is very likely to expand as AI development accelerates. We have been AI native since day 1. Relative to new upstarts, that 10 years in market gives us a real data edge, thousands of A/B tests, 10 million driving trips, millions of customer interactions and claims.

[…]

We stand apart from incumbents with a single AI system that connects every aspect of the business and from upstarts with the depth and breadth of proprietary data that feeds it.

Lemonade CFO Timothy Bixby’s remarks during the Q2 2025 earnings call directly pointed to Lemonade actively sharing economies of scale with customers:

We can grow a great deal and still be a tiny drop in the car ocean. So we don't ignore the competitive dynamics.

We tend to want to, where we can, give the benefit of our unit economics improvements or loss ratio improvements back to the customer so that our pricing is attractive. There's obviously, a limit to that. But the competitive dynamics of the market tend to be secondary to what we see in terms of what our LTV models tell us that what are good risks and where the marketing efficiency is strong. So we feel like all systems are go going into the second half.

Overall, Lemonade is successfully tracking towards a scenario in which free cash flow per share rises notably. The market has taken notice of these advancements, as evidenced by the rising price to sales ratio that you can see below. However, at just over 6 times sales Lemonade is reasonably priced. I do not have a conviction and/or position here, but I continue to track Lemonade closely.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Hi Antonio, can you cover Rubrik?

The shift from 55% to 20% quota share reinsurance is the critical inflection point here - it signals management's confidence in their loss ratio improvements and directly accelerates path to profitability. The AI underwriting engine is finally showing real-world efficacy after years of iteration. Europe growing 200% provides geographic diversification that reduces single-market risk. Most investors still associate LMND with the 2021 insurtech hype cycle, but the fundamentals have genuinly evolved. Key risk remains competitive dynamics with ROOT and traditional carriers adapting their tech.