Hims: Entering Hyper-Personalisation.

Q3 2025 ER Digest

This is an update of my original Hims deep dive and Q2 2025 ER digest.

Hims is tracking towards a “Palantir moment.”

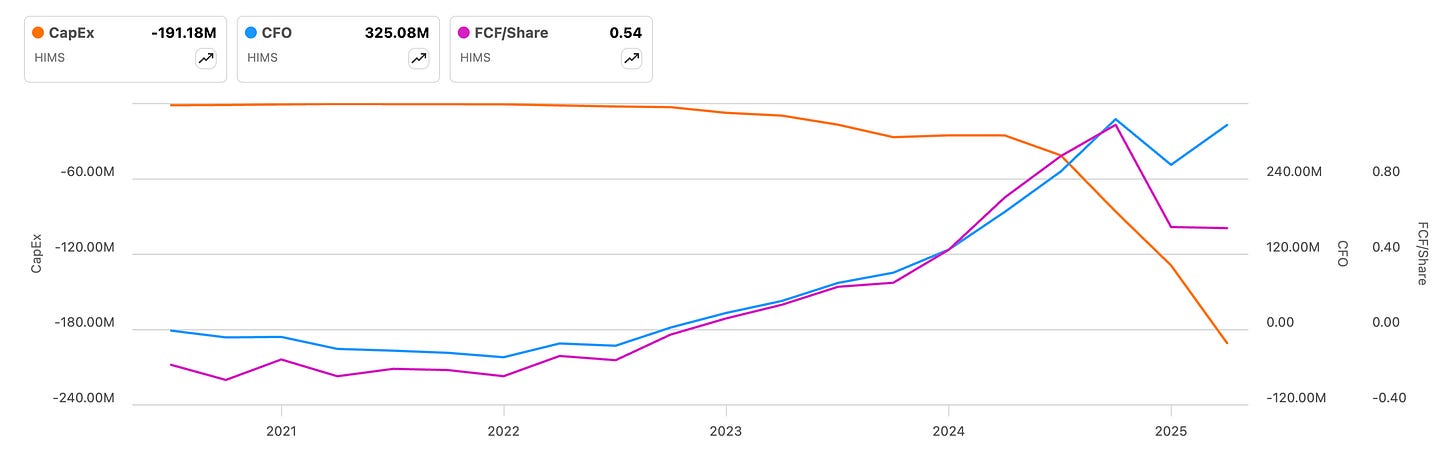

Hims is moving towards an event-horizon in which there is no boundary between healthcare verticals. Once Hims perfectly understands what is happening in your body at the molecular level (via testing) and is thus able to insert molecules of specific shapes to prevent illness, there are no healthcare specialties. There is only enhanced longevity per dollar spent on behalf of customers, as Hims continues to deploy more capital. In the graph below you can see how both cash from operations (blue line, right axis) and free cash flow per share (purple line, right axis) continue to trend up exponentially, as increasing CapEx (orange line, left axis) yields improved patient outcomes.

Healthcare is currently stuck in a siloed approach, but peptides are changing this. One peptide can address any number of conditions: all the way from dermatology, to cardiology, sexual health and more. The future is not isolated active ingredients: it’s inserting a collection of molecules into your body that synergistically optimise your health over time, adjusting the regimen based on almost real-time data. For example, GKH-CU has been shown to improve hair and skin, but also regenerates the liver, accelerates wound healing and forms new blood vessels. BPC-157 heals musculoskeletal injuries, but also heals the gut, which in turn helps rebuild your immune system. The examples are endless.

Two curves are compounding in the background, that bring this event-horizon closer everyday. The rapidly collapsing cost of

Diagnostics.

Intelligence tokens.

Beyond a certain threshold, the marginal cost of knowing what’s going inside a subscriber’s body and how to fix it before it materialises into clinical disfunction is near zero. Conversely, the lifetime value of such a service is infinite and all Hims has to do in relative terms is carry on compounding its infrastructure and user base. The intelligence to convert molecular, longitudinal data to optimal longevity at a marginal cost resides in the network and AI models are an adjacent enabler, but not the true source of value.

Hims management continues to demonstrate that they excel at allocating capital. I believe the odds of them producing the top consumer healthcare network on Earth are high. All things considered, I believe we are between one and two years away from Hims providing exponentially better patient outcomes per unit of CapEx, as it turns staying alive and healthy into a computation problem. A further stage of the “S Curve” we are likely to see after the deployment of “vanilla” peptides is Hims using its network to figure out the optimal molecule, regardless of whether it exists or not. At just over 5 times sales, this company remains drastically undervalued.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

This take on Hims captures the shift from treating symptoms to engineering health itself. The idea of peptides as a platform rather than a product feels like medicine has an affair with computation. If diagnostics and data truly converge at near-zero marginal cost, Hims could evolve into some sort of operating system for longevity. It’s bold and speculative, but a cohesive vision rarely comes cheap.

The peptide angle is really intresting when you think about how it collapses the traditional healthcare silos. Once they nail the diagnostics at scale, HIMS could basically become the infrastructure layer for personalized preventative care. The comparison to Palantir makes sense given both are building network effects that get stronger with each customer. At 5x sales with this kind of growth trajectory and FCF generation, the market is clearly missing something.