ASTS: AI at the Edge is the Endgame.

Q2 2025 Update

This is an update of my original ASTS deep dive and Q1 2025 update.

I now understand that ASTS is an AI at the Edge play and stands to become the machine that prints personalised spectrum at a marginal cost.

NEW! A growing number of Tech Stock Goldmine alumi are writing their own company deep dives. This is high quality work that I believe you will enjoy:

Christian wrote a deep dive on Duolingo.

Samir wrote a deep dive on Roblox.

Harrison wrote a deep dive on IREN, dLocal, Oddity, Wise, EMCOR and Symbiotic.

Nick wrote a deep dive on Duolingo and another deep dive on Hims.

Max wrote another deep dive on Duolingo.

I’ve now understood that ASTS is the machine that stands to provide personalised spectrum at a marginal cost and as such, is more of an AI at the Edge play than a mere cell phone operation. By enabling MNOs (mobile network operators) to re-use spectrum and giving end customers the flexibility to choose between different types of spectrum, ASTS is positioned to deliver more value to end customers per dollar spent for any end device on Earth. As ASTS satellites get larger and ASTS acquires more spectrum, the platform will likely be increasingly harder to replicate.

In effect, ASTS is an instance of the Tesla Algorithm but applied to spectrum. For example, ASTS does not yet enable L-band spectrum for MNOs and will do so once the Ligado acquisition is completed. Beyond that point, ASTS will enable customers to choose between S and L band, for example and this spectrum can then be funnelled via MNO terrestrial networks. For others to compete, they first have to figure out how to outperform ASTS’s phased array technology, which together with ASTS’s vertical integration is the primary enabler of the platform. They also have to get good at navigating regulations and closing partnerships with MNOs.

AI at the edge is the end game for ASTS, but the markets that it can capitalise on in the near term are commercial telecommunications and government applications. As I explain in my Q1 2025 update, the primary key performance indicator to gauge progress on this front is gateway bookings, which are up 9.55% sequentially, from $13.6M to $14.9M QoQ. Gateway bookings are the money MNOs spend on equipment that’s essential to integrate AST SpaceMobile’s satellite network with terrestrial cellular infrastructure. Incremental spend signals good progress.

I am still not totally clear on ASTS’s technical moat and I do not know exactly how hard or not it is to replicate the phased array tech. But I do appreciate that as time goes by and ASTS deploys a broader spectrum offering and satellites get larger, the operation will tend to be increasingly harder to replicate. It seems increasingly likely to me that the broader stack is too hard for others to replicate. It’s also true that as CEO Abel Avellan points out in the Q2 2025 earnings, they don’t need that many satellites to start printing cash, which will then unlock CapEx to further deepen the moat. If they can push limits with a bit of capital, they can probably do a lot more once they start to generate it:

Our Block 2 BlueBirds are approximately 3.5x larger with 10x capacity as compared to our Block 1 BlueBirds.

We previously held the record for the largest ever commercial deployed communication satellite ever put in low Earth orbits.

This means our phase out rate or antenna have much larger surface area than before, enabling our satellite to digitally form more cells over air surface with pinpoint precision and reduce interference.

As a result, we need far less satellites to achieve our goal of connecting the unconnected. Approximately 45 to 60 satellites for continuous coverage in key markets and approximately 90 satellites for continuous global coverage.

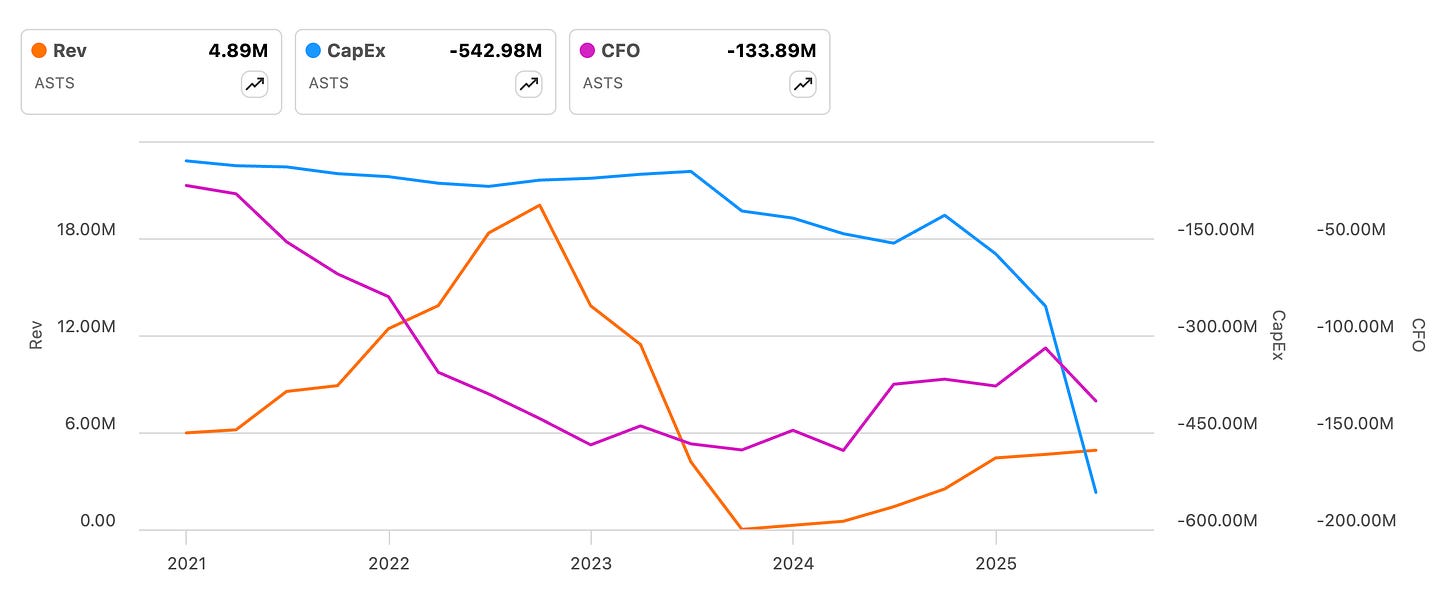

ASTS management believes the company is on track to reach a manufacturing cadence of six satellites per month in 2025. With gateway bookings increasing, it seems that MNOs would agree that ASTS is on its way to deploying a solve satellite constellation. Further, you may remember that last quarter management said they now expected satellites to cost between $21M-$23M versus $19M-$21M, due to to higher launch costs. They reiterated this expectation in Q2 2025 and meanwhile, CapEx continues to accelerate (blue line, right axis) as ASTS invests in:

Manufacturing capabilities.

Prepaying a lunch provider.

As I explore in this post, it seems that not having a vertically integrated launch capability continues to weigh on ASTS’s financials. However, I continue to believe that this won’t be a problem long term as/if ASTS makes its platform essentially impossible to imitate. On the current trajectory, ASTS satellites will likely get large enough over time to abstract away the leverage the launch chain currently has over it. Further, not focusing on launch may indeed turn out to be part of ASTS’s moat, since it won’t be easy for launch providers to also focus on phased array technology and all the other components of ASTS’s platform.

As you can see in the graph above, ASTS remains a non-viable business with revenue (orange line, left axis) still near zero and cash from operations (purple line, right axis) trending down. However, at this stage I make a fundamental observation: early stage companies of this sort that exhibit truly extraordinary process power tend to do well over time. This has been the case with IREN, RocketLab, Abcellera and Rivian in relative terms. They’re not cash machines just yet, but they are doing nearly impossible things and stand to obtain massive rewards if they succeed. The odds of this basket succeeding is much higher than it was just a year ago.

One thing these sort of companies tend to have in common is that while they strive to solve extremely hard problems, they:

Keep their balance sheet in a relatively good state.

They bleed cash, but not as much as any other company with less desirable organisational properties would.

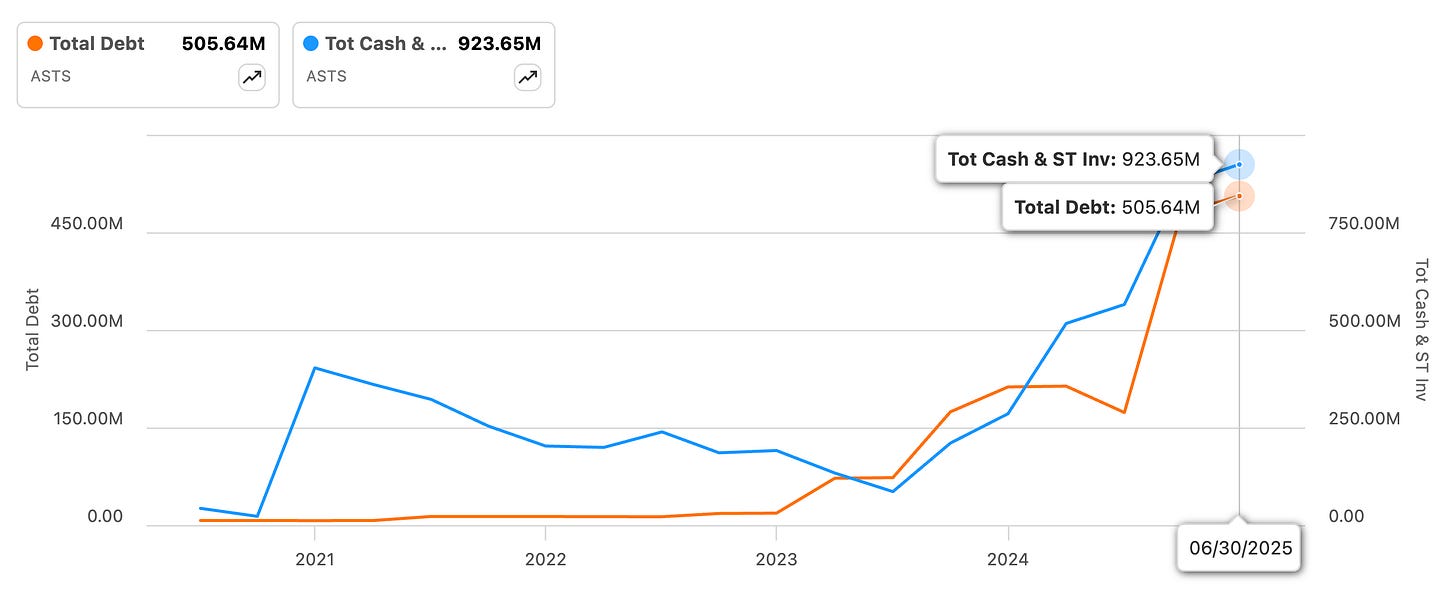

Below you can see how ASTS’s cash continues to outpace total debt by a good margin, which I don’t think is a coincidence. Another particular instance of this is Abcellera, which I wrote an update on last week.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

Curious if you have some idea of evaluation (which I realize is very difficult given that they are essentially pre-revenue)

Really interesting take, Antonio. I wonder how you see AMD’s role in this “AI at the Edge” paradigm. With its Xilinx acquisition and Versal adaptive chips, AMD seems well positioned to power edge inference and embedded intelligence — maybe even complementing players like AST SpaceMobile, where connectivity meets computation. Could AMD become one of the key enablers of this new distributed AI ecosystem?