Should the concerns about Zeta’s practices turn out to be wrong, Zeta presents meaningful upside priced at just over 2 times sales.

Much like Crowdstrike, Zeta’s business comes down to having a superior architecture that translates into more and better data than competitors. The superiority of Crowdstrike’s architecture hinges on its lightweight agent and in Zeta’s case, on the low latency enabled by AI being native to the application layer. This essentially enables Zeta to execute AI workloads faster and provide a marginally better user experience, which as I have explained many times, tends to yield a non-linear advantage in terms of adoption over time.

Zeta CEO David Steinberg captured the essence of Zeta’s value in the Q2 2024 earnings call:

In our world, a millisecond matters. We are able to create substantially better return on investment by making intelligence faster and real-time.

The graph below summarises what I now term the Vertical Ontology Playbook, which synthesises the core value creation mechanism of companies like Crowdstrike, Zeta, Gitlab, Okta and others. All these companies do is seek to optimise their infrastructure over time, to obtain a data advantage and thus train the best AI models possible, driving better customer outcomes . They effectively create vertical digital twins that automate a part of a company’s operations. For example, Crowdstrike automates security, Gitlab automates coding and Zeta automates marketing.

At the highest level of execution, the above equation translates into:

Rapidly growing revenue.

Operating leverage gains in tandem.

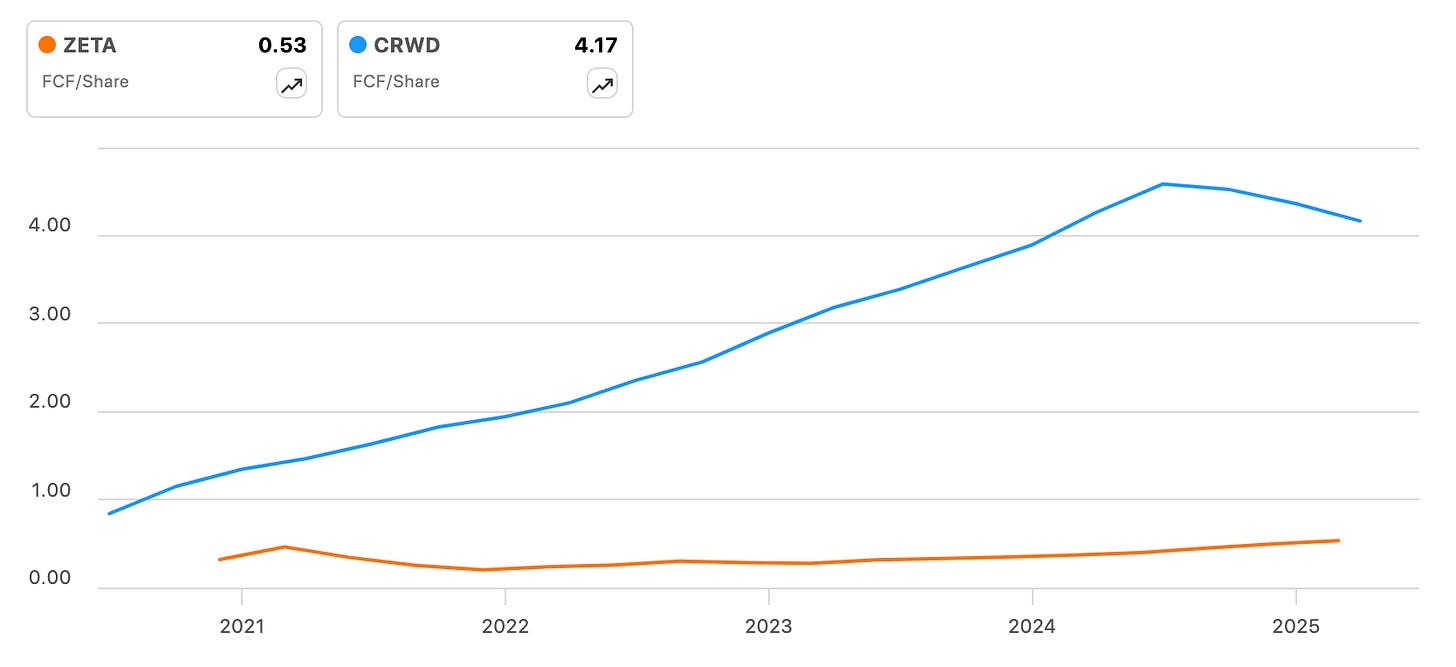

A superior architecture enables these companies to solve a growing volume of acute customer pains in a way that competitors can’t. Free cash flow per share growth tells us whether a company is capable of doing this or not. For example, Crowdstrike’s rapid free cash flow per share growth has been driven by the relative ease with which they can launch new security modules and make more money per customer. Competitors haven’t been able to catch up because Crowdstrike’s lightweight agent makes distribution easier, affording Crowdstrike more data and thus a relatively enhanced ability to deploy more modules.

Crowdstrike’s free cash flow per share is up nearly five fold over the past four years, while Zeta’s is only up 1.6 times. Crowdstrike was founded four year later than Zeta and still, the outperformance is remarkable. Per this metric alone, we may infer that Zeta’s infrastructural advantage is not as extraordinary as that of Crowdstrike.

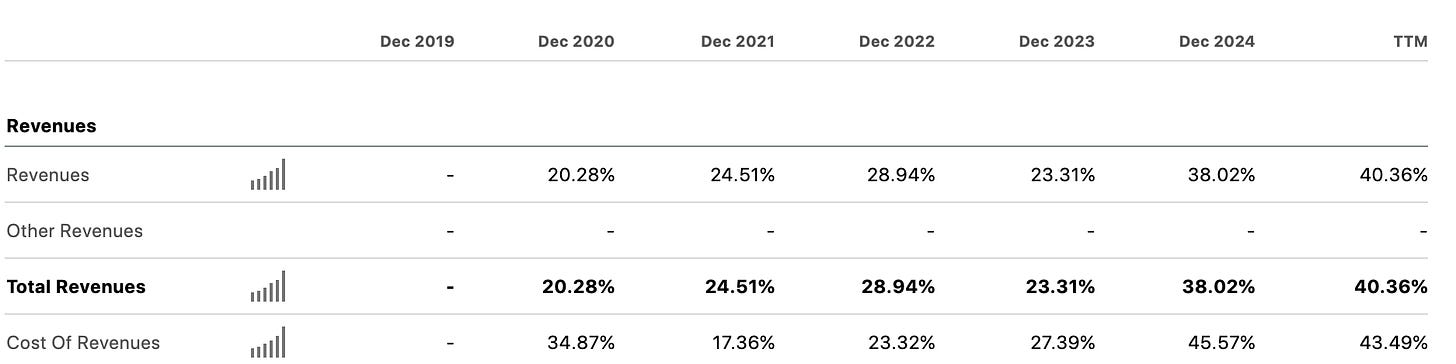

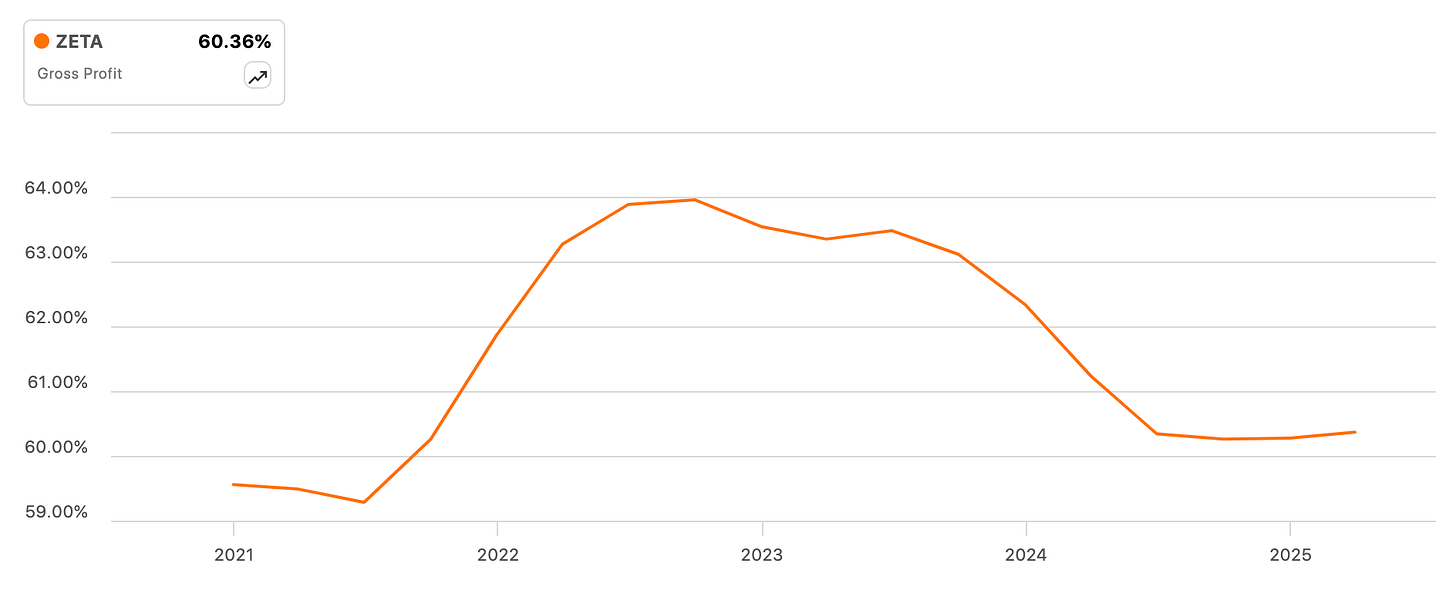

Still, Zeta’s resilience in the years 2020 and 2022 has caught my eye. Online advertising saw a severe pullback during those two years and regardless, Zeta’s revenue grew YoY remarkably, as you can see depicted in the numbers below. In the next graph, you may also appreciate the rapidly rising gross margins during the same period. Zeta rearchitected its platform in 2021 to run AI workloads natively at the application layer. The revenue growth in the aforementioned two recessionary periods suggests Zeta’s infrastructure does have a considerable advantage over other players in the market space.

CEO David Steinberg shared some insights on the value of Zeta’s rearchitecture during the Q3 2022 ER call:

I feel like we are where the puck is going, not going to where the puck is going, meaning we as you know, rearchitected the Zeta marketing platform starting about five years ago into what it is today, which has Artificial Intelligence and data as native to the application layer.

So to really put some meat on the bones of what that means. If you're running a legacy marketing cloud, and they claim to have Artificial Intelligence, your marketing cloud has to talk to their AI algorithm, which then has to do multiple data dips to pull the proper data in, based on the instructions from that marketing platform to the algorithm and think about how long that takes to make a decision.

When you put everything is native to the application layer, it can make real world decisions all at once; really a differentiator.

As of Q1 FY2025, Zeta has beat and raised guidance for 15 consecutive times. Simultaneously, Zeta is accused by Culper Research of inflating data and revenues via "consent farms" and round-tripping, raising red flags given CEO David Steinberg’s checkered history with controversial ventures. However, two things are true:

Zeta works with 44% of the Fortune 500, which suggests that the platform is indeed valuable. Customers include United Airlines, Toyota and Samsung.

Assuming the CEO is up to something bad just because he has made mistakes in the past is a rather heuristic thought process. So is assuming the mistakes were deliberate.

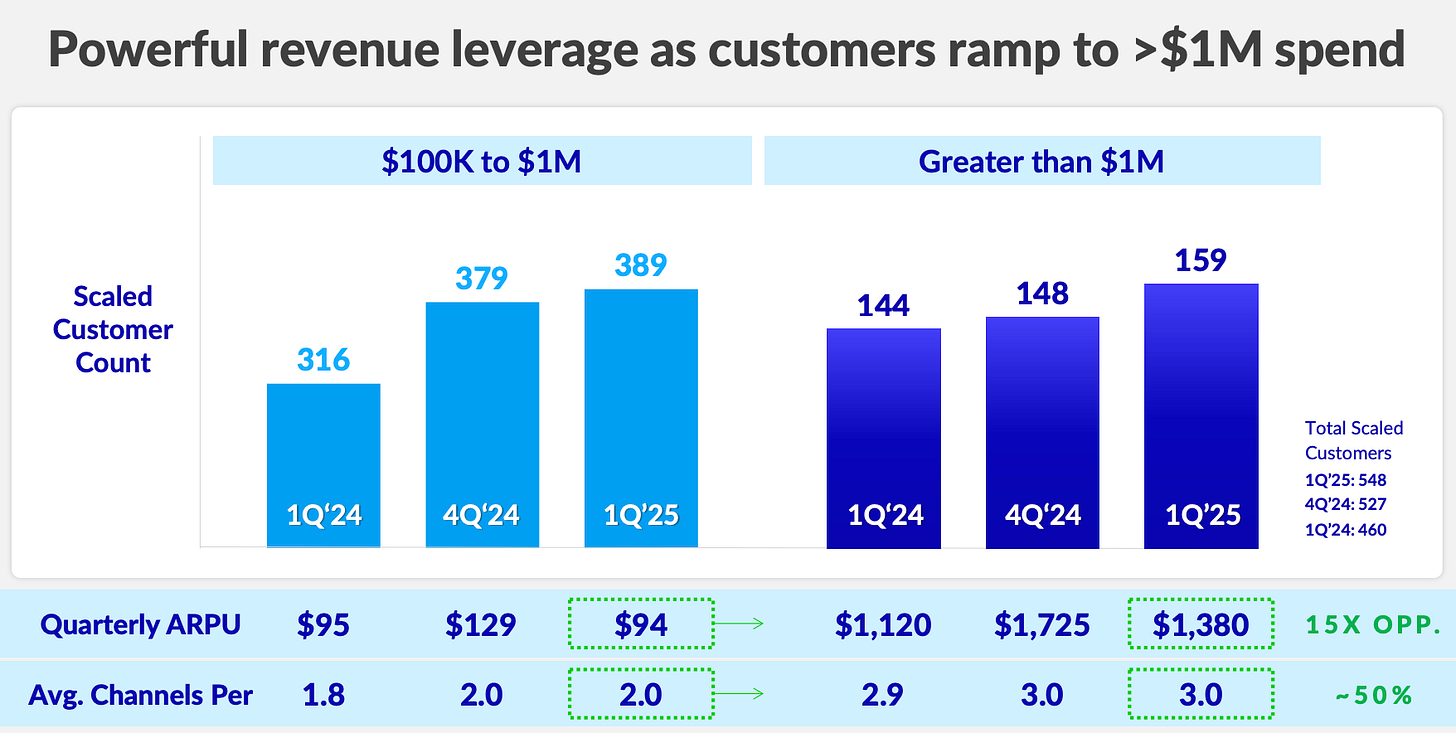

While indeed Zeta working with many Fortune 500 companies does not exclude the possibility of wrong doing, it doesn’t prevent me from continuing to study the company closely either. Assuming the numbers are truthful, the resilience demonstrated in recessionary year is compelling. And as you can see in the graph below, “Scaled Customers” (defined as customer that generate over $100,000 worth of revenue in the 12 trailing months) are up considerably over the past year. This further suggests that Zeta’s infrastructure has a competitive advantage.

Zeta could evolve into a Singularity Scaler: the platform promises to become a digital twin of all and any advertising channel over time, by creating a database of highly targetable end customers with unique IDs. Zeta encourages enterprise clients to share end-customer data by offering personalised marketing capabilities, improved ROI, and enhanced customer experiences in return. Over the long term, if indeed Zeta does obtain a data advantage, this infrastructure promises to get exponentially more powerful as AI models continue to scale.

Zeta CEO David Steinberg explained this during the Q1 2022 ER call:

But there's a bunch of stuff that's come out around our CDP being the top in the industry. A lot of it is not just the architecture of the CDP software, which is we believe superior to anybody else's, but the ability to do it with the data cloud changes the narrative when we're talking to customers and they're seeing the type of data elements that are coming in.

The really exciting thing about that is once they start using the blended data, and we're matching it greater than 80% of our data cloud to the average customer's first-party data, as we scale what we're seeing is they're coming up with incredible audiences that they want to target, inside of the data cloud.

Well, guess what? They cannot target to those audiences, because they all synthesize to a Zeta ID number, unless they use us to activate. So not only are we winning CDPs in an accelerated pace, it is truly the Trojan horse into the enterprise, because as they use these incredible attributes that we bring to life, there is no way to activate to the consumer unless you're using the ZMP.

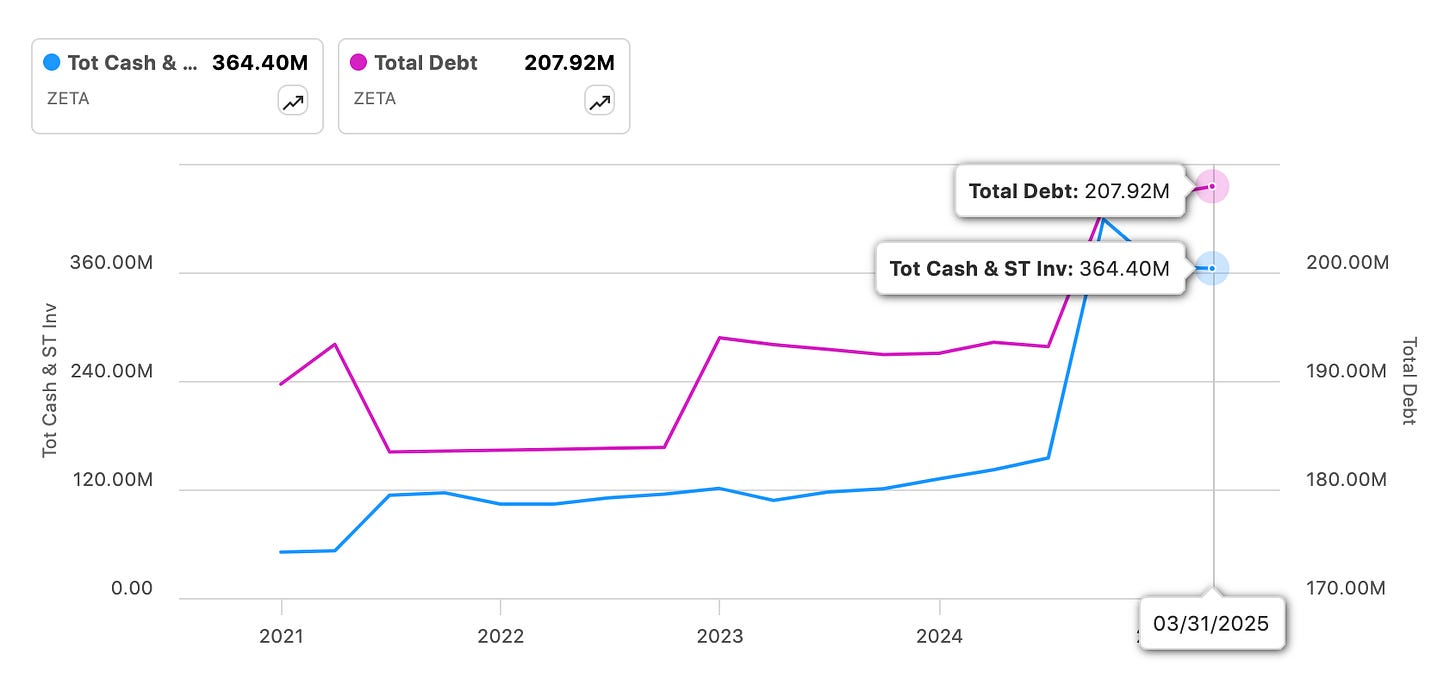

Priced at just over 2 times sales and with a reasonable balance sheet, with $364M in cash and $207M in debt, Zeta could evolve into an attractive pick. The thesis needs the validation of a large customer which is highly trusted by investors. For now, I don’t quite have the need of investing in a company led by a CEO with a track record that’s under scrutiny, when there are other companies led by CEOs that I know I can trust for sure.

At InPhonic, David Steinberg’s previous companies, he allegedly inflated revenues through questionable accounting tactics, including round-trip transactions that misrepresented the company’s financial health. He also seemed to mismanaged capital by over-leveraging the business and repurchasing stock irresponsibly, ultimately leading to the company’s bankruptcy and significant investor losses. Having said this, Zeta’a progress to date is eye-catching and it may just be that Steinberg proves investors wrong.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc