Edited by Brian Birnbaum.

Investors don’t need to worry about tariffs. They need to worry about holding onto world class businesses for as long as possible.

It’s nearly impossible to foresee how the tariff war will evolve over time and what impact it may have on companies in the short term. But this has never been the job of long term investors - investors get paid for holding world class companies forever through the ups and downs. World class companies tend to increase free cash flow per share levels against all odds, which is what drives stocks up. Tariffs may have an adverse impact on the macroeconomy, but bad macro makes world class businesses stronger.

My view is that Trump has forced other countries to the negotiation table and is on his way to getting better trade deals for the US. However, this manoeuvre may certainly slow down the economy and lead to higher inflation if the conflict with China escalates. This is nonetheless a problem for mediocre businesses and not for companies that have strong moats, pricing power, a cost advantage and an exceptional ability to deliver more value to customers per dollar spent on their behalf over time. This kind of company gains market share during recessionary times.

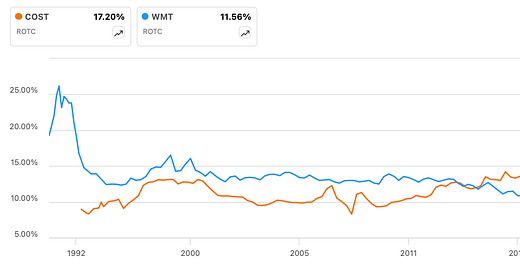

The best example of this kind of company is Costco, which gets way more popular with customers every time there’s an economic downturn. In my Costco deep dive, I explain how Costco’s philosophy gained notable traction during the Great Financial Crisis, with a large percentage of the population looking for better deals. Since, the goodwill generated from that period has enabled it to increase its total return on capital, rising above that of Walmart’s. In effect, Costco leveraged a great crisis to get much stronger.

In turn, the most notorious successes of the modern world are instances of the Costco Algorithm - the operational pattern that I teach students in my Tech Stock Goldmine course. Amazon and Spotify are two wonderful examples of this algorithm applied to the digital space, leveraging the power of network effects to speed up value creation. Amazon has been through all sorts of turmoil since inception, including the Great Financial Crisis in 2008 and the COVID pandemic in 2020. Yet, it has managed to exponentiate free cash flow per share, as you can see in the graph below.

As a result, Amazon stock is up 190,000% since IPO and 3,100% from the dot com highs. For contrast, the SP500 is up 500% since Amazon’s IPO, with Amazon outperforming the index by 380-fold since. Naturally, Amazon is a historical outlier, but being a stock picker only makes sense if your goal is to buy the next class of extraordinary businesses - otherwise buying an index is perfectly fine. The point is that although it’s tempting to give into financial panics, it’s far more lucrative to focus on finding companies that are highly likely to exponentiate free cash flow per share.

Everyone at Amazon is obsessed with giving customers better deals every day per dollar spent. Recessionary periods put a larger percentage of the population on a budget, which sends them looking for better deals. Ultimately, companies like Amazon that give customers better deals over time end up gaining market share as a result. Beyond extreme customer centricity, the main component of the Costco Algorithm is sharing economies of scale with customers - reinvesting capital to get customers even better deals.

As companies like Costco, Amazon and Spotify reinvest a growing volume of capital to get customers better deals, their businesses become exponentially harder to disrupt. Ultimately, this is what enables them to bring much of the top line down into the bottom line and increase free cash flow per share. A bad macroeconomy forces these companies to accelerate the rate at which they deliver incremental value to customers per dollar spent. Ultimately, when the economy recovers this translates into even higher free cash flow per share.

Incidentally, it’s of great psychological help to buy these businesses early and before the market comes to recognise them as world class operations. The SP500 is down over 18% as I am writing this, but my Spotify position is up over five fold. To date, it has returned my entire portfolio once and I believe it will go on to return my portfolio many times, with or without tariffs. This is because I bought Spotify when everyone thought it was a poor business, understanding that it was a world-class instance of the Costco Algorithm.

As you can see in the graph below, Spotify’s free cash flow per share is now growing exponentially. This is because in the network-defined economy, scale precedes profits by a long shot in the list of strategic priorities. Once you’re far bigger than your next competitor, then you can focus on monetising users. In turn, the organisational skillset required to grow a dominant network is the same required to increase average revenue per user non-linearly a posteriori.

