AMD: Just Getting Started.

Q3 2025 ER Digest

All logic points to to AMD’s market cap going up by an order of magnitude.

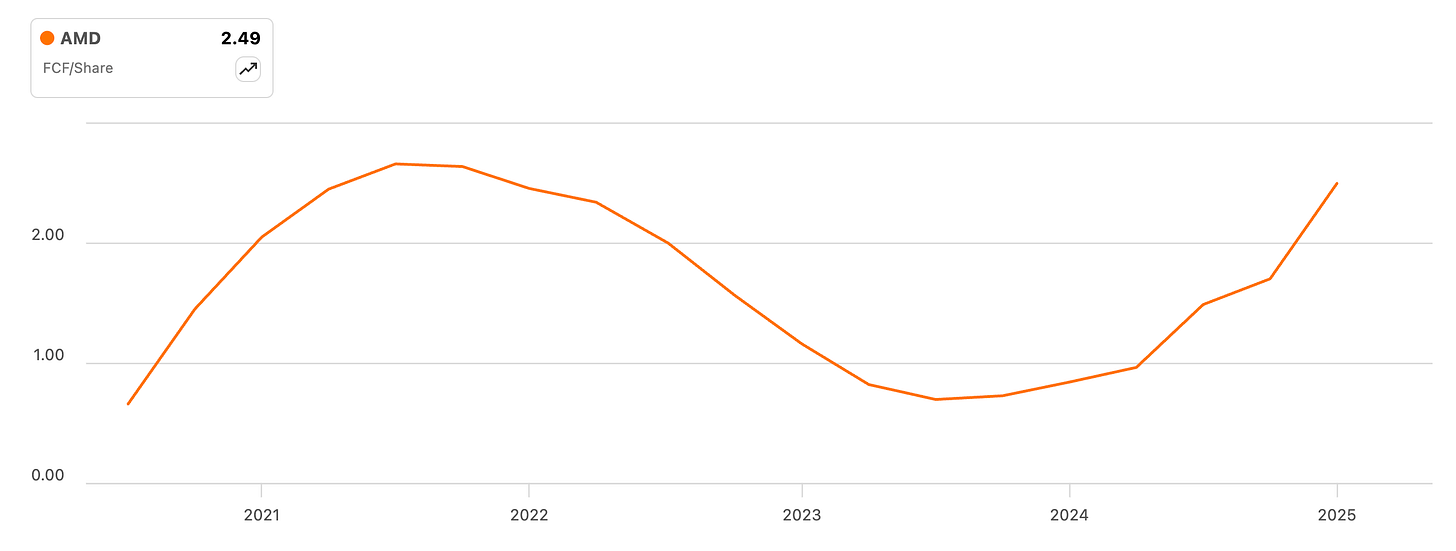

AMD free cash flow per share continues to inflect upwards and as we know, stock prices track the latter metric over the long term. The main driver of this metric is AMD’s ability to print personalised compute at a marginal cost, thus offering a total cost of ownership advantage for a growing volume of workloads. The ability to mix and match compute engines, enabled by AMD’s chiplet platform, is is the primary dynamic behind AMD’s reaccelerating growth. Datacenter revenue ( up 22% YoY) is largely driven by the outsized memory capacity of the MI family. Client revenue is driven by AMD’s ability to combine CPUs with FPGAs.

You can’t do that without chiplets.

I believe we will see AMD’s free cash flow per share eclipse previous highs as demand for AI compute continues to trend non-linearly and specifically as new workloads continue to emerge. AI is distributed and requires unprecedented levels of compute versatility. Over the next year or two we will see AMD dominate new workloads as they emerge, which I believe will yield fairly non-linear growth going into 2026:

We’re continuing to augment the libraries and the overall environment that we have, especially as we go to some of the newer workloads where you see training and inference really coming together with reinforcement learning. But overall, I think very strong progress with ROCm. And by the way, we’re going to continue to invest in this area because it’s so important to really make our customer development experience as smooth as we can.

-AMD CEO Lisa Su, during the Q3 2025 earnings call.

AI-driven value creation processes are testing the mental limits of investors. Progress is non-linear and hypothetical absolute numbers are mind-boggling just a few iterations out from here. Neither are a reason to stop thinking and indeed, it’s human nature to jump ship when something incredible is happening. I’ve been an AMD shareholder for a over a decade now and I haven’t seen Lisa Su over-speak once. Her remarks correlate with my qualitative observation that AI CapEx is delivering incremental value delivered to end customers, which is best evidenced by the time people around you spend talking to ChatGPT:

But suffice it to say, from everything that we see, we see the AI compute TAM just going up. So we’ll have some updated numbers for you, but the view is, whereas $500 billion sounded like a lot when we first talked about it, we think there is a larger opportunity for us over the next few years, and that’s pretty exciting.

The tendency is to think that we are in 1998, but that’s actually a heuristic to not have to deal with a dynamic that far exceeds our ability to think. For now, AI capabilities are doubling every 6 months and this is producing intelligence tokens that customers are willing to pay for. There is no actual obvious limit in sight to this causal trend and therefore, logic says we’re looking at a perhaps decade long run in which AMD sees its market cap go up by an order of magnitude, for example. Stocks may correct, but the underlying value creation processes has nothing to do with investor sentiment, which is by the way qualitatively at 2022 levels.

As is the case with Palantir, the AMD fundamentals are black and white. Earning power is going up, driven by strong underlying fundamentals. Earning power is ultimately a function of AI scaling laws and so long as they persist, the biggest risk is giving into age-old heuristic mechanisms designed to protect us from predators.

Until next time!

⚡ If you enjoyed the post, please feel free to share with friends, drop a like and leave me a comment.

You can also reach me at:

Twitter: @alc2022

LinkedIn: antoniolinaresc

The chiplet platfom really is the differentiator here. It's fascinating how AMD can scale workloads with CPU+FPGA combinations while maintaining cost advantages. The 22% YoY datacenter growth feels understated given where AI compute demand is heading.

Gracias por compartir Antonio.