Palantir's Next Inflection Point.

Q1 2025 ER Digest

This is an update of my original 2022 Palantir thesis.

Palantir is becoming an infinite factory of autonomous workers.

Palantir’s free cash flow per share continues to rise speedily, as they continue to execute on the back of the “AIP Bootcamp” inflection point. LLMs have made Palantir’s platform much easier to deploy and use, which has made the business stronger in just a few years. However, Palantir is now gearing up for a second inflection point which promises to yield considerably improved financials - AI agents. The latter are increasingly Palantir customers to run their companies autonomously, which will exponentiate their operating leverage and Palantir’s.

Shyam Sankar shared some highly insightful remarks about this, during the Q1 2025 earnings call:

AIP has entered the next phase of product development and adoption focused on enterprise autonomy. As I mentioned in last call, the normative value of AI is the self-driving company.

We're not talking about copilots that make you 50% more productive. We're talking about agents that make you 50 times more productive.

AIP is increasingly owning the position of being the technology that translates the ever-expanding raw capability of LLMs into business outcomes through ontology. AIP is proving to be the best harness to build, test, evaluate, and deploy agents to eat the elephant of the enterprise.

As I have explained previously, Palantir is a Singularity Scaler. Palantir’s earning power is evolving in tandem with AI model performance. As I outlined in my Palantir Q1 2025 ER preview, Microsoft CEO Satya Nadella recently said that “model capabilities are doubling in performance every six months, thanks to multiple compounding scaling laws.” Therefore, Palantir’s earning power is likely to continue growing exponentially as AI models continue to scale. This dynamic is elegantly summarised by the evolution of Palantirs's Rule of 40 (growth rate + profit margin):

The above metric indicates increased productisation levels QoQ, meaning that Palantir’s software continues to get easier to deploy and use. But much like with Hims, analysts are looking at these numbers at face value and are having a tough time understanding what could possible justify a higher valuation from the current levels. Most importantly, as AI agents get increasingly capable Palantir is evolving into a infinite labour factory. Beyond a certain level of AI agent capability, all they have to do to print endless and tireless autonomous workers is simply plug these models into the ontology.

This is currently enabling customers to automate a growing share of their operations, as Shyam explained in the Q1 2025 earnings call:

AIP as a platform enables our customers to rapidly build and deploy AI agents that automate more and more of the enterprise in a continuous fashion.

AIG announced the AI underwriting agent. AI agents are processing vast volumes of intelligence reports in the Department of Defense, finding things humans missed. AI agents are monitoring for sepsis at Tampa General.

Enterprise autonomy promises to be something akin to electricity: going forward, you simply can’t compete without it. Since Palantir’s ontology essentially has no competition, Palantir is positioned to take the whole enterprise autonomy market. In the past I said that humanoid robots won’t be effective in the enterprise unless they are plugged into a digital twin - because they need the full context of what’s happening across the enterprise. In effect, the AI agents Palantir customers are currently building are the precursor of enterprise humanoids.

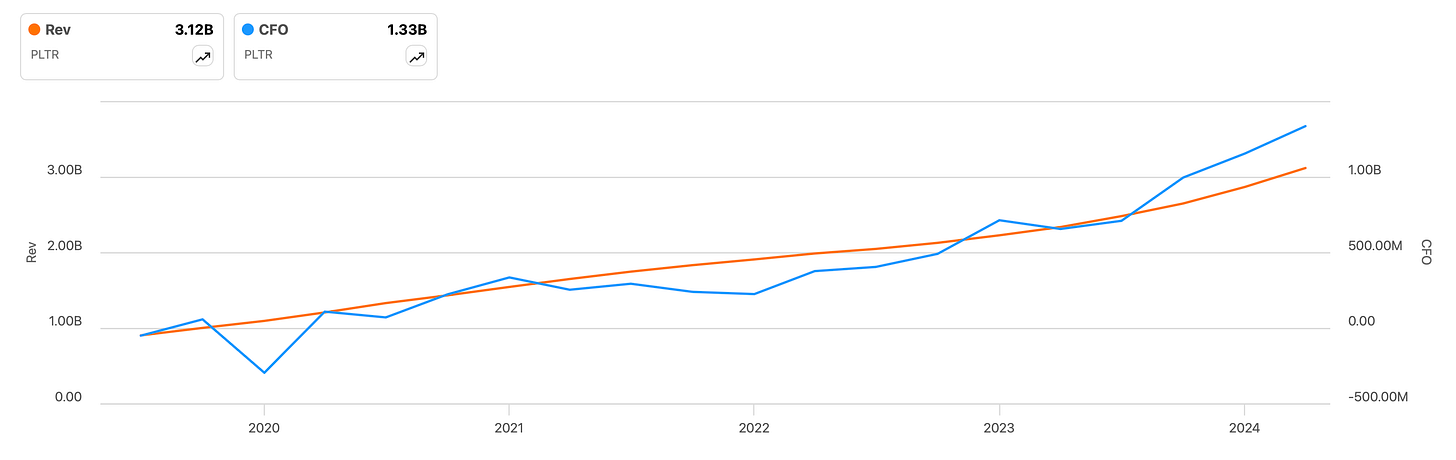

Qualitatively, this is why I’m not personally concerned about Palantir’s valuation and I continue to happily hold onto my shares. As Palantir becomes the world’s go-to-provider of autonomous labour, I think the growth of Palantir’s revenue (orange line, left axis) and cash from operations (blue line, right axis) accelerates meaningfully, taking Palantir to a multi-trillion dollar market cap over the long term.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

You likely receive hundreds of pitches.

This isn’t one of them.

Hello @Antonio Linares,

Respect your work and what you hsve built here.

I am the Founder and Steward of the 100x Farm.

The 100x Farm is a quiet strategy sanctuary for investors and capital stewards with long memories and longer horizons.

No noise. No dopamine. No trend-chasing.

Just deep-cycle clarity earned slowly, shared rarely.

We don’t believe in inbox conquest.

But if the idea of sowing $10,000 seeds to harvest $1 million trees over 20- 30 years feels familiar,

you and your patrons may already belong here.

What if the next 100x isn’t a stock but a forgotten business model hiding in plain sight?

Every thesis is backed by real capital, filtered through over 100 long-cycle lenses before it earns a word.

And if nothing else, this may help you filter what isn’t worth your time.

No urgency. No ask.

Only signal.

Should you, or your patrons, choose to engage, our farm door remains open.

Warmly,

The 100x Farmer