This is an update of my original Tesla deep dive.

The Q1 2025 earnings report is a mixed bag for Tesla. But the long term thesis remains intact.

As evidenced by FSD videos, Tesla is advancing towards full autonomy. The more cars it puts on the road, the more data Tesla has to train its AI models and thus the more autonomous the cars get. Q1 2025 presents mixed results for Tesla, but two datapoints standout. Firstly, car deliveries and net income are far lower than last quarter because Tesla stopped production for a few weeks to update factories. Secondly, Tesla continues to make good progress in terms of making cars cheaper, which should equate into more cars on the road down the line.

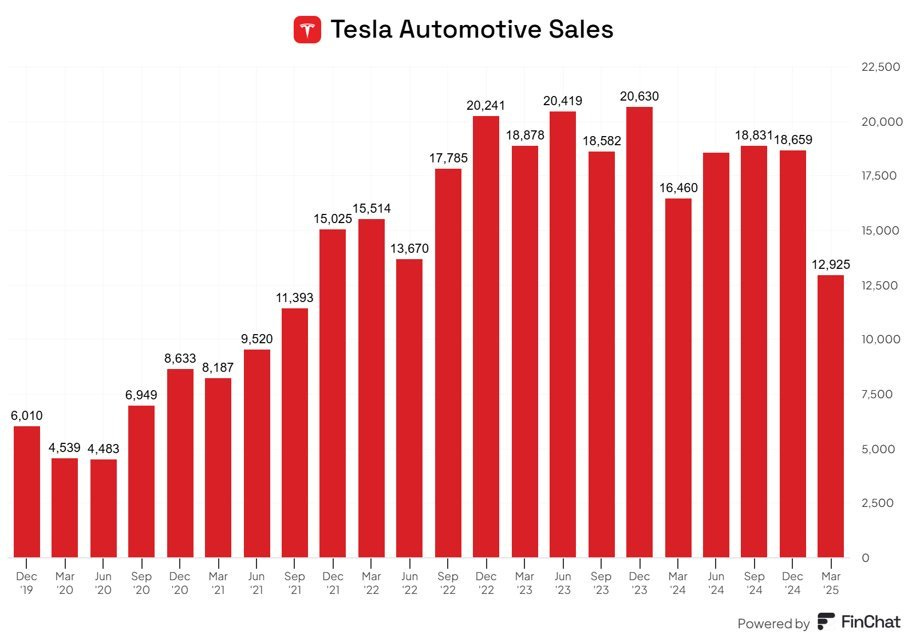

Hence, while the graph below may initially cause concern, Tesla sales continue to essentially flat line since the Fed hiked rates. With a higher price of money, cars remain considerably less affordable than in 2020. Additionally, investors seem concerned that the quarterly decline in automotive sales stems from Tesla’s allegedly damaged brand, but Elon dismissed this during the Q1 2025 earnings call:

And despite the economic strain and negative articles, in California in Q1, Tesla [Model Y] remained the best-selling car, not just EV.

And additionally, we had a record number of test drives globally in Q1 as well. So, interest remains high. And so right now, we continue to see good interest still on vehicle.

Yeah. I mean, Tesla is immune to sort of the macro demand for cars. So when there is economic uncertainty, people generally want to pause on buying, doing a major capital purchase like a car. But as far as absent macro issues, we don't see any reduction in demand.

Ultimately, Tesla shareholders will make a lot of money if Tesla’s vertically integrated autonomy infrastructure far exceeds that of the nearest competitor’s in scale. Thus, while this quarter’s financial results are not enticing, my focus remains on Tesla’s efforts to make cheaper cars. During the call, management reiterated numerous times that their focus is on maximising affordability:

But we've been targeting the low cost of ownership. Monthly payment is the biggest differentiator for our vehicles. And that's why we're focused on bringing these new models with the big, new lowest price to the market within the constraints of selling.

-Lars Moravy, Tesla VP of Engineering during the Q1 2025 earnings call.

Earlier in the call, Lars also shared some insights on Tesla’s “unboxing” method, which is allegedly an entire new way of making cars. According to Tesla management, Tesla Shanghai produces one car every 33 seconds and this new manufacturing method could bring that number down to 5 seconds. Thus, it seems that Tesla management remains focused on putting the highest number of cars on the road possible, in order to unlock Physical AI first - which in my view presents Tesla shareholders with potential upside of orders of magnitude:

Really, [unboxed presents] levels of automation that are sort of unheard of in the vehicle manufacturing scale.

This is like not something that when you see it be produced, you'll think of in terms of, like, wow, this car has been built for 100 years. It's really something we’ve changed.

In the past year, we've been like focusing on a lot of key development areas like, marrying these large subassemblies together in a precise way, in an accurate way. We've also derisked things like corrosion of uncoated aluminum structures, the ceiling across the seams of the vehicle and when you marry several components.

-Lars Moravy, Tesla VP of Engineering during the Q1 2025 earnings call.

Many investors believe that Waymo is a strong competitor in the race towards Physical AI, but I believe they underestimate the importance of a vertically integrated infrastructure. As Elon explained during the Q1 2025 earnings call, a Tesla costs 25% of what a Waymo costs. Waymo buys other cars and retrofits autonomy hardware and software onto them, while Tesla controls every component of the stack and is therefore able to decrease costs faster. For now, Tesla’s vertically integrated infrastructure remains unrivalled:

The issue with Waymo's cars is it costs way more money, but that is the issue. The car is very expensive, made in low volume.

Teslas are probably cost 25% or 20% of what a Waymo costs and made in very high volume. So, ironically, like, we’re the ones to make the bet that a pure AI solution with cameras and what do you have?

-Elon Musk, Tesla CEO during the Q1 2025 earnings call.

As I explain in my latest Costco update, qualitative remarks are signals when accompanied by quantitative datapoints that run in parallel. Below you can see the cornerstone of my Tesla thesis: as cash from operations divided by CapEx goes up, it denotes higher operational efficiency. However, you will notice that there is a cyclical pattern. This is because every time Tesla attains a new efficiency threshold, it then proceeds to lower prices.

The increment that you see in the graph below throughout the year 2020 is what led Tesla to exponentiate its free cash flow per share levels, sending the stock up over tenfold. After 2022, Tesla has been working on achieving new efficiency levels, while facing an exponentially higher price of money and considerable inflation. Tesla made good progress starting in Q3 2023, but the metric was invalidated by Houthi attacks on Red Sea shippers in Q1 2024.

Discounting the production halt in Q1 2025, operating cash flow divided by CapEx has been essentially flat since Q3 2024. Thus, although Tesla exhibits no commensurate increase in efficiency over the past few quarters, it certainly isn’t moving backwards. My view remains that if we adjusted this metric for the exponentially higher price of money, the increase in efficiency levels seen since H1 2023 is considerably higher than that seen in 2020.

Therefore, I still believe that at some point in the near future (one or two years, perhaps) Tesla’s underlying efficiency is likely to suddenly rear its head and show up in the income and cash flow statement. I believe the trigger is likely to be the release and ramp of the new cheaper models. Lars shared some insights on Tesla’s progress on that front, during the Q1 2025 earnings call:

Yeah, we're still planning to release models this year. As with all launches, we're working through like the last-minute issues that pop up. We're not getting down one by one.

At this point, I would say that ramp maybe -- might be a little slower than we had hoped initially, but there's nothing, just kind of given the turmoil that exists in the industry right now.

Additionally, you will notice that Tesla’s gross margins in the TTM (orange line) and cash from operations (blue line) are going in opposite directions. While the knee jerk reaction is to see this as a negative trend, it actually means that Tesla’s moat is getting stronger. As Bezos once said, investors can’t spend percentage margins but they can spend (free) cash flow. More cash flow with lower margins means Tesla’s business is getting harder to replicate.

Lower margins make it harder for competitors to emulate Tesla’s business while producing enough cash to stay afloat.

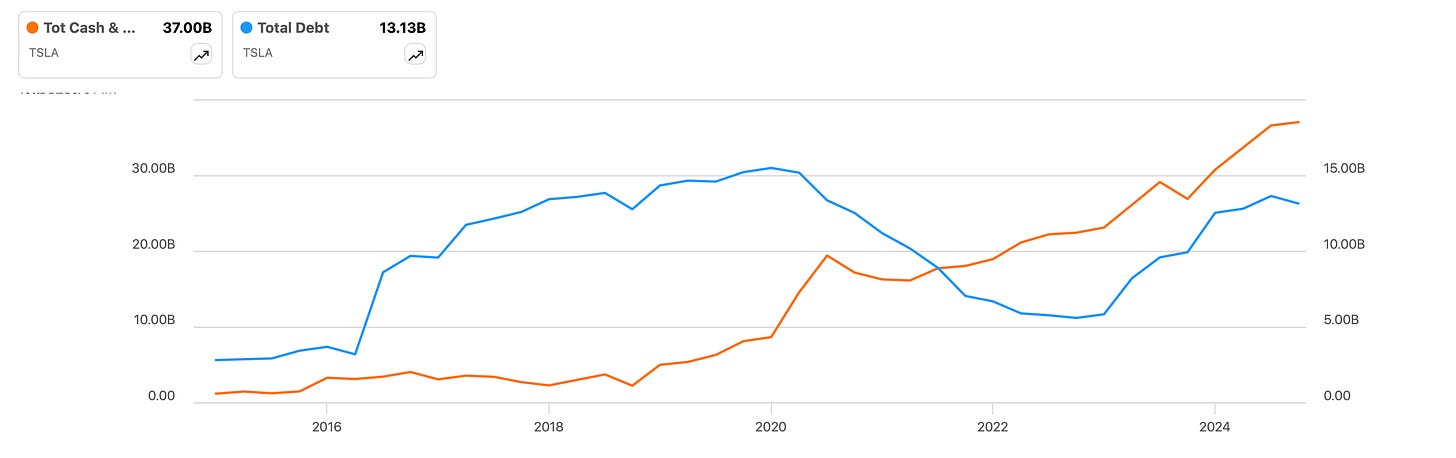

Simultaneously, Tesla’s cash position is approximately 2.8 times bigger than its total debt, as you can see in the graph below. Additionally, Tesla’s energy business continues to make good progress in Q1 2025, as you can see in the next graph. And although the energy business has a fair degree of sensitivity to tariffs, since Tesla imports LFP batteries from China, Tesla has been anticipating this scenario and sees a viable path forward:

The impact of tariffs on the energy business will be outsized since we source LFP battery cells from China. We're in the process of commissioning equipment for the local manufacturing of LFP battery cells in the US.

However, the equipment which we have can only service a fraction of our total installed capacity of late. We've also been working on securing additional supply chain from non-China based suppliers, but it will take time.

Also note that, in spite of all the impact on US from energy -- from tariffs on the energy business, we do have a Megafactory China which just started operations in Q1, and that should take care of our business outside of the US.

-Vaibhav Taneja, Tesla CFO during the Q1 2025 earnings call.

Therefore, my view remains that Tesla is a highly asymmetric bet - the financials are strong and Tesla is well positioned to capitalise on the Physical AI opportunity. While there is no guarantee that they become the Physical AI leader, their manufacturing, AI and energy curves continue to compound satisfactorily. The odds that these three curves combine to create a form of material abundance in the future, driven by Physical AI primarily, are appealing enough for me to remain long. Indeed, most of the initially appearing weak financials in Q1 2025 are noise and the company remains fundamentally sound.

Lastly, Elon’s remarks on core value proposal of the energy storage business caught my eye. Allegedly, Megapacks enable utility companies to store energy produced during the night, to then discharge it during the day. This considerably increases the yield of a power plant. Elon believes this application alone can scale Tesla’s energy storage to terawatts per year:

The Megapack enables utility companies to output far more total energy than would otherwise be the case. When you think of the energy capability of a grid, it's much more than, say, total energy output per year.

If the powerplants could operate at peak power for all 24 hours, as opposed to being at half power, sometimes a quarter power at night, then you could double the energy output of existing power plants.

But in order to do that, you need to buffer the energy, so that you can charge up something like a battery pack at night and then discharge into the grid during the day. So, this is a massive unlock on total energy output of any given grid over the course of a year.

And utility companies are beginning to realize this and are buying in our Megapacks at scale. So, at this point, a gigawatt class battery is quite a common thing. So, we have many orders and offer for gigawatt and beyond batteries. And we expect the energy -- the stationary energy storage business to scale ultimately to terawatts per year.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc