This is an update of my original Hims deep dive.

If people pay ~$130/year for Spotify, how much will they pay for a subscription that makes them smarter, have better sex, have more muscle, sleep better and have more energy, all while maximising longevity?

I suspect that at least an order of magnitude more.

Ray Kurzweil believes age-related deaths will be preventable by the year 2030. I now believe this is likely and that Hims will be an important enabler. This is because the body is in essence the same as a car: with the right tools, we can keep all the parts going indefinitely - or at least much longer than now. Hims is building the infrastructure to deliver these tools to the masses, cost effectively and conveniently. In turn, this is laying the foundation for a biotech renaissance, in which humanity moves towards achieving optimal health - and Hims’s subscription (perhaps) becomes the most valuable one on Earth.

The tools are the key enablers of precision medicine and can be broken down into two broad categories: diagnosis and input. The body’s processes are mediated by molecules of a specific shape which determines their function. Humans are essentially a giant LEGO puzzle: proteins with specific shapes are constantly binding with other proteins that have an inverse shape and this is how life’s underlying biological process unfold. Illness is the result of a loss of function, stemming from an undesired change of shape. Once you know what shape has gone wrong (molecular diagnosis), you can fix it by introducing by introducing a molecule with a specific shape (molecular input).

Human illness (including ageing) ceases to be a problem the moment you have an exhaustive comprehension of what each molecule is doing in the body in real time, combined with an ability to synthesise molecules with a specific shape and put them into the body. In effect, I believe that in the future we will have digital twins of our proteomes, that will be permanently calculating the odds of a specific biological process going wrong. This will inform our providers about what molecules to insert into our bodies, in order to prevent illness and optimise health. I also expect this value chain to become the most valuable on Earth: because once we have material abundance (which I believe we will achieve over the coming two decades), the only thing that matters is being healthy to enjoy life).

While this future may seem distant, the required building blocks are compounding exponentially today. AI models are doubling their performance every six months and humanity’s ability to synthesise specific molecules is advancing fast as well, as evidenced by Abcellera’s progress. As these two curves continue to compound and costs collapse rapidly, the specific tools will get commoditised in relative terms - as happened with smartphones, for example. Over the long term, the value will accrue to the network that facilitates the distribution of these tools and is able to yield better patient outcomes over time, per dollar spent on their behalf.

In turn, I believe the primary driver of better patient outcomes per dollar will be data. Much like Tesla, the vast majority of Hims’s future value will accrue for the proprietary data that stems from its network effects. For example, Tesla’s goal is to maximise the number of cars on the road to pick up the most data and ultimate train the best Physical AI in the world. Similarly, by compounding its user base Hims is positioned to yield a similar infrastructure: the more patients they have and the more conditions they treat, the more data they will have on what works and what doesn’t. If they achieve a clear data advantage, Hims will be able to train a better AI than competitors and will ultimately win.

Although Hims’s Q1 2025 financials were spectacular, they don’t quite reveal how Hims is connected to the future I paint above. Firstly, Hims is already at work building the necessary infrastructure to bring precision medicine to the masses, while growing its user base and compounding network effects. They recently acquired an at-home full body testing company and a peptide manufacturing facility. Given Hims’s extraordinary capability to iterate, I believe the former will become the basis for democratised molecular diagnosis over time. In turn, the latter now enables Hims to print molecules of specific shapes (peptides, which are sequences of amino acids), that yield desirable health outcomes for patients.

In effect, the two aforementioned acquisitions are version one of the future I describe above. while GLP1-s are version 0.1. GLP-1s are a peptide that help people lose weight and are a preview of what Hims’s infrastructure can do for folks at scale. There are countless peptides with fantastic properties: some help you sleep better, others make you gain muscle and others make you smarter. In effect, every function in the body can be modulated via peptides and Hims now has the infrastructure in place to do that for millions of people, cost effectively and conveniently. This is why I believe Hims will likely grow exceptionally fast over the coming five years, as peptides go mainstream.

In turn, as AI and biotech continue to accelerate, I believe that Hims will likely evolve into the infrastructure that brings it all together to create an entirely new healthcare industry. The current healthcare model offers a terrible experience and scarcely works. Hims is building a model that’s preventative and thanks to peptides, will enable to you to optimise your health. If people pay ~$130/year for Spotify, how much will they pay for a subscription that makes them smarter, have better sex, have more muscle, sleep better and have more energy, all while maximising longevity? I suspect that at least an order of magnitude more.

Over the very long term, if Hims evolves into a winner-takes-all and has more data than anyone else on healthcare (and therefore trains the best precision medicine AI), the subscription becomes an indispensable thing in order to stay healthy forever. Fairly dystopian in a sense, but also much better than simply dying of old age while consuming ibuprofens at will.

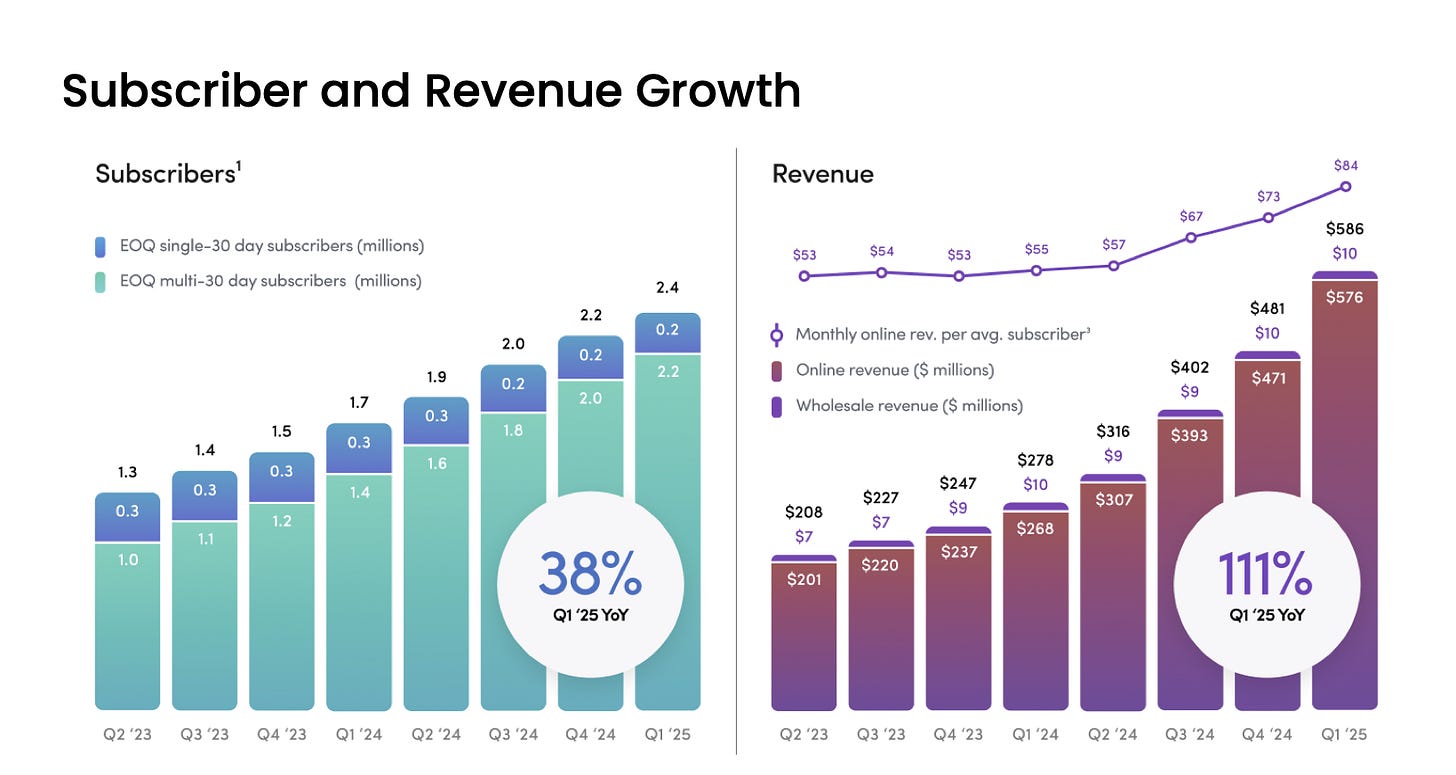

While Hims’s rapidly rising monthly revenue per online subscriber (right hand side of the graph) is impressive, it totally fails to capture the above upside. The uptick in this metric is largely driven by GLP-1s and is likely to grow exponentially, as Hims deploys new peptides. In turn, early Hims customers didn’t want to others about the service because Hims was initially treating stigmatised conditions. Once Hims launches peptides that make you gain muscle (like sermorelin, which I’m currently cycling), guess who won’t be able to shut up about it? Every male on the planet.

Qualitatively, therefore, I believe the current financials are only a depiction of extraordinary management. However, they fail to capture the direction Hims is moving in and just how the key drivers of the business can evolve: namely, CAC (cost of user acquisition) and LTV (lifetime value). Word of mouth is already decreasing CAC and we are seeing GLP-1s increase LTV (or its proxy, monthly revenue per online subscriber). If Hims continues executing as they have done to date, these metrics should improve exponentially from here.

The Hims thesis is very similar to Amazon’s: Amazon doesn’t make the planes it uses to send stuff around or the smartphones its customers use, but it has created the go-to network that stakeholders use to leverage that technology in order to obtain better outcomes in commerce. Hims is a start up in the public markets, which means there is plenty of risk in the thesis and that the stock will likely remain extremely volatile. However, I see the building blocks of a stellar investment and so far, management has given me no reason to doubt them.

As Hims launches their menopause and testosterone verticals, I believe the market will come to understand the value of their at-scale precision medicine infrastructure and how uniquely positioned it is to benefit from the rapidly compounding AI and biotech curves.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

At the current high valuation, which would be a good price to buy hims stock?

Would there be any possibility of Hims acquiring AbCellera? Mcap is only 605m and it would maybe be possible with some kind of cash+stock deal. If that would be possible, what would be your reaction to that move?