RocketLab: Positioned for an Inflection Point.

Q2 2025 Update

This is an update of my original RocketLab deep dive and Q4 2024 update.

The Neutron platform is close to being operational now and promises to radically improve RocketLab’s unit economics, by enabling it to instantiate perpetual cash flow streams per launch.

RocketLab is on track to become a constellation provider and owner. While at first glance it may seem the business is about rockets. it’s actually about developing the infrastructure to operate and monetise spaceship constellations. As I explain in my Q4 2024 update, just three Neutron launches are expected to match the entire yearly revenue from Electron launches at the current cadence. Neutron will be able to carry approximately 43 times more mass than Electron, paving the way for RocketLab to deploy space assets which pay dividends, both for third parties and for itself.

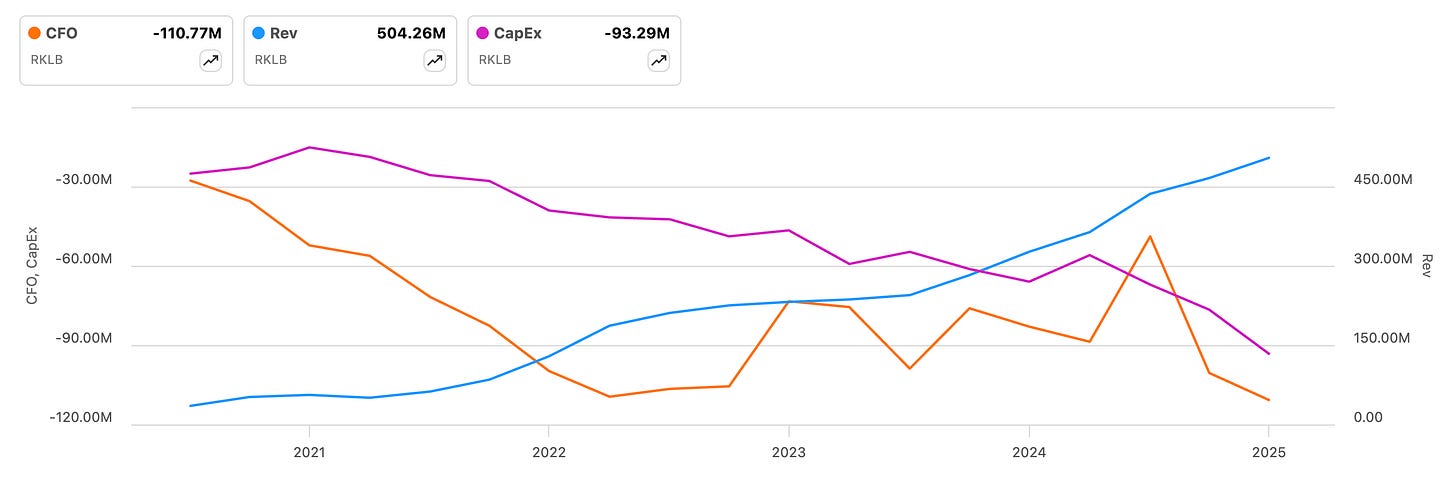

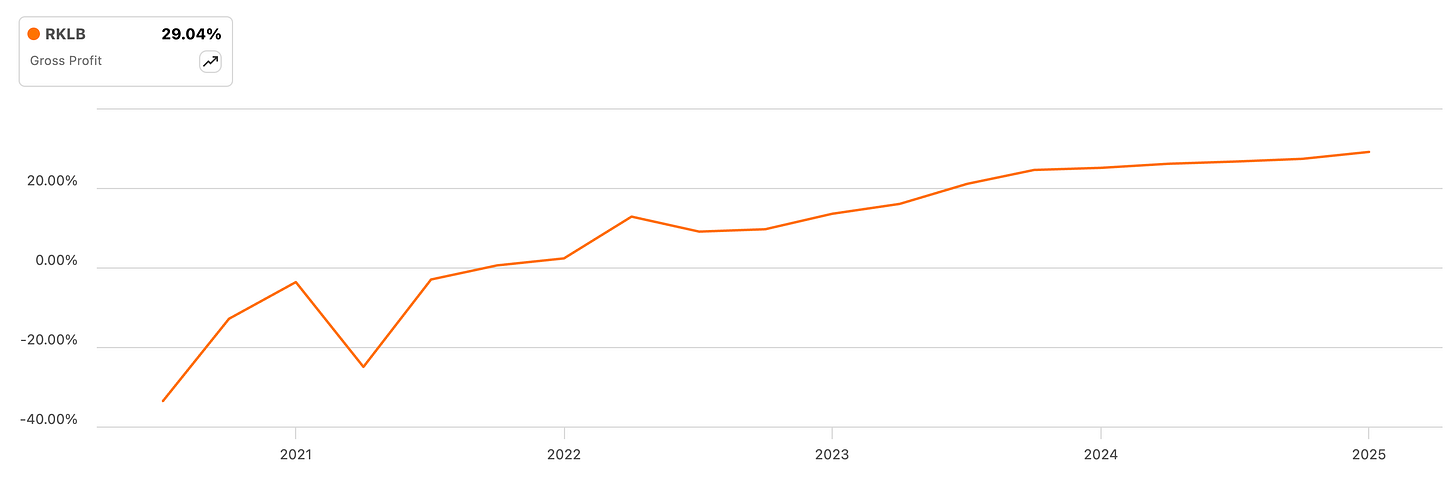

The graph below showcases an unprofitable business, which nonetheless is fairly likely to become viable following the launch of the Neutron platform. Cash from operations (orange line, left axis) continues to be negative, as RocketLab continues to accelerate CapEx (purple line, left axis), but the rapidly rising revenue (blue line, right axis) points to RocketLab solving a real problem for customers. The next graph showcases a steadily rising gross profit margin, which combined with the rising revenue makes it fairly likely that:

RocketLab has pricing power.

RocketLab has the process power to deal with the complexity of the Neutron platform, while yielding a business with improved unit economics.

The latter requires merging many sub-components of its operation, like solar panel technology within its Space Systems division, which further points to notable process power.

I believe that RocketLab is positioned to see meaningful operating leverage gains as/if the Neutron platform comes online. As you can see in the first graph above, cash from operations is negative: but not quite as negative as it could be given the complexity of the operation. Neutron launches promise to considerably improve RocketLab’s unit economics and given the robust nature of the top line, I don’t think it’s impossible for RocketLab to yield a strong cash flow statement. Additionally, two things stand out from the Q2 2025 earnings call:

RocketLab CEO Peter Beck believes the infrastructure to power the Neutron platform is largely in place now.

RocketLab is adding assets to its portfolio of Space Systems which promise to unlock meaningful cashflow from future constellations.

I don’t normally take CEO statements at face value, but Beck and co have demonstrated strong process power to date. If he says the Neutron infrastructure is near completion, it’s quite likely that this is indeed the case. See his remarks during the Q2 2025 earnings call:

We know that from experience that building the first one is hard, but building the system that gets you to launch #10 and 20 and beyond is much harder. Most of the capital of any rocket program goes into building out the infrastructure, and we believe we’ve got all the critical elements in place now.

Our launch in test sites are substantially complete, recovery infrastructure is on track. The Archimedes engine manufacturing line is now capable of knocking out an engine every 11 days, and we believe that we’ve scaled our operations to be ready to support -- to move into multiple flights a year after the first launch gets off the ground.

Further, RocketLab is in the process of buying Mynaric and Geost: the former specialises in laser-based communications and the latter in making missile-tracking satellites. Both promise to unlock perpetual cash flow streams per launch, by enabling RocketLab to deliver services to third parties by operating its own constellations. Via this approach, RocketLab goes from making money once per launch to instantiating assets that make money for a long time, radically changing unit economics.

The RocketLab thesis largely hinges on two factors going forward:

RocketLab’s ability to bring down the costs of the Neutron factor fast, leveraging the reusability of the Neutron rocket.

RocketLab’s capital allocation and how it balances investments in the Neutron platform itself versus additional assets that help them unlock additional revenue streams per launch, such as Mynaric and Geost.

Should RocketLab decrease Neutron costs steadily, increase launch cadence regularly and solve a growing volume of acute customer pains in space, the operation will likely be a success. The primary reason I remain bullish on RocketLab and continue to watch closely is essentially Peter Beck and the general aura this company has of defying the odds, as Peter himself pointed to during the Q2 2025 earnings call:

And we’ve been able to bring down Electron costs dramatically, right? And that’s without reusability. So we have a track record of successfully kind of scaling and bringing down costs as we’ve talked about many, many times, another big influence to gross margins is overhead absorption.

So I suspect that Neutron will be a little bit different, but not fundamentally different from the fact that what’s going to drive its gross margins is going to be cadence, right?

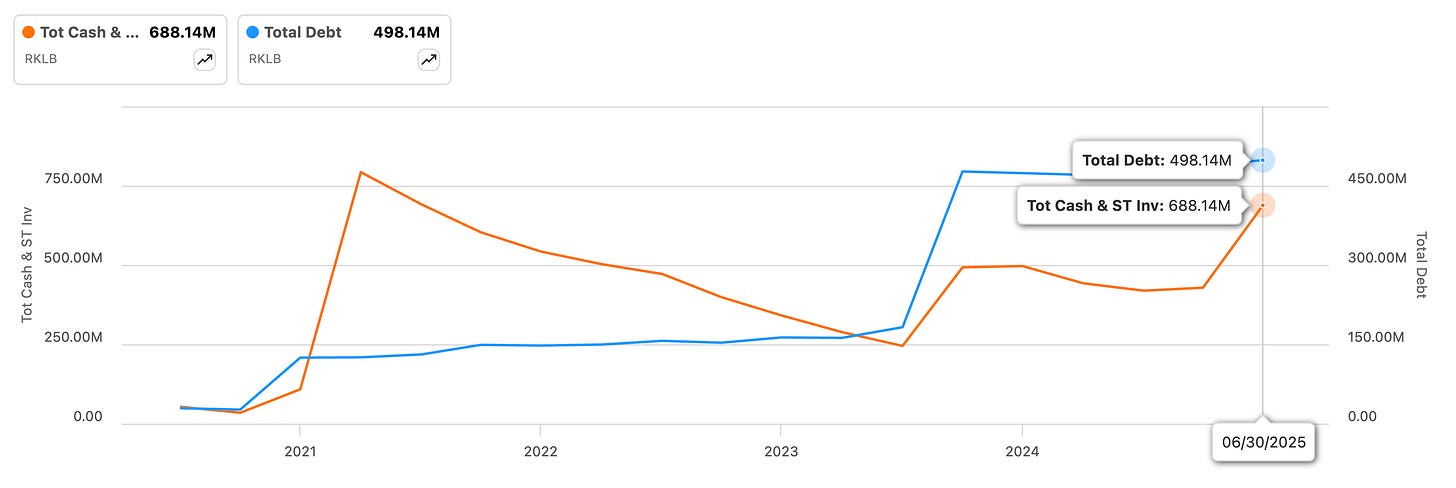

Meanwhile, the balance sheet remains appealing with total cash coming in just over total debt in Q2 2025. RocketLab’s financials below the top line will likely continue worsening as Neutron investments continue, which add a considerably degree of risk to the thesis. However, there I believe the odds that RocketLab emerges from this endeavour with a platform with far better unit economics are relatively high. Further, I believe the size of the space industry will come to be far larger over the long term than we can possibly imagine right now - it’s still early days for RocketLab.

Until next time!

If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Rocket lab is the only real alternative to SpaceX for consistent commercial launch services. The geopolitics of countries wanting to use American commercial space launch capabilities but not being beholden to Elon Musk will be a driver for some time as well