Palantir: Only Getting Started.

Q3 2025 ER Digest

This is an update of my original 2022 Palantir deep dive, in which I explained why it was and is the most important company in the West. Palantir stock is up 1,200%+ since.

Singularity Scalers will create a historic bifurcation between AI haves and have nots.

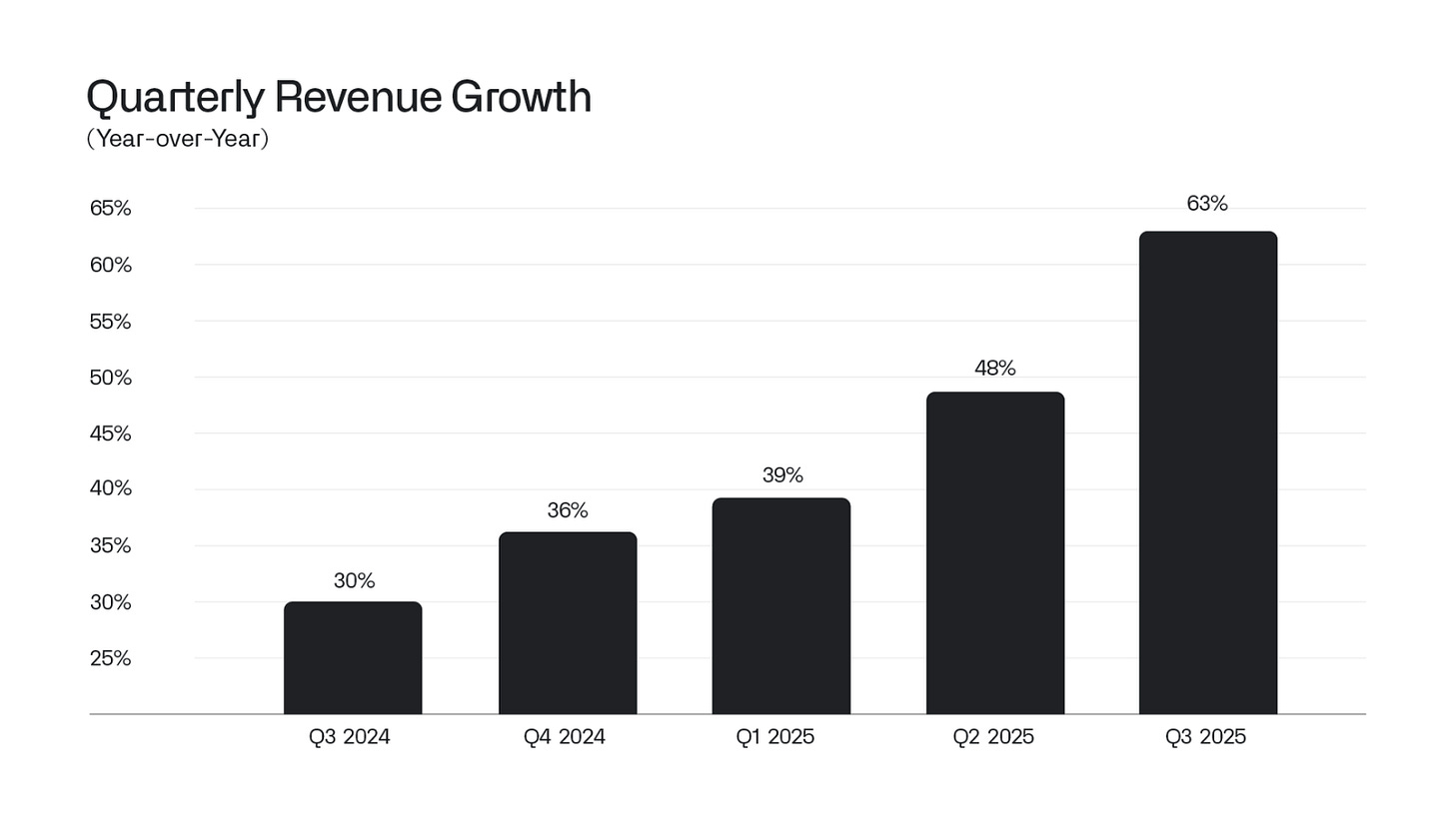

Palantir is accelerating as it gets bigger, as I anticipated with my “100X” call. This is a counterintuitive time in humanity’s history, because we’ve stumbled upon a technology that emulates our minds in ways that are not natural to us. It’s not natural to think that I stock that went up over ten-fold by December 2024 could go up another a hundred fold. But as I anticipated, Palantir continues to find ways to minimise time to value and maximise value delivered per dollar spent on behalf of customers, in tandem with the evolution of AI scaling laws. With AI capabilities doubling every six months, the only obvious limit in sight is human psychology. Palantir will continue accelerating as it gets bigger, making the naysayers poor if only in relative terms.

This “Cambrian” explosion for Palantir started with AIP and we now clearly see the onset of AI FDEs (agentic models that automate the function of forward-deployed engineers) radically increasing Palantir’s productivity and that of its customers. There’s no limit to the productisation of the Ontology and as I also anticipated, we will see Ontologies get interconnected and Palantir become a network, rather a mere provider. Palantir currently powers companies, but as it continues penetrating sectors, it’s inevitable that customers will want to connect with providers, customers and collaborators at the Ontology level. As we’ve seen with my Spotify thesis, the emergence of new verticals tends to yield non-linear operating leverage gains.

See this patent:

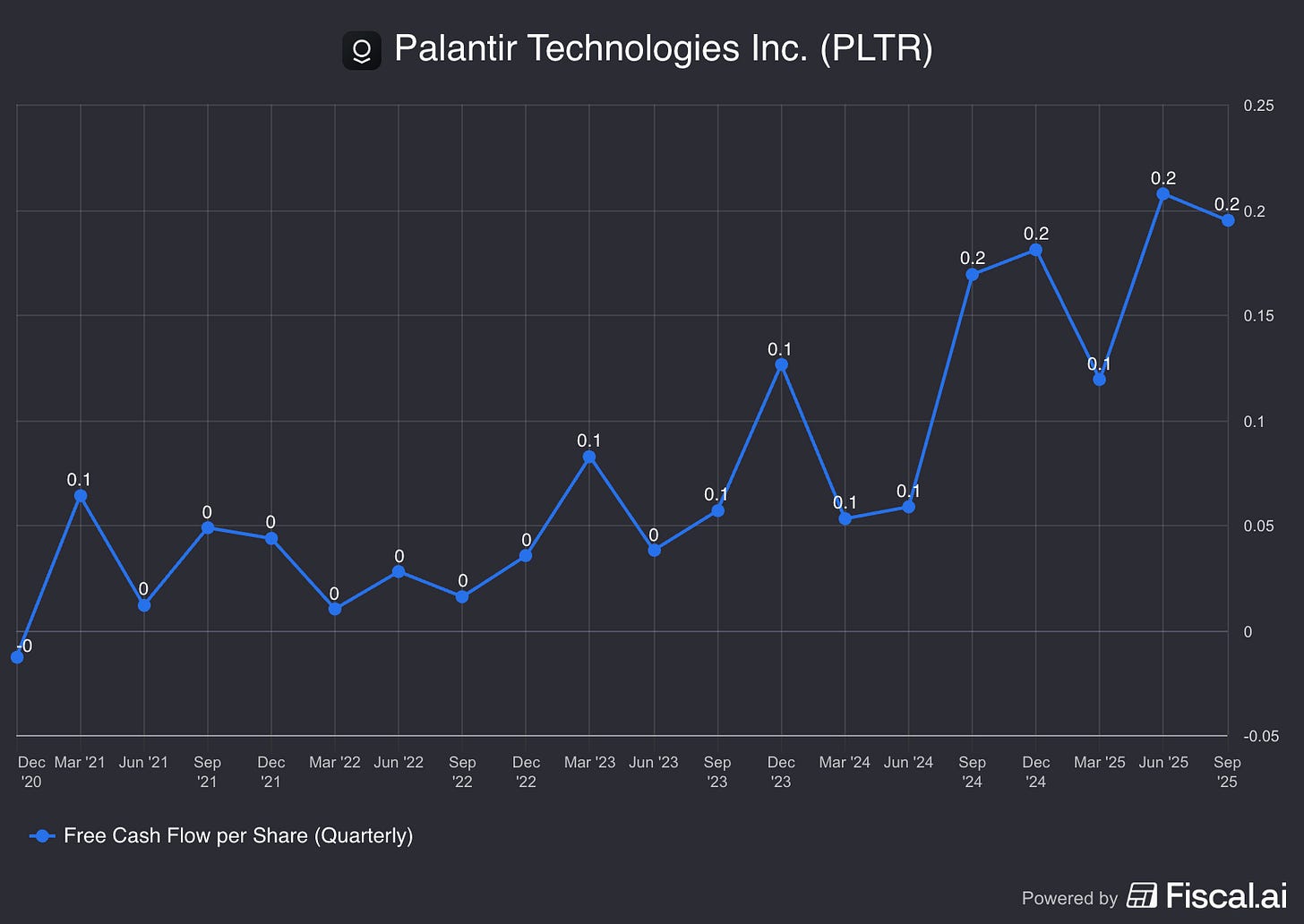

Free cash flow per share continues to trend up and as we know, stock prices track free cash flow per share over the long term. There’s naturally questions about the valuation, but the following is true:

Palantir has an Ontology monopoly.

Everyone needs an Ontology to leverage AI successfully.

Palantir has penetrated immaterial portion of the market.

Palantir is accelerating as it gets bigger.

Betting against Palantir stock is thus the stock-market equivalent of peeing against the wind. The stock may correct, as we saw in April with a 50%+ decline, but all logic points to an exponential increase of Palantir’s free cash flow per share going forward. Interestingly, the naysayers seem incapable of addressing this logic and instead only express disbelief regarding the price action and onomatopoeias with negative connotations. What we are seeing this week is the majority of the population struggling to understand AI-driven value creation processes and their non-linear nature - but value creation processes don’t care about that.

The Army recently issued a memo “directing all army organisations to consolidate and centralize on Vantage”, which is an instance of Palantir’s Ontology designed specifically for the Army. Palantir recently passed to production the “Edge Ontology” which is a “lightweight implementation of ontology that runs on mobile devices.” AIP Hivemind is a “new AIP capability that orchestrates a form of a dynamically generated agents”. Every quarter that goes by, Palantir demonstrates there’s no limit to how much they can productise the Ontology. And at the current pace Palantir is not only going to be powering companies, but soon entire supply chains, industries and nations.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc