Netflix has thrived against all odds by focusing on delivering more value to customers per dollar spent. Hims is doing the exact same thing, but applied to healthcare.

Meanwhile, the market continues to focus on GLP-1s and is absolutely missing the point.

Two years after leaving Netflix stock for dead, the market now sees Netflix as a “recession hedge.” Analysts have figured out that Netflix has become a sort of utility that customers are unlikely to cancel during times of economic hardship. While it’s tempting to attribute this property to the resilient nature of the entertainment business, it fundamentally comes down to Netflix’s ability to deliver more value per dollar spent to customers over time.

This propensity has seen Netflix survive the Great Financial Crisis, a worldwide pandemic, ravaging inflation, intensified competition in the streaming space and everything in between. As you can see in the graph below, both cash from operations (orange line) and free cash flow per share (blue line) are now considerably higher than the 2021 highs. Hims is executing the same playbook but applied to the healthcare space.

During the Q1 2025 earnings call, Netflix co-CEO Greg Peters shared that buzzy titles drive less than 1% of total viewing hours. This shows how Web 2.0 platforms (like Spotify, Uber, Hims and others) are a complex user experience optimisation game. The foundation of Netflix’s business is about creating a highly effective content personalisation system that connects 700M users worldwide with the content they want to see, among an endless ocean of possibilities.

The complexity of this component of the business remains misunderstood by the market, which is why many investors still believe Netflix, Uber, Spotify et al have no moat. However, as evidenced by Netflix’s evolution since the market declared it uncompetitive in 2022, the moat is there. Although you could argue Netflix’s user experience is not perfect, it gets harder every day to connect users with content like they do. And as they reinvest capital to improve their business, it gets even harder.

If this is not true, why haven’t other platforms thrived as Netflix has? Why have Netflix’s cash from operations and free cash flow per share gone on to eviscerate previous records? The financial performance is necessarily indicative of an operation that is hard to replicate.

Meanwhile, the market is myopically focused on Hims’ GLP-1 offerings, despite management reiterating countless times that most of the growth is driven by other healthcare verticals. As happened with Netflix in 2022, many investors believe Hims has not moat. However, they underestimate the complexity of delivering personalised treatments to a growing number of subscribers, across healthcare verticals, while producing cash from operations.

In effect, I believe Hims’ moat is the same as Netflix’s plus a component of at-scale personalised compounding. The market is concerned about Amazon disrupting Hims, but we have seen Amazon make repeated attempts to replicate the business and fail. We have seen other businesses like Walmart try to replicate Hims and fail in time as well. If Hims were so easy to disrupt, the $4T healthcare industry would’ve disrupted the operation by now too.

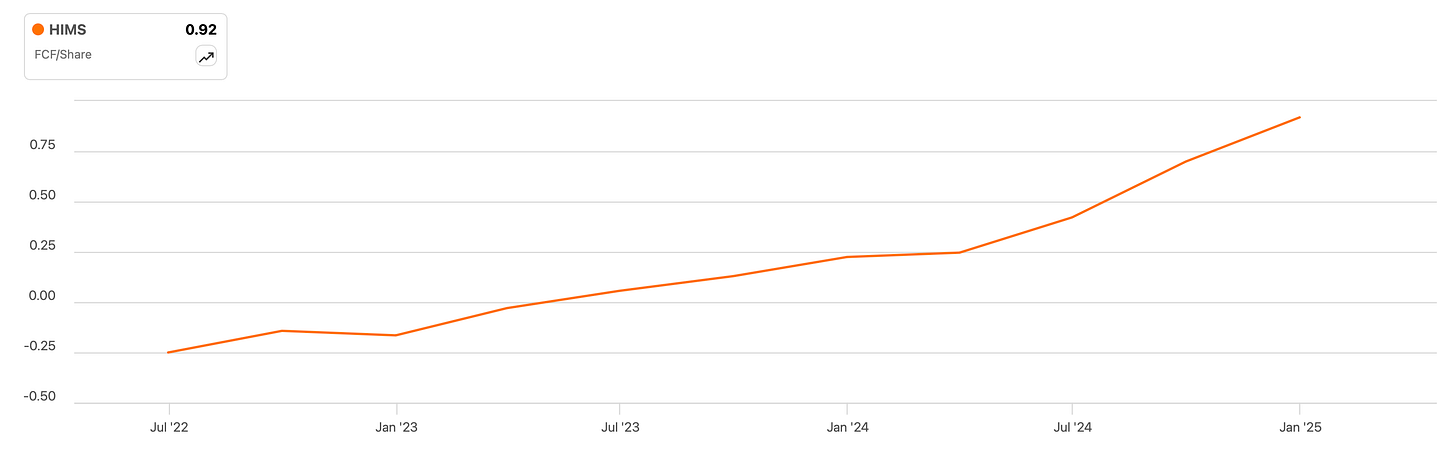

Meanwhile, Hims continues to compound free cash flow per share at breakneck speed as you can see in the graph below.

The reason Hims is succeeding to fend off a $4T industry and companies with vast resources is that it’s unreasonably focused on delivering better patient outcomes per dollar spent on their behalf. They offer a growing range of healthcare solutions on their platform at a lower price over time, thus making it harder for subscribers to find superior alternatives elsewhere. It is the exact same model Netflix have applied for decades to entertainment, but applied to the healthcare space and at a much earlier stage.

Every time new fears about an alleged recession comes along, the market proceeds to sell Hims stock. However, during a recession a “Netflix of Healthcare” is likely to be even more resistant to economic hardship that Netflix itself: healthcare problems are a far more pressing problem than entertainment.

Hims is an eight year old company and it has a long way to go to demonstrate to the market that it is a strong business. However, the execution so far has been flawless and Hims is succeeding against all odds. This is usually indicative of a world class management team, which is the essence of all Netflix-like success stories. You could just as well say that Hims is like Spotify 15 years ago, because genetically Spotify and Netflix are the same. In turn, they are almost genetically identical to Amazon, Walmart Costco.

The most powerful force in capitalism is sharing economies of scale with customers. What the above businesses have in common, on top of extraordinary founders, is that they focus unreasonably on delivering more value to customers and they then reinvest the capital they acquire to get customers even better deals. At this stage, disrupting Netflix and Spotify is nearly impossible until we see a groundbreaking technological shift. Yet, a few years ago the market was looking down on these two businesses and especially in Spotify’s case.

In effect, it pays more to focus on getting good at spotting world class instances of economies of scale shared (or instance of the Costco Algorithm, as I call it) than to focus on price action. The market will go from disdaining a particular company to declaring it undisruptable a few years later, as has also happened with Meta and Amazon over the past few years. Certainly, Hims presents additional risk given its relatively small size, but all qualitative elements point to a prime example of the Costco Algorithm.

As I have said many times, tech investors are forced to deal with one of two types of pain: buying when no one wants to and before the market realises the value of a company or buying when everyone wants to and the market is aware of the value. Hims is currently in the former bucket, but as management continues to execute at the current level I believe doubts will dissipate. This process takes years, but it then goes on to create wealth relatively quickly.

For example, analyst are now setting ~$700 price targets for Spotify, when they said just a few years ago in the $70-90 range that it would never amount to a profitable business. I’m up 6X on Spotify since and I’m delighted to be sitting on the business as Ek and co continue to deliver more value to customers per dollar spent on their behalf.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc