Wise: The Costco Algorithm Applied to Finance.

New conviction. Q4 2025 ER digest.

This is an update of my original Wise deep dive.

I see Wise becoming one of the largest financial institutions on Earth.

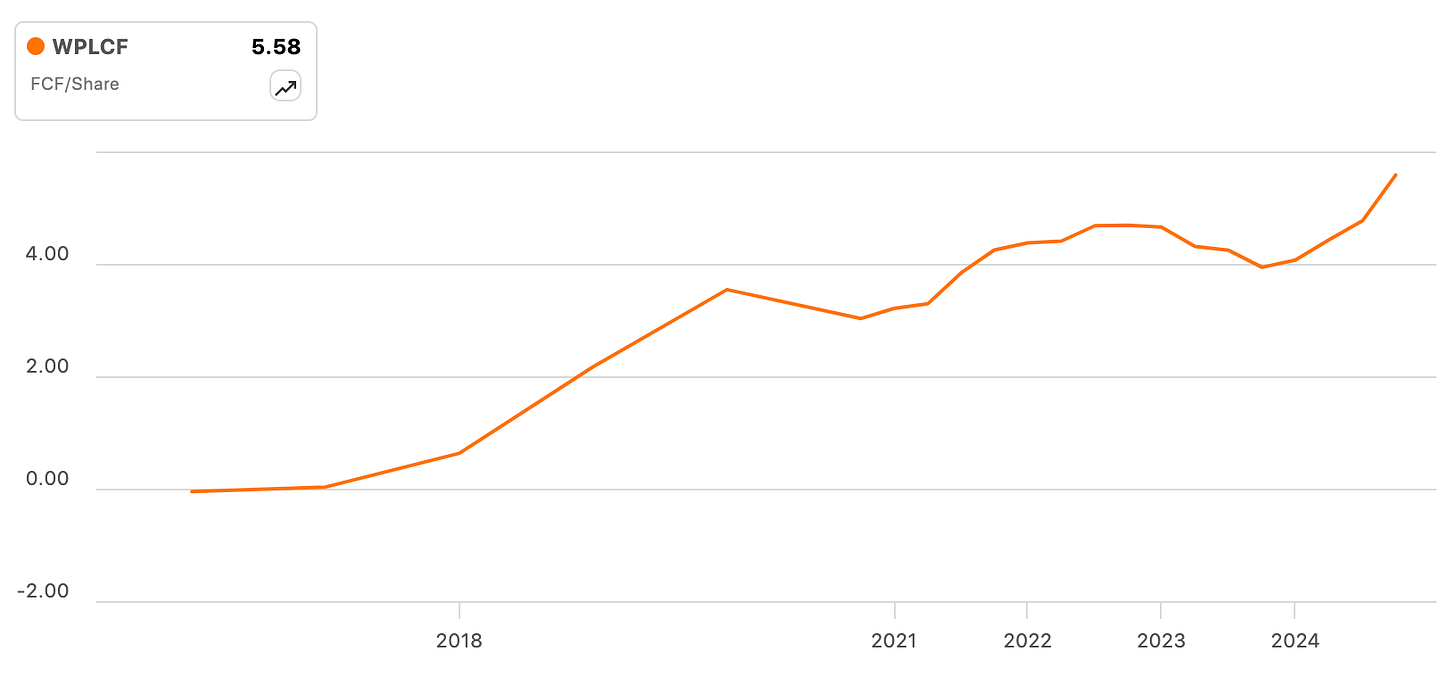

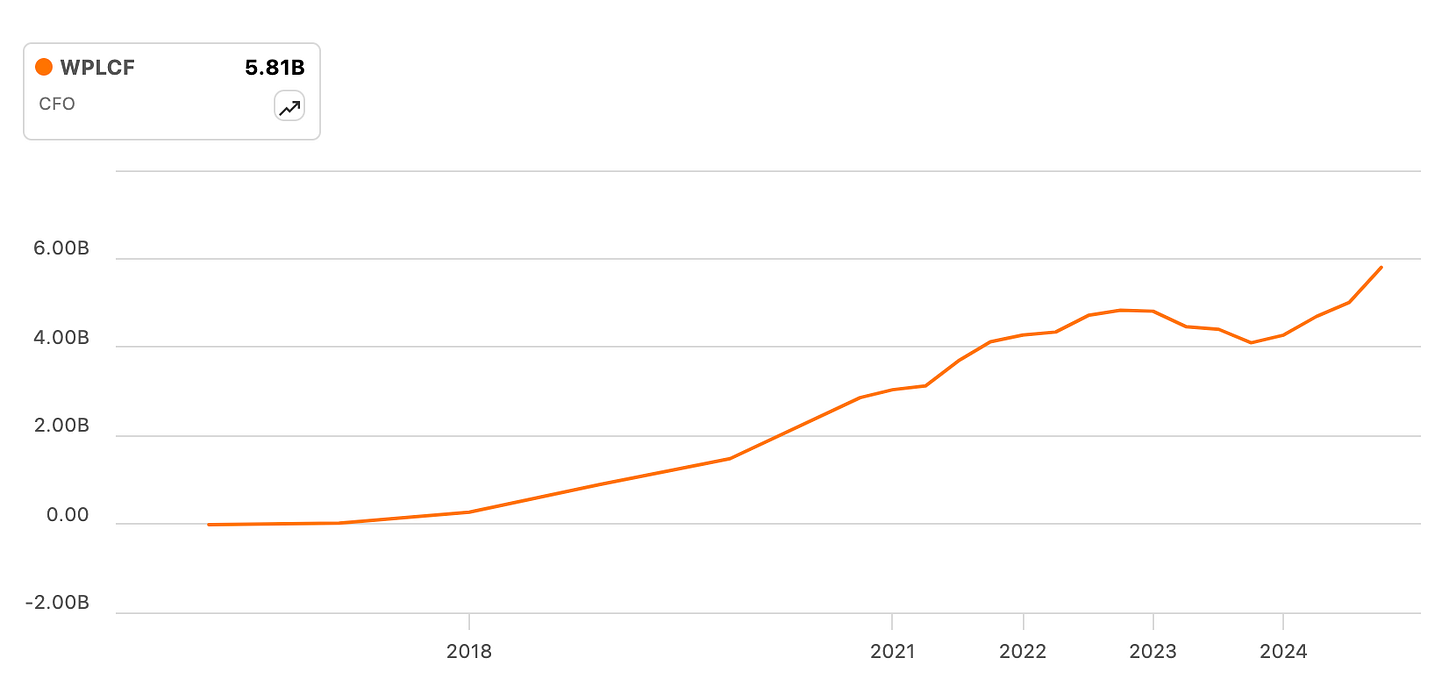

Over the past decade, Wise has demonstrated an extraordinary ability to solve a growing volume of acute customer pains, in a way that’s increasingly harder to imitate. Said prowess is best summarised by the evolution of Wise’s free cash flow per share, depicted below. Wise is making international payments easier, faster and cheaper over time and has exponentiated its cross border volume, while decreasing prices. In effect, Wise is a near perfect application of the Costco Algorithm and has found a way to compound tremendous goodwill with ~15M customers worldwide and counting.

Wise is now positioned to:

Grow to billions of users.

Exponentiate revenue per user, by deploying additional verticals at a marginal cost.

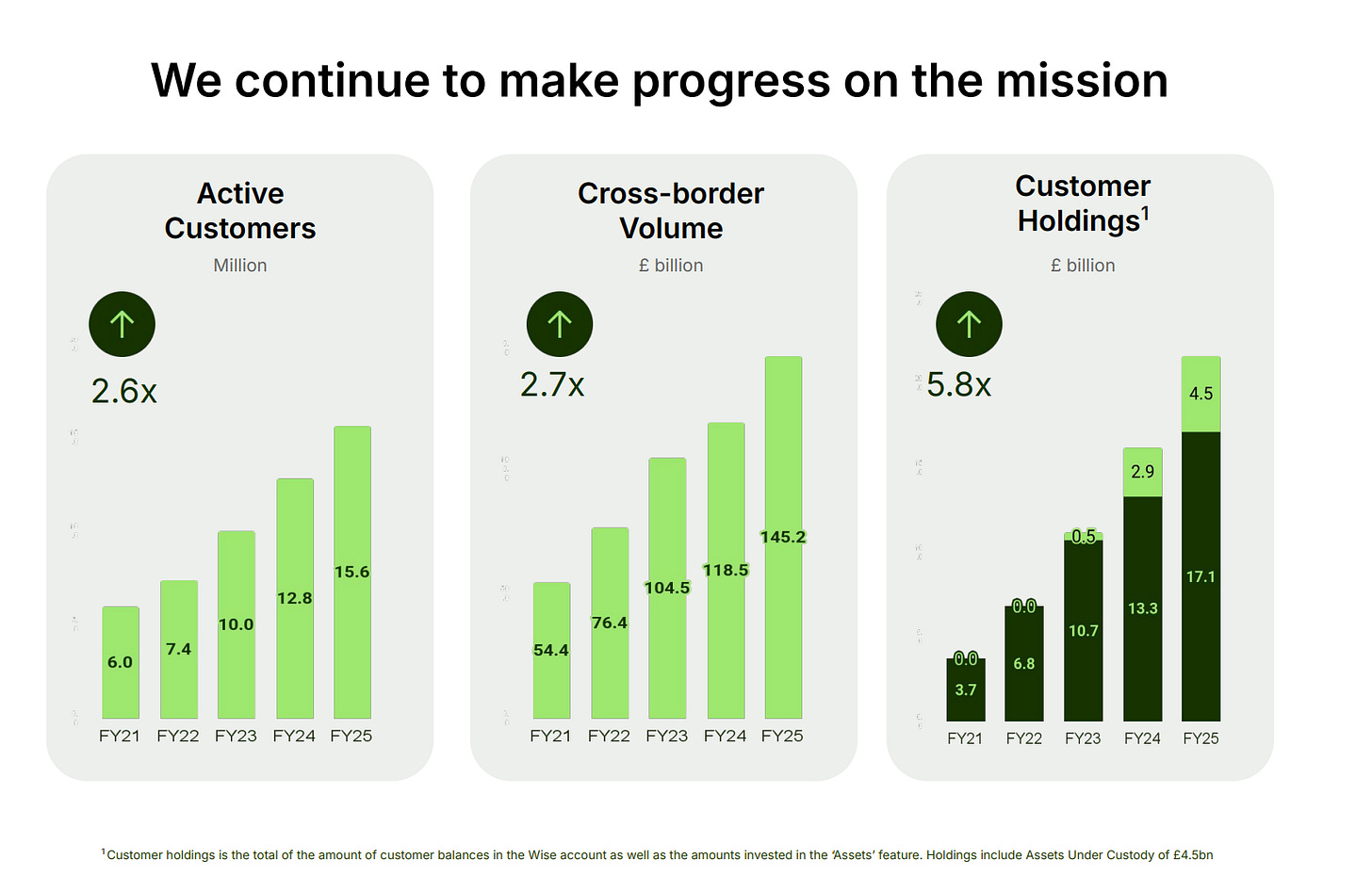

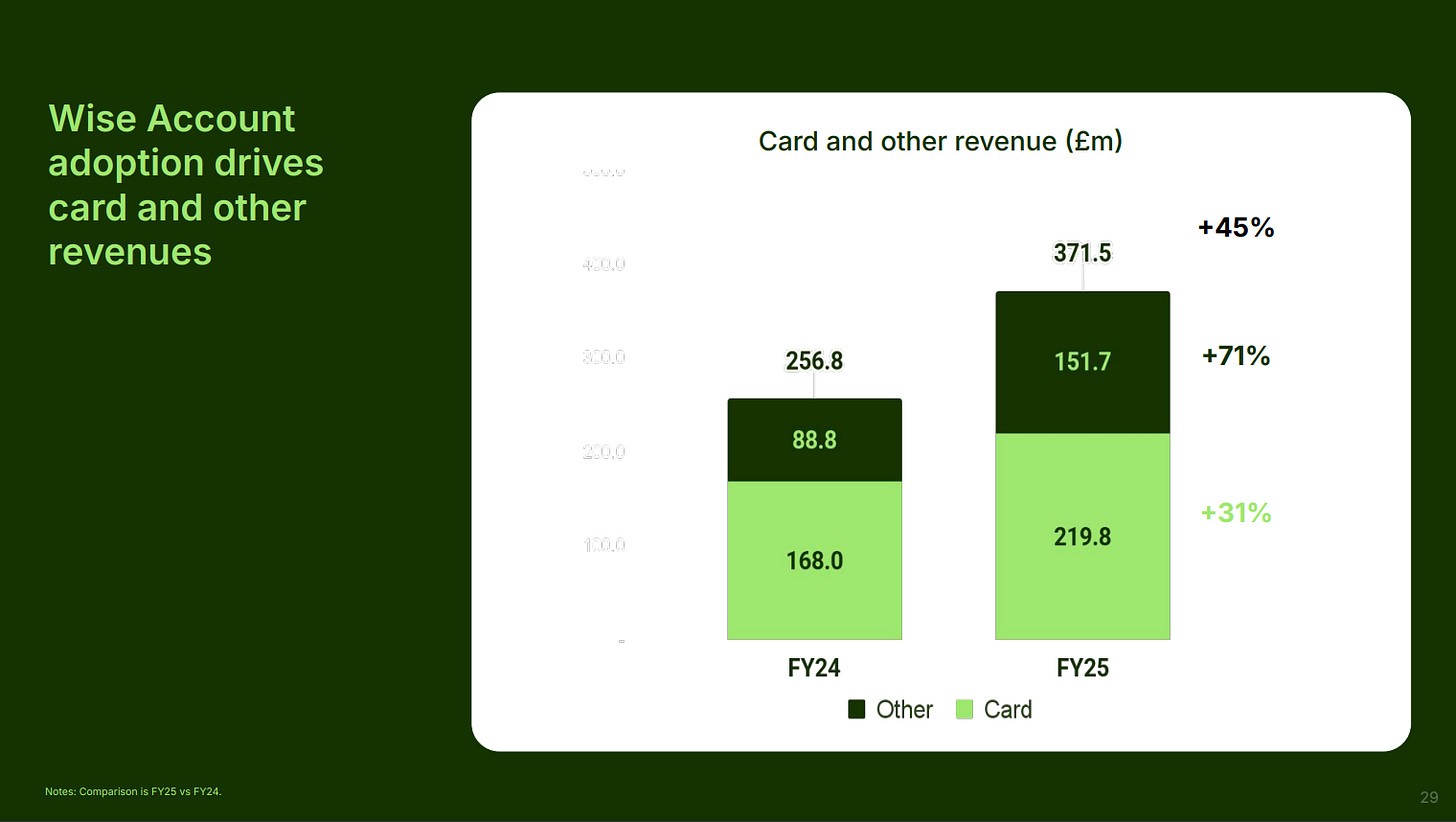

Wise’s free cash flow per share has ticked up in 2024 driven by the growth of the Wise Account, which lets users hold, convert, spend, and invest in multiple currencies and equities globally as well as spend their balance via a credit card. Customer holdings are up from £3.7B in FY2021 to £21.6B in FY2025. Additionally, Wise Account drove 38% of Wise’s total revenue in FY2025, indeed proving that Wise has the ability to successfully deploy new verticals. Thus, Wise is quickly evolving from being an international payments app into a complete commercial finance platform. This positions Wise to drive notable operating leverage gains over the coming decade.

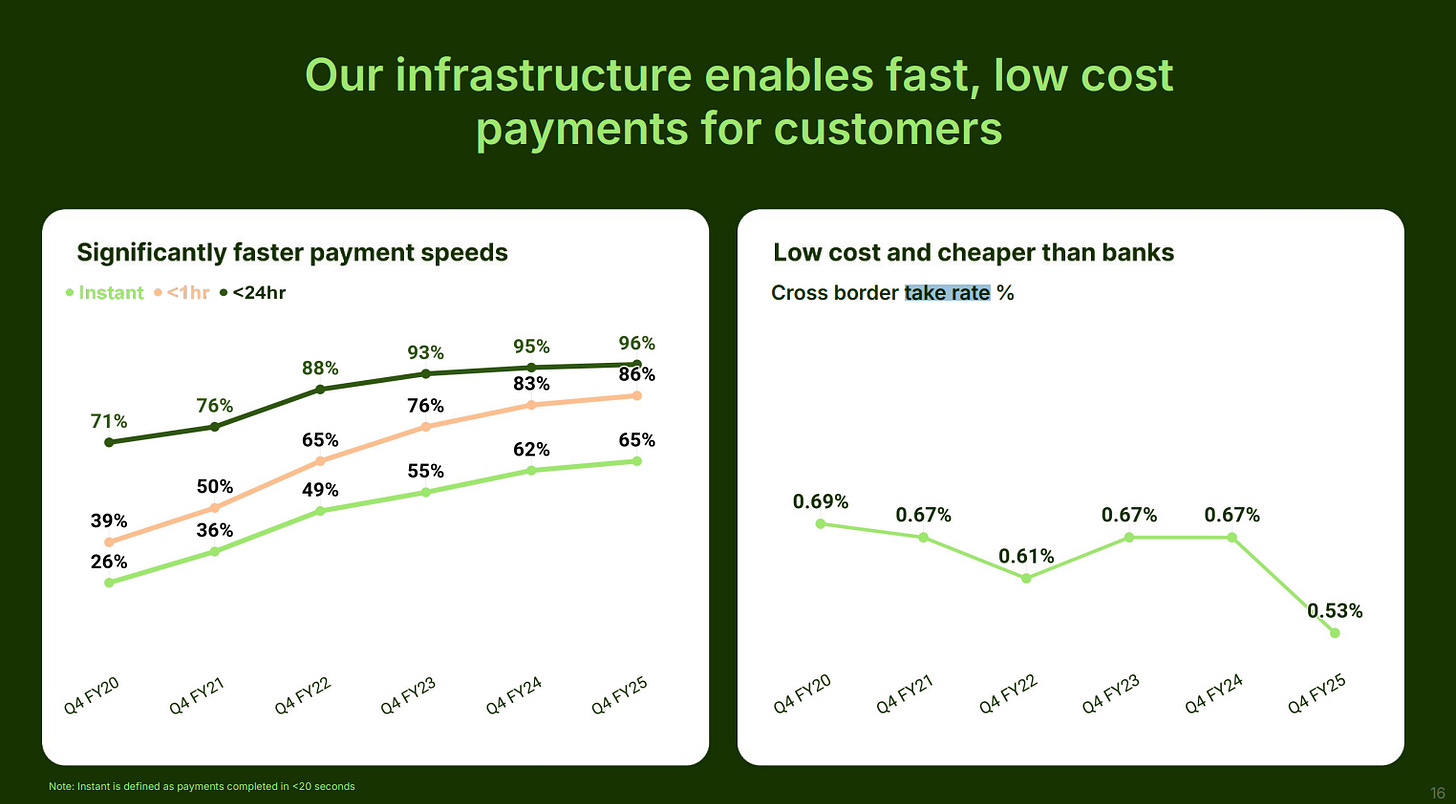

International payments require the complex integration of national banking systems. The task is hard enough for banks to have struggled with the workload for decades and for customers to despise conventional offerings. As you can see below, Wise is constantly making international payments faster and cheaper, with the take rate declining from 0.69% in Q4 FY2020 to 0.53% in Q4 FY2025. This is known as sharing economies of scale: giving customers better deals over time, as the company gets better and more efficient. The Wise thesis is rooted on one premise: that its infrastructure is nearly impossible to match at present and will get harder to imitate over time.

The world sees £32T worth of international payments per year and Wise only processed £145B in FY2025. Given the superiority of Wise’s infrastructure, I believe they are positioned to take the entire market over time and in an accelerated manner once they come to be the default platform for banks. Per Wise’s ability to grow the Wise Account, I believe the superiority of its infrastructure positions Wise to become one of the largest financial institutions on Earth by deploying additional financial services over time. Additionally, switching over to crypto would only require a minor modification of the platform, as CTO Harsh Sinha explains in the Q4 FY2024 earnings call.

I believe that so long a Wise continues to enhance the superiority of its infrastructure and grow the adoption of additional financial services, it will come to produce hundreds of billions of cash from operations per year. Currently valued at ~2.3 times cash from operations, Wise seems remarkably undervalued. And with CEO and founder Kristo Käärmann owning approximately 18.4% of total shares, the management team is well aligned with shareholders. I currently do not own Wise shares, but I plan on starting a position soon.

So while today, we already move around GBP145 billion a year, that we're building this network to move trillions.

-Wise CEO Kristo Käärmann during the Q4 FY2025 earnings call.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc