Snapchat has been left for dead by the market.

But their rapidly growing DAUs and paid subscription tier, Snapchat+, suggest Snap may have a brighter future ahead than most investors think.

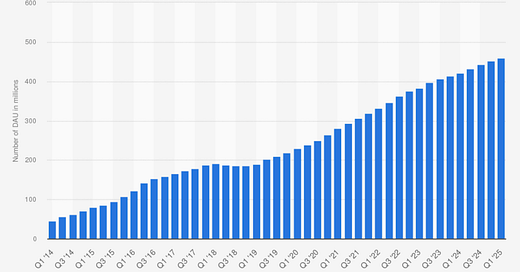

When one hears the term ‘Snapchat’, the knee jerk reaction is to think of a dying app. However, ever since Snap stock declined 87%+ from the all time highs in late 2021, Snap has continued growing its user base as depicted in the graph below. DAUs (daily active users) are up from ~375M in Q4 2022 to 460M in Q1 2025, making Snap one of the world’s top social media networks. To put this into context, Spotify has just over 670 MAUs (monthly active users) which accounts for roughly three quarters of Snap’s ~900M MAUs and is valued today at $145B - around 9 times more than Snap. Having studied Snap in depth, my view is that this network is most likely undervalued and presents notable upside.

Just a few years ago Spotify was valued at just one tenth of its present valuation. I invested heavily in Spotify at the time motivated by the following premise: in networks, scale precedes profits in the list of strategic priorities by a long shot. Often times networks fly under the radar because they don’t produce profits, as has historically and repeatedly happened with Amazon and most recently Spotify. However, if the network in question is well managed it can yield operating leverage seemingly instantaneously: often times a few additional features are sufficient to radically transform a company’s financials for the better, as you can see in Spotify’s free cash flow per share, depicted below.

In Spotify’s case, the deployment of audio verticals beyond music (podcasts and audiobooks, for now) together with newly acquired organisational focus on leanness and profitability have turned the company into a cash machine.

Snap and Spotify are essentially identical businesses: they come down to acquiring more users and making more money per user over time. Snap’s user base has evolved favourably and while revenue per DAU has actually trended down from $12.2 in Q4 2022 to $12.02 in Q1 2025, they have demonstrated that they can improve monetisation over time. The latter delta is due to most of Snap’s DAU growth coming from emerging markets and in my view, the evolution of Snapchat+ is the ultimate testament of Snap’s organisational capabilities. Following the launch in Q2 2022, Snapchat+ revenue has grown to an annual revenue run rate of just over $600M as of Q1 2025: up 75% YoY.

Snap’s My AI is an in-app chatbot that uses OpenAI technology to provide personalised, conversational assistance inside Snapchat. It debuted in February 2023 as an experimental feature by Q2 2023, “more than 200 million people had" sent more than 20 billion messages” via this interface. In Q1 2025 Snap CEO Evan Spiegel said that they’re “investing a lot in it”. The evolution of My AI coupled with the rapidly growing Snapchat+ use base suggests Snap is capable of more than the market currently presumes, with Snap valued at just over 2.7 times sales - a rather cautious multiple for the world’s number nine social media network, that also happens to be quickly improve its financials.

As you can see in the graph below, Snap’s free cash flow per share (orange line) has inflected upwards since Q1 2024. This has been driven primarily by Snap’s focus on improving its advertising business, operating in a leaner fashion and growing new revenues sources (primarily Snapchat+). In turn, Snap’s stock price (blue line) seems to have overfitted for the temporary flatlining of Snap’s free cash flow per share, from Q4 2021 to Q4 2023. Most of Snap’s revenue today and back in Q4 2021 comes from advertising and the macro headwinds seen post-pandemic took a toll on Snap’s financials, but this was a common theme across the board for online advertising companies.

Snap’s quarterly conference call transcripts are littered with extremely boring examples of what they did during the quarter in question to improve their advertising operations. They mention advertiser outcomes repeatedly, which suggests they’re intensely focused on the end customer. Total advertisers on the platform were up 60% YoY in Q1 2025, which tentatively points to notable ad revenue growth ahead. When asked about this growth during the Q1 2025 earnings call, Evan Spiegel again pointed to Snap doing a lot of things to continue growing this part of the business.

My long term readers may sense an Innovation Stack sort of scenario in Evan’s words, as I do - Snap is palpably obsessed with delivering better outcomes to advertisers over time:

We're excited about what we've seen with Snap Promote, and we've got a whole string of product updates there. Plan to really streamline the Snap Promote product within the app and, of course, try to ease that transition to the full-fledged ads manager, including a lot of work that we've been doing to simplify ads manager overall. I think, looking at the small and medium customer segment, I'd say in terms of our acquisition focus.

We're really trying to ramp up those medium-sized advertisers, just I think in terms of the dollar volume overall, certainly in terms of active advertiser count, Snap Promote is very important. But in terms of the dollar volume, I think those medium customers can really help accelerate the growth of our direct response business, and we're seeing some really good product market fit there.

The rising free cash flow per share is driven by Snap’s cash from operations (orange line) going up, as a result of improved advertising operations, additional revenue sources and operating expenses as a % of revenue ticking down from 30.57% in 2022 to 20.42% in the TTM (twelve trailing months), coupled with CapEx scaling back (blue line). In effect, since 2022 Snap has been investing to improve its operations. This is not the first time we see the market punish a business for investing into long term value creation: Meta and Netflix were notable examples of the 2022-2023 period.

Breaking down Snap’s business down to its primary building blocks (number of users times revenue per user), it seems the business is doing far better than back in 2021. As of Q1 2025, Snap has ~15M Snapchat+ subscribers which account for just ~3% of Snap’s DAUs and a minuscule 1.5% of their MAUs. For context, around 39% of Spotify’s MAUs are paid subscribers - there is indeed no guarantee that Snap will ever attain such a rate of paid subscriptions, but the progress of Snapchat+ does not call for ruling out this possibility either.

I believe much of Snap’s presently compressed valuation arises from two factors: the assumption that Snap’s worsening financials over the past few years came from a fundamental deterioration of the network’s quality, rather than from an investing cycle, and from the seemingly widespread believe that no other social media platform can thrive so long as Meta exists. While the latter is generally true for most players, the truth is that Snap now has nearly half a billion DAUs and a billion MAUs and their paid subscription is growing fast. Qualitatively, Snap differentiates itself by connecting you to your friends in the real world, while Meta sucks you into a virtual loophole that’s far removed from the physical world.

Many investors criticise Snap CEO Evan Spiegel for not showing up much in the quarterly conference calls, which I found unusual too. But other than the fundamentally improving health of the network, what makes me want to continue studying Snap closely is that management has done what they said they were going to do. In the Q2 2022 shareholder letter they acknowledge the difficulties the business was facing and they outlined what they were going to do about it. A few years later, the execution has been rather good:

Platform policy changes have upended more than a decade of advertising industry standards, and macroeconomic challenges have disrupted many of the industry segments that have been most critical to the growing demand for our advertising solutions.

[…]

To return to a higher rate of long-term revenue growth, we are focusing on three priorities. First, we will continue to invest in our products and platforms to sustain the growth of our community. Second, we will invest heavily in our direct-response advertising business to deliver measurable returns on advertising spending. Lastly, we will cultivate new sources of revenue that will help diversify our top-line growth to build a more resilient business.

My qualitative impression is that Snap is also highly focused on improving their platform and delivering a more engaging experience over time. Every quarterly conference call transcript that I have read has plenty of examples of product iterations. Indeed, management’s words in the abstract are always to be taken with a grain of salt - but they’re backed by the satisfactorily growing DAUs. In the Q1 2025 earnings call, the different interfaces for varying degrees of user engagement particularly caught my eye:

Our most engaged Snapchatters consistently demonstrated a preference for a five tab layout, favouring the familiarity of tile based content discovery and a dedicated map tab.

Informed by these insights, we have begun testing a refined five tab interface that combines the best of both approaches, bringing more stories to the messaging experience and adding easier access to Spotlight, now placed directly to the right of the camera.

As always, we are iterating thoughtfully to deliver the most seamless experience for Snapchatters, creators, and our advertising partners. We are committed to growing our creator community, and we are prioritising Snap native creators who bring fresh original content to Snapchat, fostering a dynamic and engaging content ecosystem.

The natural question to ask is: with a global population of ~8B, how much can Snap’s business truly grow? My impression is that Snap’s focus on connecting friends via an interface that enhances the physical world presents more optionality that the valuation is presently factoring in. Management mentioned the opportunity ahead in this sense in the Q2 2022 call and I broadly agree with them, in that they have the opportunity to multiply revenue per DAU by pursuing the commerce route:

We are also working hard to deliver new revenue-generating opportunities, including Spotlight, augmented reality advertising, our Snapchat+ subscription service, and, over time, by monetising the Snap Map.

We see a massive opportunity for AR-driven product innovation in e-commerce.

Since January of 2021, more than 250 million Snapchatters have engaged with AR shopping Lenses more than 5 billion times, and we intend to focus on translating this AR engagement into AR revenue.

I don’t have a conviction on Snap just yet, because I haven’t seen anyone I know use the product in the past five years. But as previously mentioned, this business is about acquiring more users and making more money per user: Snap ticks these two boxes thus far. Additionally, Snap’s total debt (blue line, right axis) has noticeably outpaced their total cash (orange line, left axis) since the 2022 downturn, which adds a slight touch of financial risk to the thesis. Nonetheless, with cash from operations now ticking up this risk may lessen going forward.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Despite Antonio’s lack of conviction stemming from not seeing the product used in his circles, as a high school student in America, I confidently can say that Snapchat is essential to everyone in high school or university as it is the primary mode of communication. It’s become the most optimal way to run large group chats or to interact casually with friends. I don’t think our generation will ever go back to SMS/MMS/etc for casual or group communications.