Spotify: Just Getting Started.

Q3 2025 ER Digest

This is an update of my original Spotify deep dive and Q2 2025 update.

Spotify stock is up 550%+ since I bet the ranch on them.

Spotify continues to hike prices with minimal churn, showcasing a world class implementation of the Costco Algorithm.

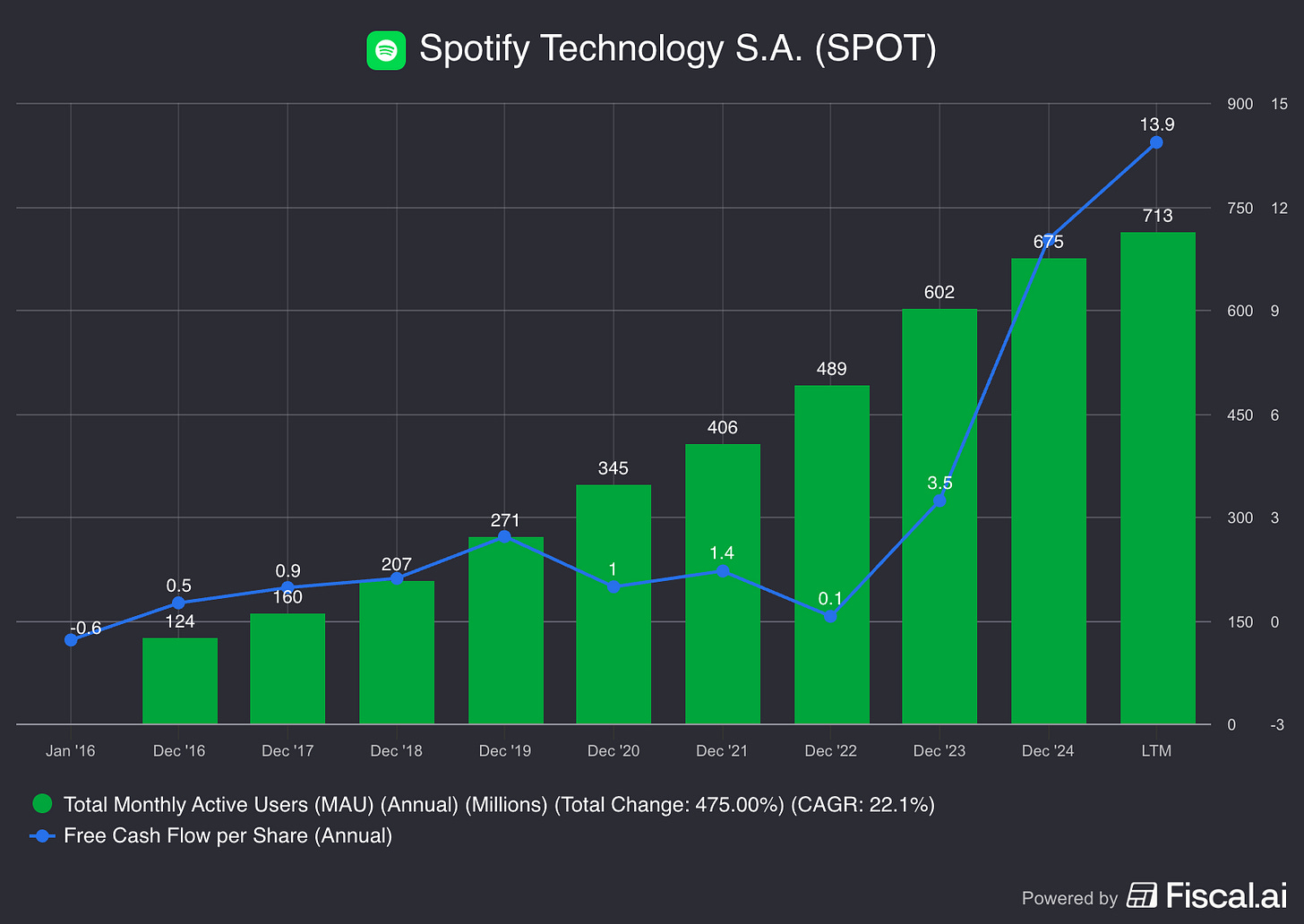

Spotify’s market cap is a direct function of its speed of iteration. Like other Web 2 platforms, Spotify is an A/B testing machine that optimises for user lifetime value. MAUs (monthly active users) have increased by 6 fold since 2016 and free cash flow per share by 27 fold. All Spotify does to achieve this kind of growth is solve a growing volume of acute customer pains, by iterating on the user experience. I believe we now see free cash flow per share growth accelerate as AI enables Spotify to iterate much faster. And as we know, stock prices track free cash flow per share over the long term.

As I highlighted in my Q2 2025 update, Spotify has been working on deploying an agentic layer over its traditional backend, that increasingly enables it to “speak” features into existence. Newly appointed co-CEO Gustav Soderstrom was bullish on this development during the Q3 2025 earnings call:

And while we spent much of last year and part of this laying and building foundations, the pace of shipping and the speed of iteration are now at record levels. We both strengthened the core experience and added new value with a variety of first-to-market features and improvements in almost every facet of the product.

Free cash flow per share is a direct function of speed of iteration only when the company in question has extraordinary organisational properties: a relentless focus on delivering more value to customers and prioritising long term value creation over quick profits. among others. Indeed, the remark may seem abstract - but it’s the result of having studied Spotify deeply for years. Moreover, it’s the result of having seen Spotify management be happy to have the share price obliterated in 2022, prioritising long term value creation instead - a bit like Duolingo management today.

Daniel Ek’s remarks about Spotify’s value creation process are highly educational:

And with that foundation in mind, let me talk about how we think about building the business. I’ve said this before, but it’s worth repeating. We don’t optimize for quarterly results. We optimise for lifetime value because at our scale, very few metrics shift quickly. The decisions we’re executing on today were set in motion well before they show up in the numbers.

In some cases, this means we made these calls many quarters ago or in some cases, even years. But that doesn’t mean we get a free pass on our performance. Our job is to make smart investments that create more value over time, and we fully expect you to hold us accountable for them. Our goal is to deliver extraordinary results, and that means having both a great product and a great business. And those things aren’t in conflict, they compound each other.

[…]

We can launch new features, experiment faster, and that drives better user outcomes, more growth, higher engagement, stronger retention, which then drives a better business. It’s a flywheel and a playbook we’ve run many, many times. Our partners also do better, so both sides win. And that’s what good long-term investments look like.

In yesterday’s Snap update I discussed the importance of the Costco Algorithm and how it enables companies to create value over the long term. The hallmark of succesful implementations of this operational blueprint is minimal churn after subsequent price hikes. It signals the company in question is capable of widening the value:price ratio, thus delivering more value to customers per dollar spent. Spotify remains a world class implementation, as evidenced by co-CEO Alex Norstrom’s remarks during the Q3 2025 earnings call:

And the second thing that’s important is that when we adjust prices, when we raise prices, you need minimal churn. And that’s also what we’re seeing. Third of all, and then to your point, as specific question, is about intake. For healthy subscriptions growth, you need a good replenishment of MAU. And as you can hear us talk about this quarter, that really is the standout number.

Our MAU is increasing to higher levels than we expected. And as MAUs grow, we also see engagement grow. And as the engagement of the MAUs grow, we typically see much higher levels of conversion. Every time that we have made a change to the free product and it’s generated more MAU in the history of Spotify, it’s led to more business growth down the line. So we just have to trust the funnel.

It was delightful to see Alex mention the value:price ratio explicitly during the earnings call too:

We pay attention to competition, but what we pay attention the most attention to is obviously our own offering. And we care a lot about the value to price ratio. You’ve heard Gustav talk about how we’ve shipped much faster in this last quarter.

There’s more than 30 product -- 30 features that’s been shipped in the product and users are loving it, right? So the important thing for us is just keep continuing to improve the value to price ratio, meaning raising value and relentlessly just build the best product out there. The best product will always win.

Qualitatively, you may have observed that Spotify’s TV app is starting to look a lot like Youtube. Spotify is no longer just a music app, as it continues to branch out in relatively unexpected ways. The title of my original thesis, “Spotify the Google of Audio in the making”, still captures the essence of Spotify’s journey: it’s becoming a media platform and search engine, as it solves a growing volume of acute pains for media creators and consumers over time. So long as organisational properties remain top decile (or better), Spotify will continue solving problems and getting heavier.

Daniel has been an extraordinary CEO and I will always be grateful for his work. It’s an emotional moment to see him step down, but I can clearly sense the Spotify Algorithm imbued in Gustav’s and Alex’s DNA. I think Spotify is just getting started and that, over the long term, they will tend to continue outperforming.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Just had a look at Spotify's TV app... might indeed be YouTube's biggest competitor in the future.

I really like the the new product iterations too. The chat function is nice to share music and the smoothness of the app has increased a lot.