You can learn the mental framework behind this investment (and my 20X+ AMD, Tesla and 10X+ Palantir picks) in my Tech Stock Goldmine course. Lifetime access sells for just $350 and also gets you access to the free Slack channel, where you will be able to engage with me and over 270 international investors that have already taken the course.

The length of bear markets is inversely proportional to the pace of innovation.

Further, we can draw many lessons from financial history in order to gain clarity. The lesson is that policies don’t quite matter in the long term, so long as America continues to innovate. And America is innovating faster than ever, leading the way into the next industrial revolution.

Just two months into Grover Cleveland’s term, the US stock market had a panic in 1893. The panic was driven by the bankruptcy of various railroad companies and decreased confidence in the US’s financial system greatly. At the time, the US had a bi-metallic monetary system: silver was used for payments and gold was used as a storage of value. Driven by a loss of confidence, both nationals and foreigners were redeeming their silver into gold and shipping it abroad.

This led the US’s gold reserves to dwindle. Cleveland worked with JP Morgan to issue bonds and replenish the gold reserves, but they only succeeded in buying time. People continued to withdraw gold and ship it abroad. Simultaneously, farmers wanted to trigger an inflationary spiral in order to capture more value and businessmen wanted the US to remain in a deflationary state, in order to keep wages down and be more competitive abroad. Cleveland did everything he could to reestablish confidence and please both sides, but he failed to do so. The US remained in a deep recession.

However, eventually businesses were reorganised into large conglomerates with vast financial resources. This gave birth to the US Steel Corporation in 1901, which later arguably came to command more power that the US government. It also gave way to large railroad conglomerations and to the US becoming an industrial titan. Just a few years earlier in 1887, gold cyanidation was invented by John Stewart McArthur in collaboration with the Forrest brothers. This made gold abundant in the US, fixing the monetary crisis.

The combination of business reorganisation and technological innovation allowed the US to move beyond what seemed like an insolvable problem, for more than four years. Allegedly, the last thing Cleveland said before dying was something like “I tried very hard to make things right, but I couldn’t. Reading about this period of time in Robert Sobel’s book, Panic on Wall Street, I personally struggled to come up with a plausible solution for the dilemma Cleveland was faced with.

However, American innovation solved it eventually.

We saw this pattern repeat itself in 2022. We had rampant inflation, a tech stock crash and economists were saying that the economy was going to grow slowly. Howard Marks termed this period of time a “Sea Change”, implying that the rules of value creation had somehow changed. However, tech businesses reorganised and got leaner and more efficient. Then, LLMs (large language models) started to increase productivity, driving top line and margin growth. And now we are the other end of the technological “boom” that has ensued.

The 2022 bear market was short because innovation happened quickly.

Going forward, the question is whether the US can manufacture things domestically. The confrontation with China was only a matter of time and the rest of the countries have essentially come to the negotiation table to offer lower tariffs. While at present making iPhones cost-effectively might not be viable, I suspect that automation is going to be over the coming decade what cyanidation was to the late 1890s. The US is now in a position to deploy a large army of robots to get things done and US manufacturing jobs will be about supervising these robots.

In effect, the way forward to survive the tariff wars is holding onto extraordinary business and going long American innovation - as always.

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Hello Antonio,

I hope this communique finds you in a moment of stillness. Have huge respect for your work.

We’ve just opened the first door of something we’ve been quietly crafting for years—

A work not meant for markets, but for reflection and memory.

Not designed to perform, but to endure.

It’s called The Silent Treasury.

A place where judgment is kept like firewood: dry, sacred, and meant for long winters.

Where trust, patience, and self-stewardship are treated as capital—more rare, perhaps, than liquidity itself.

This first piece speaks to a quiet truth we’ve long sat with:

Why many modern PE, VC, Hedge, Alt funds, SPAC, and rollups fracture before they truly root.

And what it means to build something meant to be left, not merely exited.

It’s not short. Or viral. But it’s built to last.

And if it speaks to something you’ve always known but rarely seen expressed,

then perhaps this work belongs in your world.

The publication link is enclosed, should you wish to open it.

https://helloin.substack.com/p/built-to-be-left?r=5i8pez

Warmly,

The Silent Treasury

A vault where wisdom echoes in stillness, and eternity breathes.