I learned a lot about IREN from Agrippa Investments. Thanks a lot for your great work.

A growing number of Tech Stock Goldmine alumni are writing their own deep dives:

Brian wrote deep dive on Western Union.

Lorenzo wrote a deep dive on Nebius.

Max wrote a deep dive on Hims.

IREN is successfully applying Tesla’s playbooks to datacenters. With compute demands skyrocketing across the board and a solid and repeatable blueprint, IREN has notable upside.

IREN has scaled from 1.1 exahash in Q3 FY2022 to 50 exahash in Q3 FY2025, while getting remarkably more efficient. IREN yielded 15 joules per terahash in Q3 FY2025, up from 22 the prior quarter and from 29.5 joules per terahash in Q2 FY2023. In other words, IREN has increased its Bitcoin mining power by 50X in just three years while cutting the energy required per unit of compute in half. This is a remarkable engineering feat which points to world class process power. The main driver of this dynamic is IREN’s vertical integration, which co-CEO Daniel Roberts points to in the Q3 FY2025 earnings call:

And it's the same thing with all this. It's just a bottom-up analysis, how much does the raw materials cost, what's the most efficient way to assemble everything, not signing layers upon layers of contractors, designers, builders, et cetera. It's all controlled in-house. And I think you're right, like it's going to be a competitive advantage, the ability to deliver cost at this level.

The datacenter business is ultimately about providing more compute per joule (unit of energy). As explained above, IREN has demonstrated an organisational capability to rapidly deliver more compute per joule over time. And while IREN got started by pointing its compute capabilities at mining Bitcoin, the AI vertical is growing quickly. IREN initially deployed 248 Nvidia H100 GPUs in early 2024 and now has 1,896 H100 and H200 GPUs, as of Q3 FY2025. The AI vertical is being deployed on IREN’s platform at a marginal cost, which is in turn being funded by mining and selling Bitcoin. As the AI vertical scales, IREN could therefore see tremendous operating leverage gains.

Two additional datapoints stand out as further proof of IREN’s process power:

IREN management consistently does what they said they were going to do, ahead of schedule.

One example of this is the completion of the Canal Flats site, which was scheduled for December 2021, but was actually completed in September 2021.

Canal Flats was expected to operate at 700 peta-hash, but was actually operating at 850 peta-hash in Q3 FY2022.

Another example is management in the Q1 FY2025 earnings anticipating the operating leverage gains seen in Q3 FY2025: IREN’s “other costs” have gone from 23.76% to 17.08% of revenue YoY, in the face of rapid expansion and joules per terahash gains.

IREN has pounced on liquid cooling technology, while the rest of the market hasn’t been able to yet.

IREN management first mentioned liquid cooling in the Q3 FY2022 earnings call, when asked if they were considering it.

In Q1 2025 they said they would be installing liquid cooling at the Prince George and Childress datacenters.

In the Q3 FY2025 they announced the new Horizon 1 site (effectively a sub-component of the Childress site, where most of IREN’s activity is concentrated), which will be liquid cooled and delivered by Q4 FY2025.

As a result, Horizon 1 is expected to have a rack density of 200kW, placing it at the cutting edge of data center technology. Nvidia’s Blackwell currently needs 130kW, so this means IREN is executing ahead of what’s required today.

I define process power as the intangible force that drives most of an organisation’s success. In Bayesian terms, it’s often represented as the continued completion of near impossible achievements, one after the other, such that in the abstract the probability of completing all of them is near zero. IREN has not only increased its mining capacity by 50X in the past three years and halved the amount of energy required per unit of compute in the past two years: it’s done so executing ahead of schedule, over-delivering, yielding fixed cost leverage and pouncing on liquid cooling technology, simultaneously. IREN is defying the odds, driven by notable process power, as co-CEO Daniel Roberts tentatively points to the in the Q3 FY2025 earnings call:

Operationally, we continued our cadence of delivering 50-megawatts every month of data centers with energisation of Childress Phase 4. And during the quarter, we averaged 29.4 exahash of operating mining capacity, which represents a nearly 5x uplift year-on-year.

So these results reinforce both the earnings power of our growing data center platform, along with the strength of our procurement engineering, construction, mining and AI teams who simply continue to execute. We anticipate this earnings momentum to continue into fiscal Q4 as we further progress on our key growth initiatives, which I'll now come on to.

If AI scaling laws persist, the world is going to see an outsized energy shortage, with energy consumption rising exponentially over the decades to come. I believe IREN is building a flywheel akin to Tesla’s, but tailored said energy requirements. On a first principles basis, Tesla’s rapidly rising cash from operations over the past decade can be attributed to its ability to franchise manufacturing sites. Once they ramped up their manufacturing efficiency to bring the Model 3 to live (after going through “production hell”) , leveraging that blueprint to bring more production sites online has been the primary driver of Tesla’s financial performance. IREN is doing something very similar

The Childress site, which as previously explained now aggregates most of IREN’s activity, is an instance of the Canal Flats blueprint, as former IREN president Lindsay Ward explained during the Q3 FY2022 earnings call:

We're now taking out Canal Flats standardised design and the improvements that we've trialed and investigated and starting to roll those out to Prince George Mackenzie, both in British Columbia and then down in Childress.

Another key point which is a little bit different for us is that we've got quite an extensive facility in Canal Flats that's a fabrication facility. It's contributing a lot of the materials and the know-how to the facilities themselves and that really does give us confidence in delivering schedule and delivering quality outcomes and at a really effective price. So that's again one of our competitive advantages for our British Columbia-based facilities.

Lindsay explained during the same call that the “key” of said standardised design is the way they manage the air in the datacenters:

The large exhaust fans that they adjust their speed to the ambient temperature. So they ramp up and down optimising miner performance and optimise ancillary power consumption.

And that's really key to our success is the design of that integrated system.

[…]

And one of our innovations is the way in which we recirculate the hot air coming from the miners, reinject that back into the inlet area and that gives us a consistent temperature throughout our data centers particularly in winter. And that has a great impact on life and also optimisation of the chips themselves.

Per the way in which IREN has scaled compute capacity and energetic efficiency over the past few years, I’d say that the blueprint is working quite well. Therefore, IREN’s franchising capacity is something that I could tentatively bet on. On top of IREN’s standardise design (which it seems to be continuously iterating on), IREN’s franchising power is founded on its ability to contract grid power and secure land for its operations. The combination of these three factors makes the operating hard to replicate and increasingly so via the aforementioned iterations.

As a result of these three factors, IREN is not only decreasing the joules per unit of compute over time, but is also decreasing the cost of the energy itself. In Q3 2022 their energy cost was $0.05 per kilowatt hour in British Columbia: Canal Flats is located in South Eastern British Columbia. A few years after and following tremendous inflation, the average power cost at Childress is $0.03. This is not doubt aided by the plentiful supply of renewable energy at Texas, but it shows that IREN knows how to leverage the land component to obtain further operating leverage across the value chain.

I’m not personally a Bitcoin fan, since I much prefer productive assets. In turn, most of IREN’s revenue in FY2024 came from mining and selling Bitcoin. However, I am impressed with IREN’s process power and they’re now leaning into their AI and high performance computing blueprint at Sweetwater. Given their ability to execute and the strong AI scaling laws that we’re seeing (for now), I believe IREN’s AI vertical could scale rapidly, mitigating the reliance on Bitcoin. On the flip side, IREN presents an interesting opportunity to gain some exposure to the crypto space, while pursuing the AI opportunity long term as I do in the rest of my picks.

IREN co-CEO Daniel Roberts shared some insightful remarks on their AI blueprint, during the Q3 FY2025 earnings call:

So in context, we own the land, we own the substation and the infrastructure. We are building to rack level specifications required by future workloads, not just what fits today, and it positions us, Horizon and Childress to be one of the few potential large-scale liquid-cooled AI campuses in North America.

So this is a blueprint, not just for Childress, but also for Sweetwater and how we can potentially scale our broader platform to meet this rising demand. So Sweetwater is our flagship AI site, which we've mentioned for the last year or so now.

And it's a very rare combination of secured land, grid scale power and site readiness that is well in motion.

So to recap some of the fundamentals, 1,800 acres with up to 2 gigawatts of high-voltage power capacity already secured through binding contractual agreements. That's enough capacity to support over 700,000

[…]

And this is where Sweetwater stands out. Most of that demand is bottlenecked by land use, zoning, grid connection, politics. And at Sweetwater, we've solved for those constraints.

The world is going to need a lot of power, and IREN’s primary asset is the 2.9 GW of grid capacity it has secured, enabling it to monetise that power through large-scale computing for clients. All of IREN’s value creation process comes to delivering more giga-watts to computing end customers, making total power secured the primary KPI for the IREN thesis. Securing giga-watts for customers is not easy. In fact, while IREN is obviously far from Tesla’s maturity, its present moat is somewhat reminiscent of AST Spacemobile’s: getting all the technical, geographic and political stuff right is quite hard.

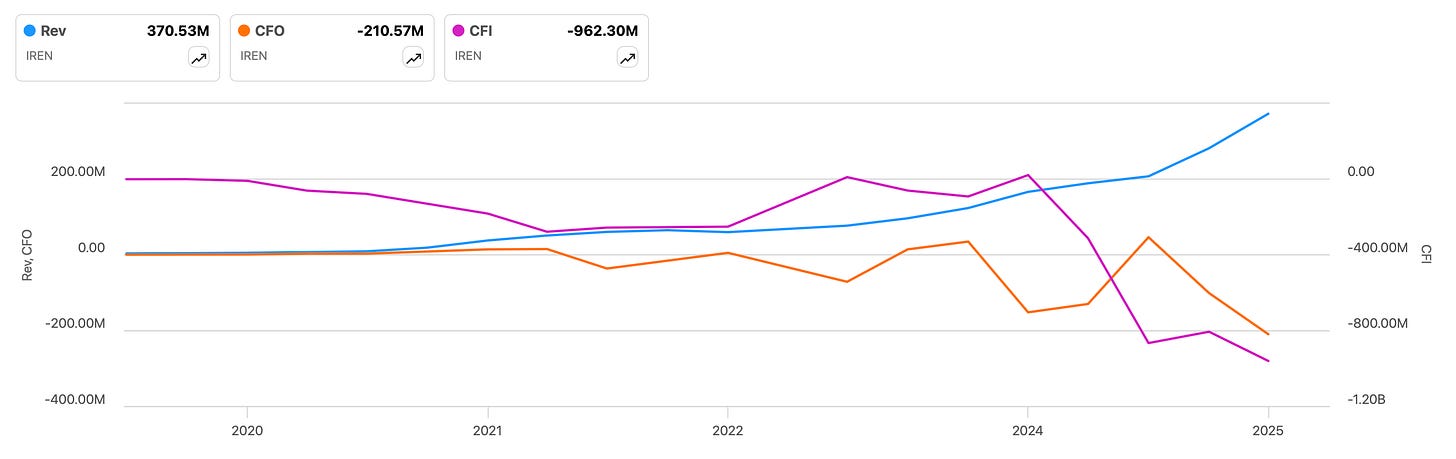

As you can see in the graph below, the market is responding well to IREN’s offerings, with revenue (blue line, left axis) growing non-linearly. Given the rapid expansion, however, IREN’s cash from operations (left axis, orange line) and cash from investing (right axis, purple line) remain negative, adding notable financial risk to the thesis. Note that IREN shifted how it reports proceeds from Bitcoin sales: as of March 20, 2025, after an SEC review, the company began classifying those cash flows under investing activities instead of operating activities.

The IREN thesis rests on two factors going forward:

IREN’s ability to deploy more giga-watts.

IREN’s ability to do so while increasing operating leverage, primarily driven by its standardised design.

Since IPO IREN has established a solid track record, which suggests that its ability to compound these two curves is solid. As and if its AI vertical scales, IREN is positioned to become a truly asymmetric bet for investors, by providing exposure to the two primary compute trends of our lifetimes: crypto and compute. At a certain level of maturity, IREN promises to capture AI upside if crypto fails and viceversa, which is a fairly asymmetric scenario. Further, regardless of the fate of these two workloads, I am certain humanity will require exponentially more compute over time and IREN’s blueprint seems like a highly differentiated asset in this context.

At a market cap of just $3.4B, with such notable organisational properties and a vast opportunity ahead, IREN is an appealing stock for me.

Until next time!

I currently do not have a position in IREN. Because on top of all the above IREN is founder-led, I will continue studying the company closely. IREN joins my “venture capital” shortlist, together with other companies like AST Spacemobile, Oscar Health, HelloFresh and Rivian.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Great write up. Having a presence in Australia, Canada, and the U.S is somewhat of a differentiator as well. The founders seem to know how to find, invest, and manage large scale global infrastructure.