HelloFresh: Increasingly Asymmetric.

Q3 2025 ER Digest

This is an update of my original HelloFresh deep dive and Q2 2025 ER digest.

Trading at just 0.16 times, HelloFresh is increasingly asymmetric as it starts to reinvest cash into widening the value:price ratio.

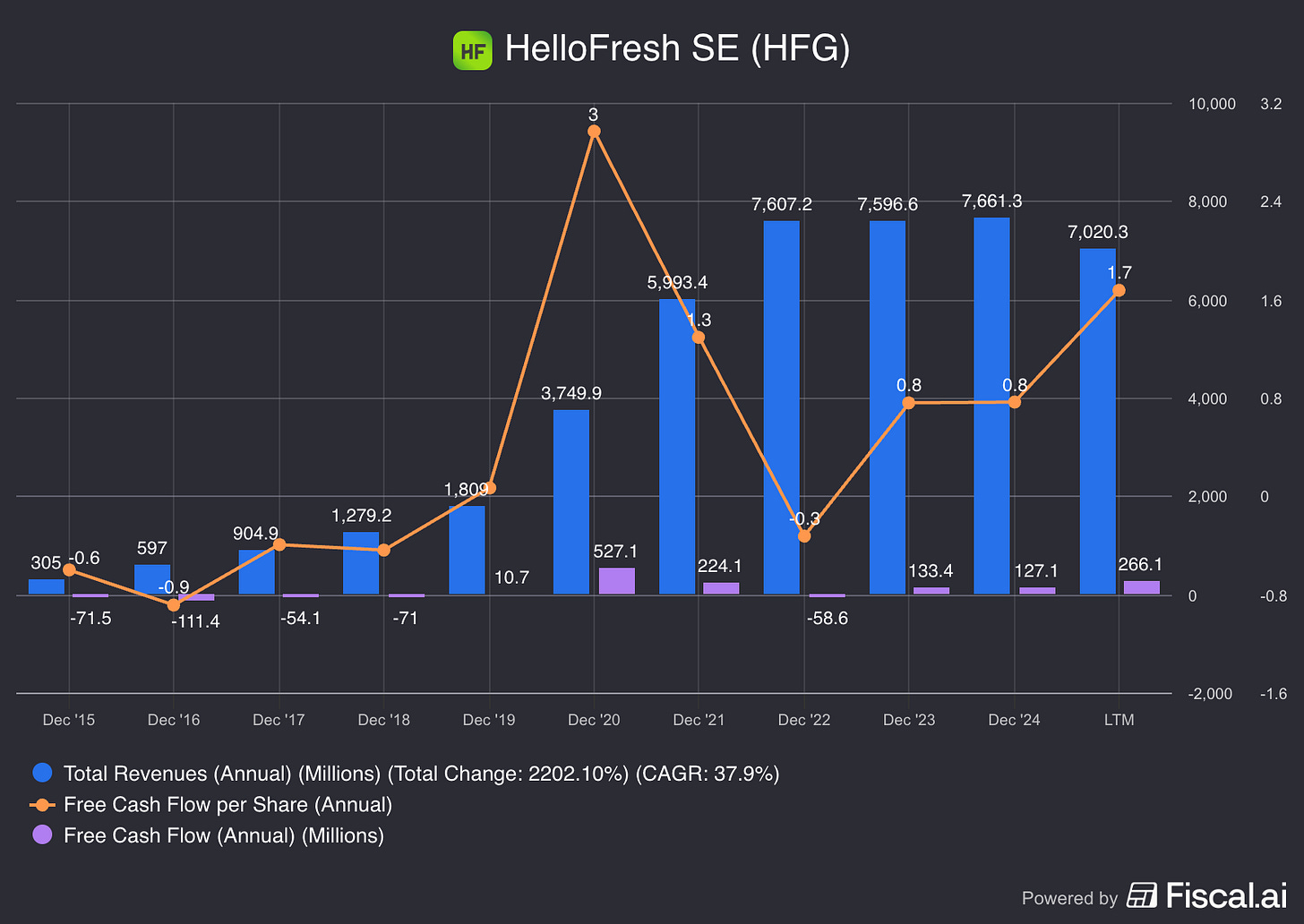

HelloFresh has been successfully executing on its efficiency program, as evidenced by the graph below. Revenue continues to decline since the peak in 2021, but free cash flow (per share) is up meaningfully YoY. According to management, they’ve implemented 70% of the efficiency program they outlined initially and expect to complete the remainder in the coming quarters. This now provides HelloFresh with cash to reinvest into improving the service. Priced at just 0.16 times sales, should reinvestments serve to expand the value:price ratio, HelloFresh could turn out to be an unusually lucrative investment.

As I explain in my original deep dive, HelloFresh’s achievements to date denote extraordinary process power. The supply chain they operate is arguably one of the most complex ones on Earth. Yet, their service is a nice-to-have for the majority of the population, which prioritises money over time. That’s in essence why growth plateaued as the world returned to normal post-2021. However, I believe that as HelloFresh continues to invest in improving the service, the odds of it optimising the value:price ratio over time are meaningful.

Bringing personalised, high quality food to everyone at higher levels of convenience and lower prices than supermarkets do is an appealing endeavour. HelloFresh doesn’t have to get to that stage immediately for the business to work. It can expand the value:price ratio over time, thus unlocking an additional volume of pockets in the market in which the value proposal is good enough for clients to pay. At the moment, the service makes most sense for those that value time over money. But with gradual efficiency improvements, the situation can change, thus unlocking a much bigger TAM.

Simultaneously, HelloFresh remains the only food company on Earth with a sufficiently capable, vertically integrated infrastructure at scale.

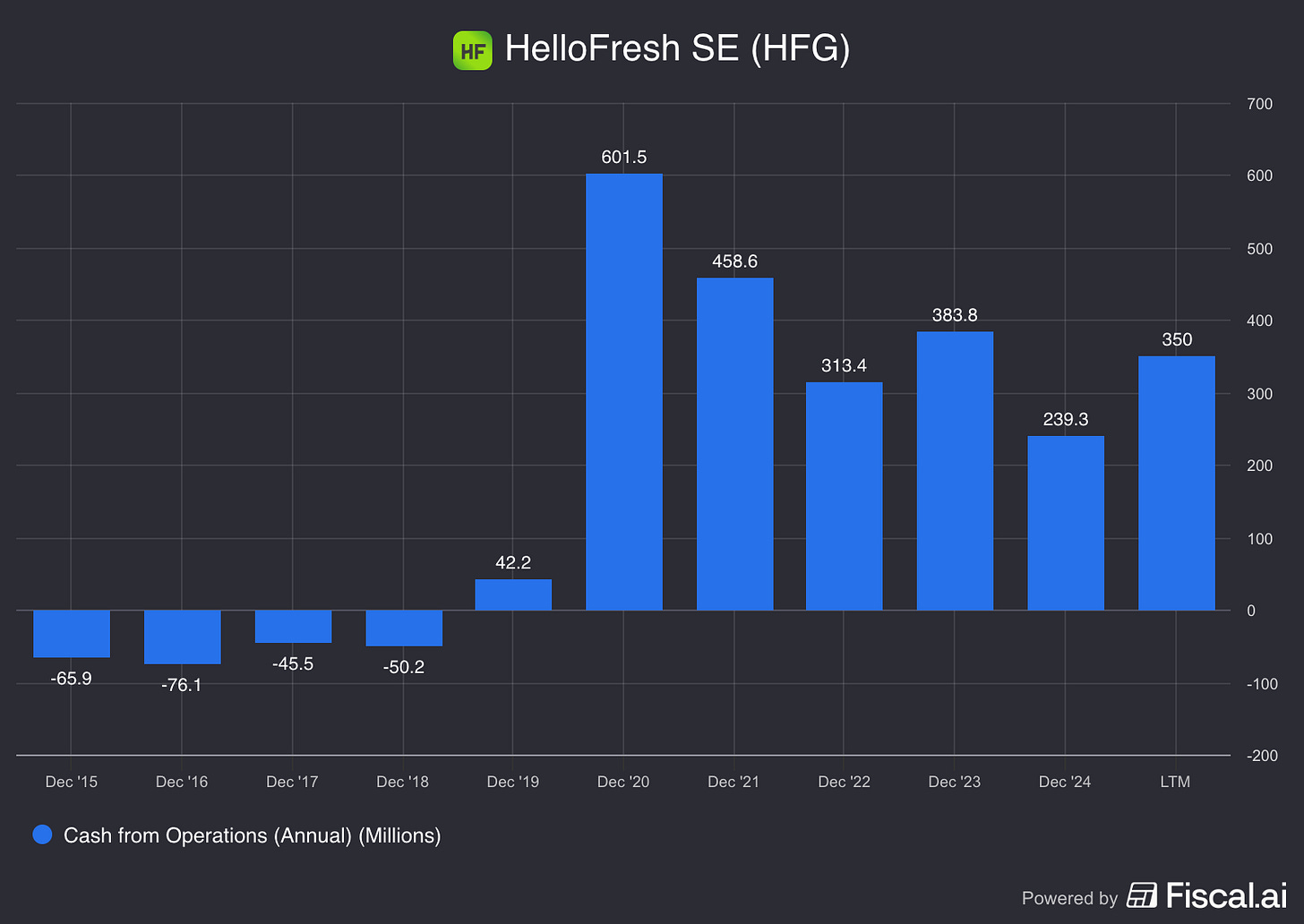

As I explain in the original deep dive, HelloFresh must necessarily have a large degree of control over what factors optimise lifetime value at any point in time. Indeed, if would’ve been impossible for this company to print cash otherwise, especially post-2021. Without a universally strong value proposition, there’s no way to print cash while operating a supply chain that moves perishables around. The resulting unpredictability of end customers (sometimes they do value time over money and sometimes they do not, depending on their changing circumstances, because the service doesn’t always make sense) makes it almost impossible to operate the supply chain. Yet, HelloFresh’s cash from operations have been solidly positive since 2020.

CEO Dominik Richter is now increasingly turning his attention towards widening the value:price ratio. He claims they are seeing satisfaction metrics improve and are now guiding for a sequential revenue increase going into Q4. The inference I explain above leads to me to tentatively assign a fair degree of weight to his remarks during the Q3 2025 earnings call:

We are now starting to put that foundation to work via the ReFresh strategy that I introduced in the last call. The flywheel is clear. Cost discipline funds product innovation, a great product drives retention and lifetime value, and improved retention unlocks profitable growth at scale.

In Q3, we embarked on our most significant investments to date in the U.S; in August for HelloFresh and in September for Factor.

In meal kits specifically, we expanded to over 100 weekly options on the menu, up from about 60 at the beginning of the year and focused our menu expansion primarily on featuring new cuisines, additional ingredient varieties and many new never-before featured SKUs.

We also invested in larger portion sizes and have upgraded the quality and aesthetics of our packaging, keeping our ingredients fresher for longer.

The response has been really positive, especially among our most loyal and also lapsed customers who are typically at the highest risk of becoming bored or feeling too much sameness week-over-week in a limited options menu.

Sentiment on both social media and across our internal customer satisfaction metrics has been great, and gives us confidence that this is the way to improve long-term customer happiness, retention and ultimately customer lifetime values.

As is the case with Spotify, HelloFresh is an A/B testing machine that optimises for lifetime value. While top line evolution is blurry, with RTE revenue (that has been offsetting meal kit contraction to-date) ticking down this quarter and expected to tick down again in Q4 due to “operational challenges”, the buoyant cash flow and the evident progress on the efficiency side makes me increasingly bullish on HelloFresh. When it comes to serving many customers, there is no single deterministic path towards an optimal value:price ratio. Instead, it’s about listening to customers closely and solving a growing volume of acute pains for them.

The odds of HelloFresh succeeding are increasingly appealing to me and given the complexity of their operation and rather pessimistic valuation, I remain very much interested in watching the company closely. I don’t have a position for now and will continue tracking their evolution. As is the case with Snap, it’ll to be hard to ignore the opportunity if I see the value:price ratio start to widen.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc